Popular Posts

E-check deposit is the latest transaction tool which will change the way you bank's

04-02-2019

The online transactions which are easy and quick- e-check deposits

15-02-2019

Deposit E-check for hassle-free money transfer

05-03-2019

Garner benefits using E-checks

25-03-2019

Everything You Need to Know about Ach Transactions

26-03-2019

E-checks services are certainly instant fund services

28-03-2019

Now, pay instant checks through your phone!

04-04-2019

What all things to keep in mind while looking for Echeck Payment Services

10-04-2019

Going cashless, UPI and beyond

22-04-2019

Online payment fraud – the current dilemma and how to prevent it with the help of e-check deposits

29-04-2019

Insights on online payment methods.

13-05-2019

The benefits of using e-check payment by phone.

30-05-2019

Why prefer ACH payment over credit card payment

15-06-2019

Why is it Important to use E-check services when we can use online payments?

29-06-2019

Easy Steps Anyone Can Take to Stop Check Fraud

09-07-2019

The Lerner Guide to Accepting eCheck generated by eCheckDesposit

15-08-2019

eCheck Services Are Alive and growing vigorously

12-09-2019

What is an Electronic Check?

10-10-2019

What are electronic checks and what are the benefits?

08-11-2019

How Payment Processing Drives the Economy

17-12-2019

The Payment Processing Revolution: Why Your Company Needs to Stay at the Forefront

06-01-2020

Deposit E-check for hassle-free money transfer

- 05-03-2019

- 0

An electronic check popularly known as e-check payment is made through the internet. The procedure of the payment is different but the function is quite similar to paper checks. The most unique thing about e-checks is that since it is processed in electronic form, fewer steps are involved to receive and send payments.

This is noted that although the steps that are required to transfer the money are less it doesn’t compromise on the security features.

The E-checks expansion

The e-checks have been developed with the development of e-commerce. They were meant to take place of the paper checks because they can be used for the same type of transactions as the paper checks are used. Even they are governed by the laws which are applicable to the paper checks. Electronic check payment services was introduced by the U.S. Treasury and was the first form of electronic and Internet-based method to pay.

Benefits of the electronic way of paying

The benefits of e-checks services in the USA are numerous and they are the future of ACH (Automated Clearing House) payments. Electronic cash can be handled using this procedure. E-checks payment services save the business houses the cost of hiring employees to process checks. These business houses accept E-checks by phone services in the USA. The use of e-checks has made it easier for the customers to pay anyone. So, the merchants find it easier to accept payment by e-checks.

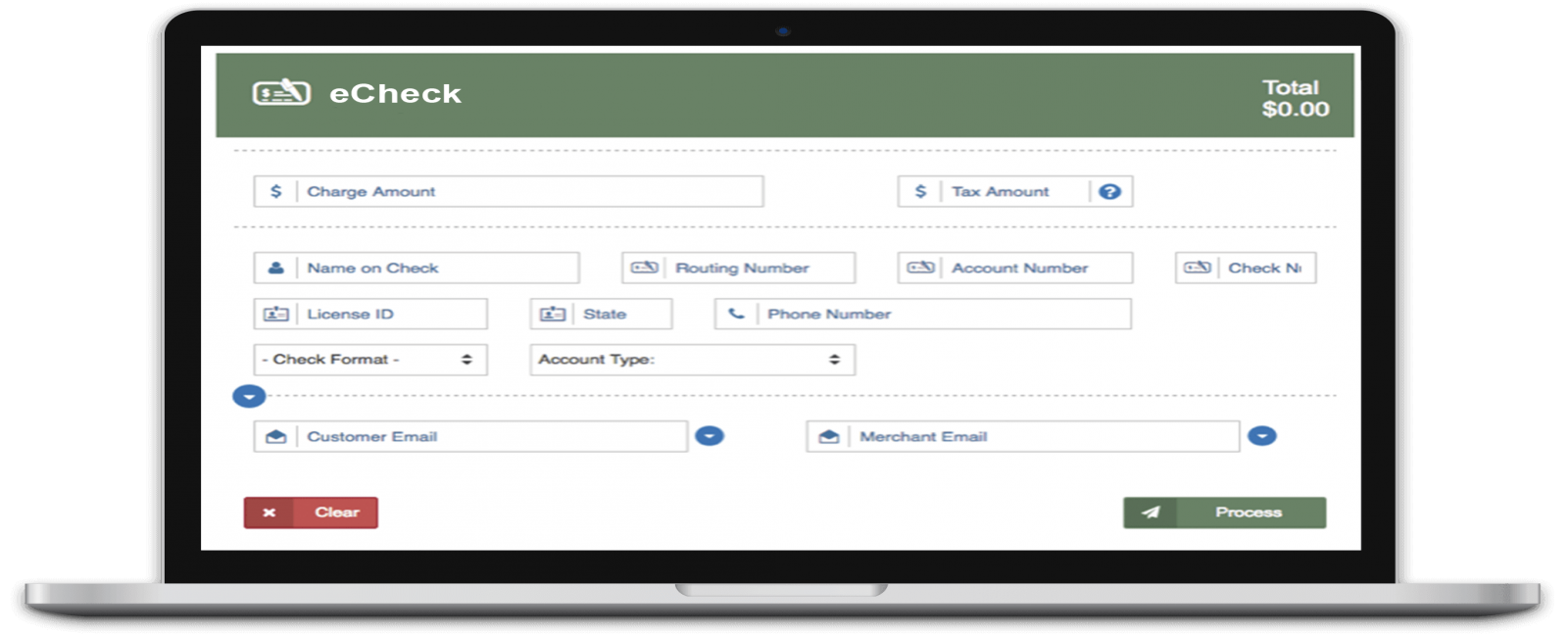

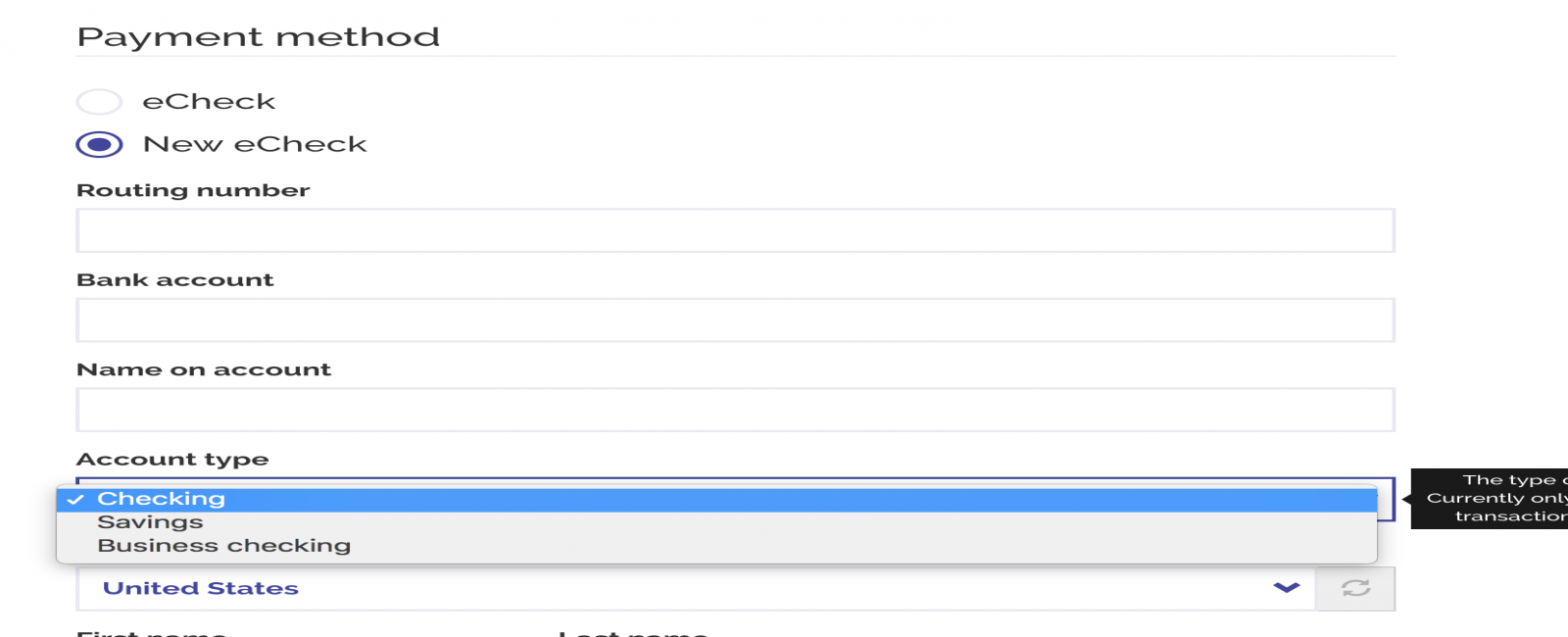

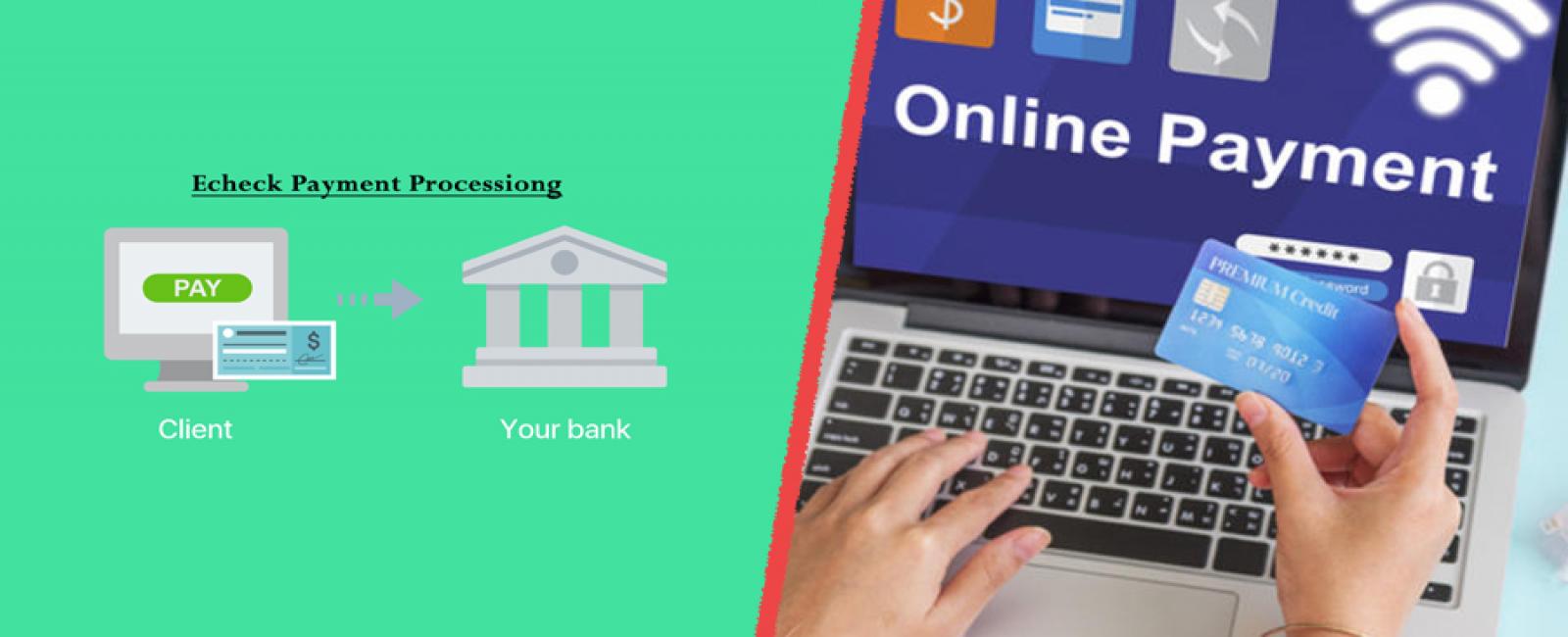

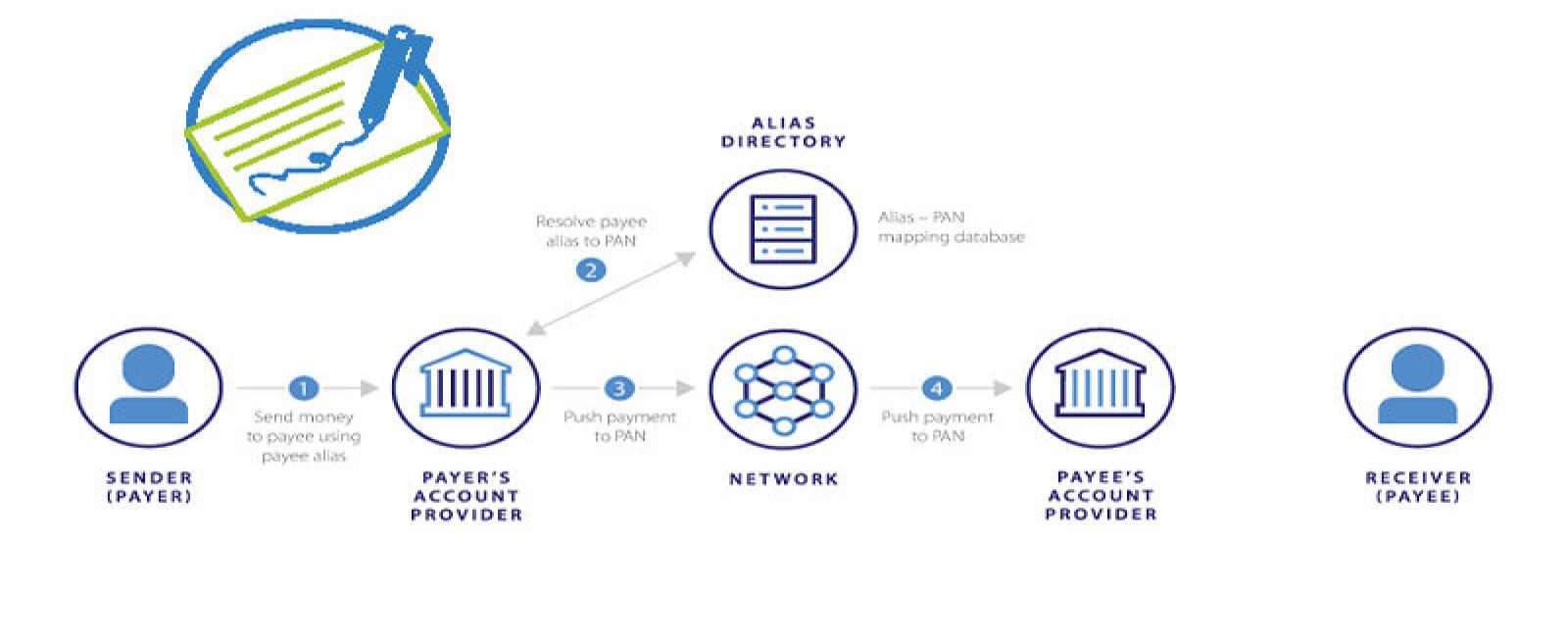

The process of E-check payment in the USA works like this:

- The bearer or the cheque writer types an e-check using the input device on his/her computer or mobile phone with the user interface.

- This check is sent to the payee via a website. These websites are secured for doing this sort of transaction.

- The payee now deposits the e-check online. This way accepts payment by e-check.

- The money is credited in the payee’s account.

- The bank transfers the check amount and clears the e-check.

One thing about e-check payment services is that the website which has collaboration with the bank will help to make all online transfers levying certain transaction charges.

Convenience using e-checks

The process of e-check payment is speedy and beneficial for the merchants. There is a significant reduction in the use of paper cheques since the ease of doing business with e-checks has started. This speeds up the receipt of money to the bank account. E-check payment services also reduce processing errors. These are less expensive than traditional methods. The fee charged is minimal for the E-check payment processing.

Time is taken for E-check online payment In USA

The process of e-check clearing is speedy. But do you want to know the number of hours taken to get the payment? E-check processing services take about 24 to 48 hours. This time duration is required to verify the information with the bank accounts about the person initiating the request.

But it is known that sometimes more than four to five business days are taken to get the funds from an e-check. It happens due to the amount written on the e-check. You may be surprised but high amount e-checks may sometimes delay the e-check processing as the amount withdrawn from the account should be according to fund availability. Moreover, if a healthy account balance is maintained in your account for a long time and the account had no history of overdrafts, the e-check payment is made easily.

Fee for e-check processing

The e-check provider companies in the USA charge an average fee for e-check money transfer. This fee is variable with different E-check services in Colorado. The average e-check transaction rate is $0.30 to $1.50 per eCheck transaction for e-check online payment in the USA.

Also Check The online transactions which are easy and quick e-check deposits