Popular Posts

E-check deposit is the latest transaction tool which will change the way you bank's

04-02-2019

The online transactions which are easy and quick- e-check deposits

15-02-2019

Deposit E-check for hassle-free money transfer

05-03-2019

Garner benefits using E-checks

25-03-2019

Everything You Need to Know about Ach Transactions

26-03-2019

E-checks services are certainly instant fund services

28-03-2019

Now, pay instant checks through your phone!

04-04-2019

What all things to keep in mind while looking for Echeck Payment Services

10-04-2019

Going cashless, UPI and beyond

22-04-2019

Online payment fraud – the current dilemma and how to prevent it with the help of e-check deposits

29-04-2019

Insights on online payment methods.

13-05-2019

The benefits of using e-check payment by phone.

30-05-2019

Why prefer ACH payment over credit card payment

15-06-2019

Why is it Important to use E-check services when we can use online payments?

29-06-2019

Easy Steps Anyone Can Take to Stop Check Fraud

09-07-2019

The Lerner Guide to Accepting eCheck generated by eCheckDesposit

15-08-2019

eCheck Services Are Alive and growing vigorously

12-09-2019

What is an Electronic Check?

10-10-2019

What are electronic checks and what are the benefits?

08-11-2019

How Payment Processing Drives the Economy

17-12-2019

The Payment Processing Revolution: Why Your Company Needs to Stay at the Forefront

06-01-2020

Going cashless, UPI and beyond

- 22-04-2019

- 0

One of the reasons why most countries would prefer to go for a cashless economy is so that all transactions can be traced and tracked down, and that everyone would have to pay the required tax on the same.

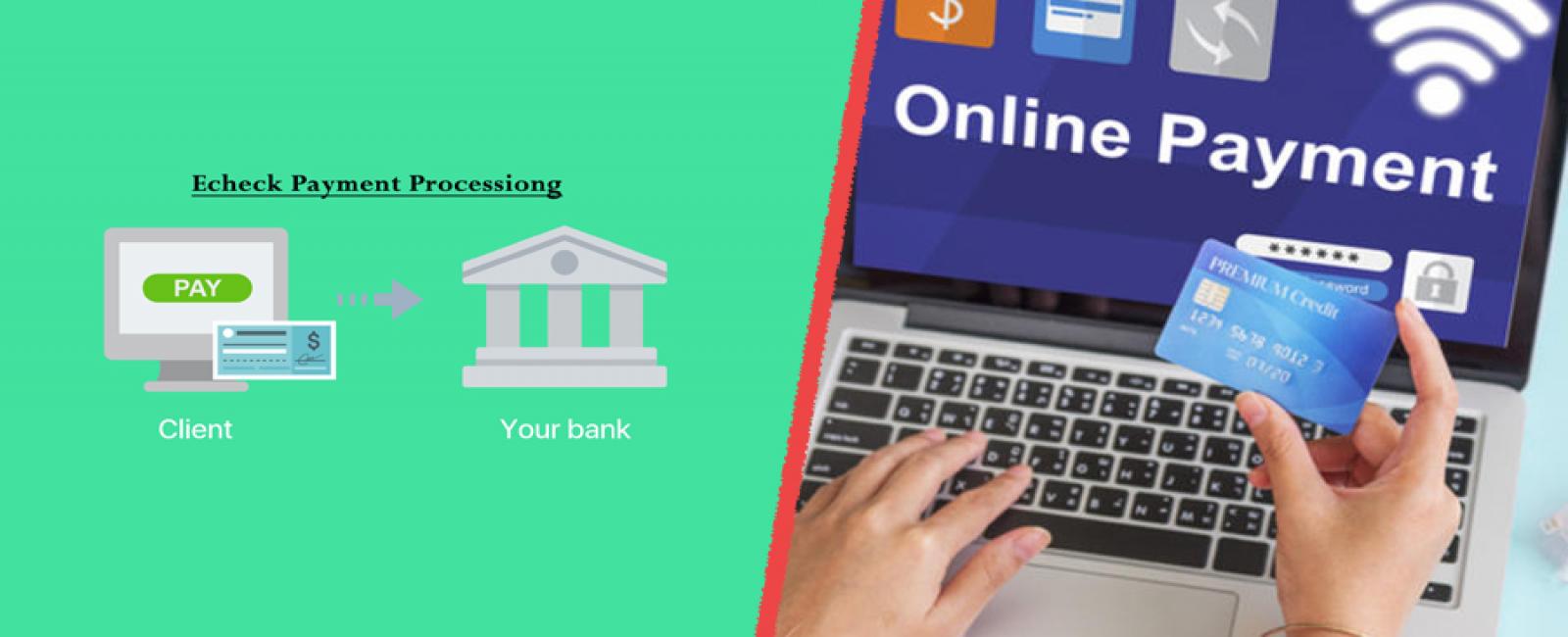

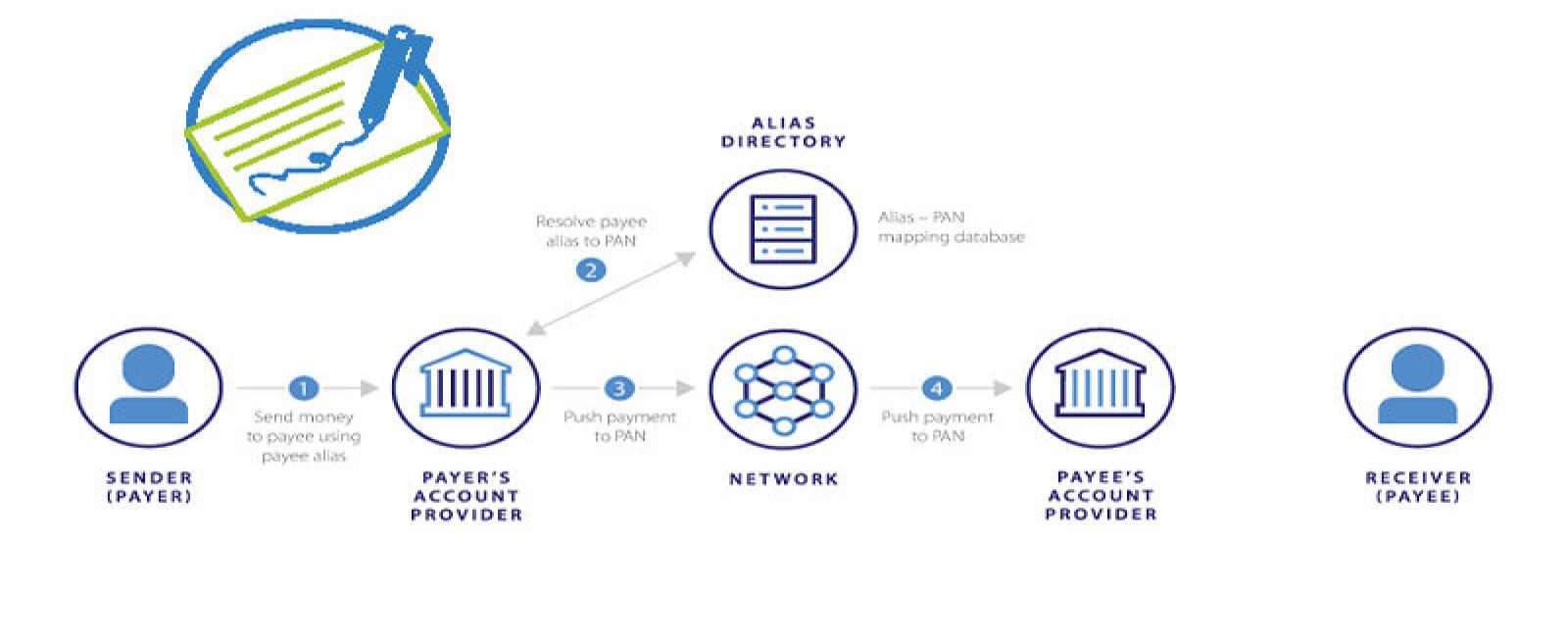

In other words, unlike with the paper economy, digital transactions are recorded and can easily be tracked down; so the days of hiding money to avoid paying tax, are long gone. Now thanks to innovative approaches like UPI, banks are able to transfer funds between various accounts instantaneously. Here’s what you can expect, with online payment services – going forward and even with online payment by phone.

- No lag time: Given that the GOI is interested in streamlining online payment services and enabling businesses to conduct online payment by phone in seconds, you can expect UPI to get additional features, including an advanced mobile e-wallet. But UPI or united payments interface remains predominantly a vehicle for one bank to send funds to another bank account on the basis of vetted and verified information. This information is subject to change but seeing how the basic motivation for introducing UPI was to give a boost to local businesses, so as to enable them to conduct online transactions faster. It is expected that UPI may introduce additional features which will make it easy for you to transfer funds from UPI to another e-wallet or online account, with ease.

- Instant credit: One of the great things about UPI is that the payment is instantly credited to the bank account that is linked to your phone. The current usage of UPI and the seamless way that most online transactions are handled makes it apparent that you can expect a few sudden changes in the near future, in a matter of a few years. In fact, you should be able to send online payment by phone, to someone’s bank account or transfer the same to their mobile e-wallet. You can send online payment by phone with ease, already. In fact, when it comes to online payment services, you will find that it is easier not just to send payments but also to accept payments by phone. The GOI is intent on modernizing banking and in the process, making it easier for businesses to conduct their day to day operations without any extra surcharge or for that matter, any lag time.

- E-checks: E-check services in the USA are the norm and it is only a matter of time before the GOI introduces the same here for online payment services, on par with e-check services in the USA. You can expect to soon pay retailers, various merchants and even banks with the help of E-checks and get the same accepted immediately as well. You would no longer have to wait one week and more to encash an out of state e-check but can look forward to the same being processed right away.

- Online payments: With smartphones getting cheaper, and with better penetration of the market, it is widely expected that the GOI would encourage the public to opt for various online payment services. You should soon be able to use online checks, along the lines of e-checks in the USA, and even be able to send and accept payments by phone, instantaneously. In fact, you can expect more than a few changes as far as online payment by phone is concerned with more emphasis being placed on “immediate credit”.

These are some of the changes you can expect as the UPI option is being increasingly adopted by both businesses and individuals alike. Welcome to a smarter and more convenient way to transfer funds and a paperless economy in the process.

Comments

sitender karl

sdsdsd s d sdsd sdsdsdsdsdsd sd s s d

mayank singh

sdghsdgsdgsdgsdgsg

04-24-2019

mayank singh

sdghsdgsdgsdgsdgsg

04-24-2019

mayank singh

sdghsdgsdgsdgsdgsg

04-24-2019