Popular Posts

E-check deposit is the latest transaction tool which will change the way you bank's

04-02-2019

The online transactions which are easy and quick- e-check deposits

15-02-2019

Deposit E-check for hassle-free money transfer

05-03-2019

Garner benefits using E-checks

25-03-2019

Everything You Need to Know about Ach Transactions

26-03-2019

E-checks services are certainly instant fund services

28-03-2019

Now, pay instant checks through your phone!

04-04-2019

What all things to keep in mind while looking for Echeck Payment Services

10-04-2019

Going cashless, UPI and beyond

22-04-2019

Online payment fraud – the current dilemma and how to prevent it with the help of e-check deposits

29-04-2019

Insights on online payment methods.

13-05-2019

The benefits of using e-check payment by phone.

30-05-2019

Why prefer ACH payment over credit card payment

15-06-2019

Why is it Important to use E-check services when we can use online payments?

29-06-2019

Easy Steps Anyone Can Take to Stop Check Fraud

09-07-2019

The Lerner Guide to Accepting eCheck generated by eCheckDesposit

15-08-2019

eCheck Services Are Alive and growing vigorously

12-09-2019

What is an Electronic Check?

10-10-2019

What are electronic checks and what are the benefits?

08-11-2019

How Payment Processing Drives the Economy

17-12-2019

The Payment Processing Revolution: Why Your Company Needs to Stay at the Forefront

06-01-2020

How Payment Processing Drives the Economy

- 17-12-2019

- 0

The ability to effectively sell a business’s products or services is one of the most important aspects of running a company. After all, a business will not run if products do not sell

How Payment Processing Drives the Economy

The ability to effectively sell a business’s products or services is one of the most important aspects of running a company. After all, a business will not run if products do not sell. But what about the actual transaction between a company and the consumer? It needs to be a seamless experience for the customer, and the business must ensure that they collect their money. With the use of electronic payments on the rise, an effective payment processing system has never been more important. Let’s take a look at how payment processing affects the economy.

What is Payment Processing?

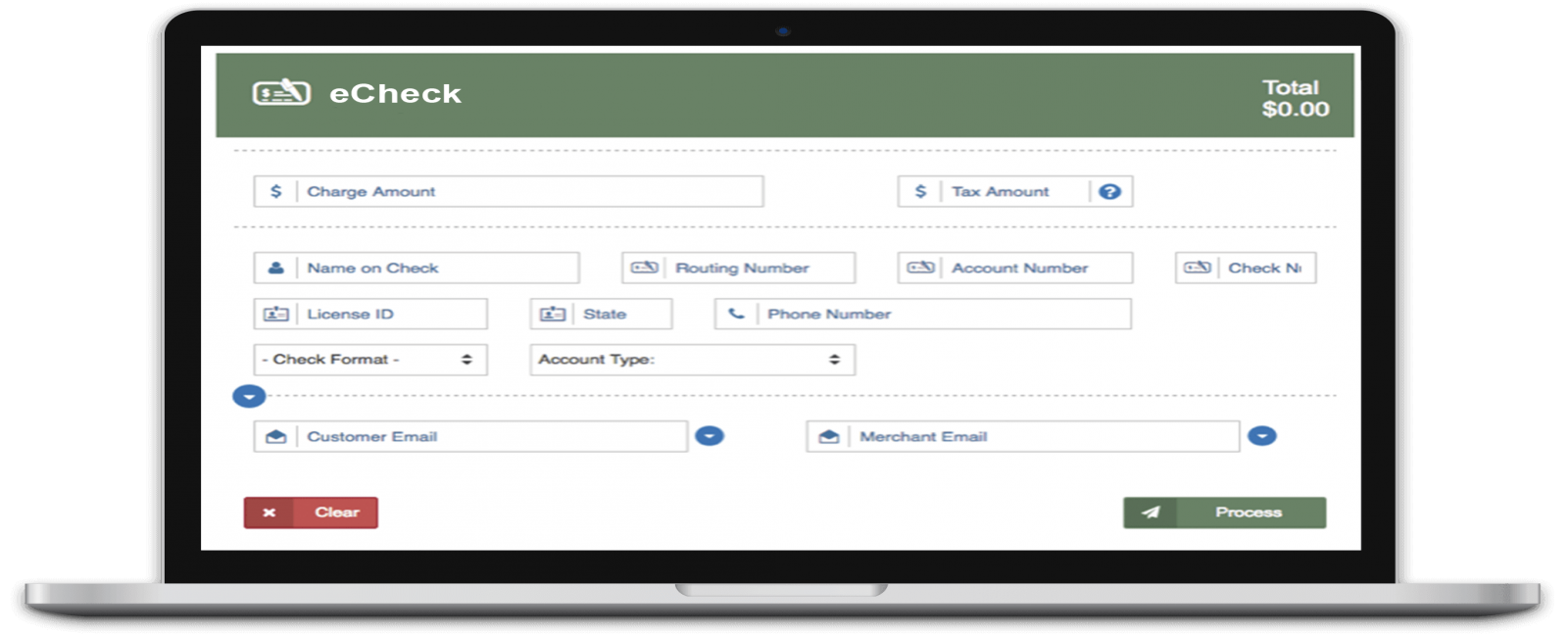

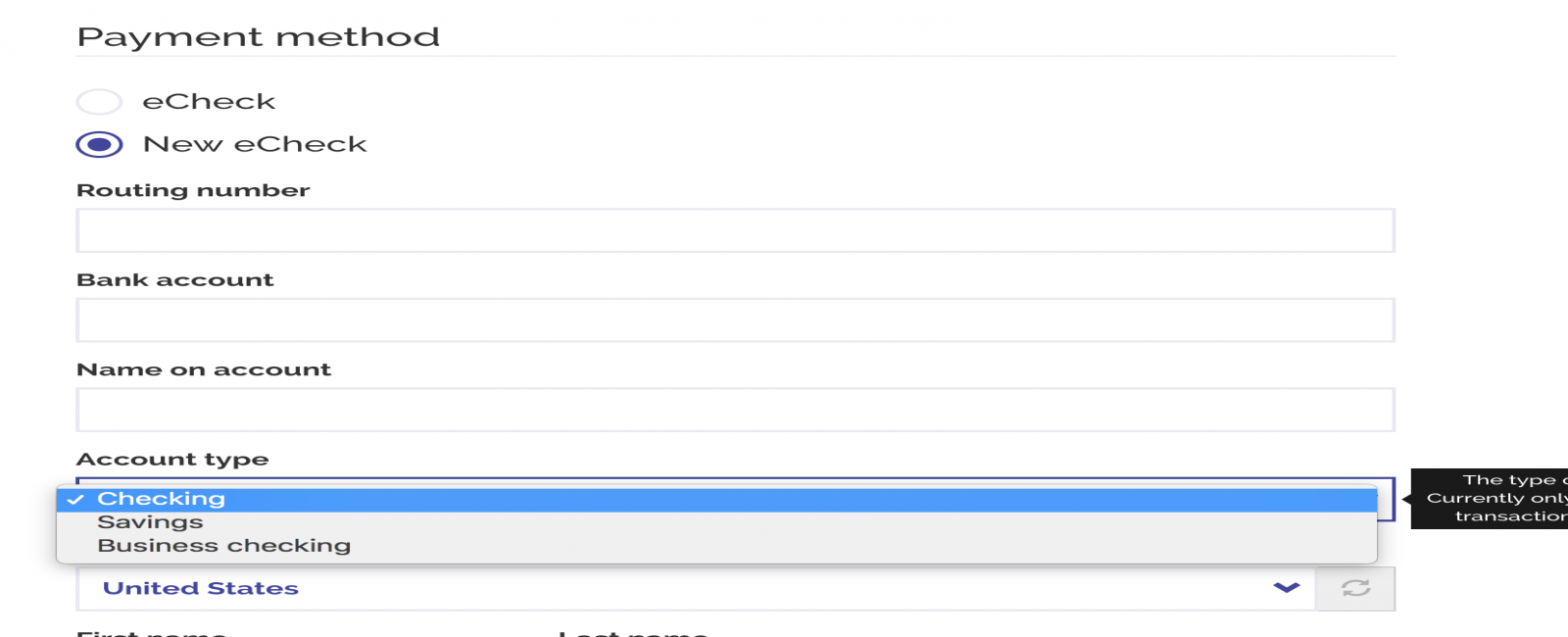

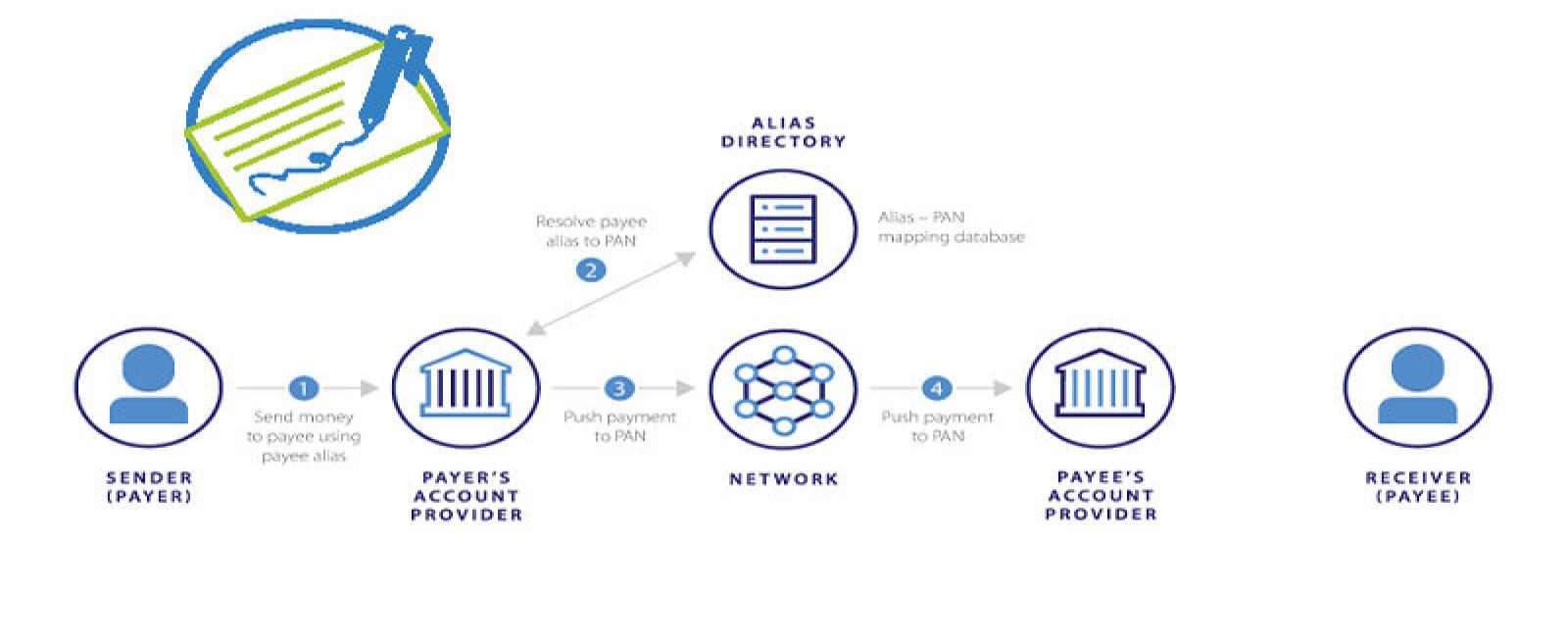

Payment processing is an important part of every transaction between a business and its consumers. Payment processing refers to the way in which payments are handled between the company and the consumer. For instance, let’s say a customer pays for their purchase using a credit card. The way in which the credit card is processed is considered to be payment processing. Payment processors subsequently facilitate the transfer of funds to ensure businesses get paid in a timely manner. Having an effective payment processing system is crucial for successful transactions, customer satisfaction, fraud prevention and a business’s reputation.

How Do Electronic Payments Benefit Businesses?

The shift from cash payments to electronic forms of payment has revolutionized the way business is conducted. Electronic forms of payment allow businesses to have more security than any other form of payment.

However, when electronic forms of payment are used, a third-party payment processor must either confirm or deny the transaction in real time and transfer funds instantaneously with the click of a button. An example of this is when a customer uses a credit or debit card with insufficient funds. Chances are the transaction was denied when the consumer attempted to complete the transaction. This is because it was automatically detected that the funds needed were not there. This is a form of elevated security for businesses and leads to a decrease in fraud, scams and the timely task of waiting on payments that may never come. Any business that accepts electronic forms of payments should be utilizing a payment processing system for the benefit of both the business and their customers.

What Does Payment Processing Mean for the Economy?

It may seem as if the effects of payment processing are only limited to consumers and businesses, but the bottom line is that payment processing affects the economy as a whole.

Increase in the Number of Sales

Payment processing makes it easier for consumers to purchase goods and services either online or in brick-and-mortar locations. This leads to an increase in spending on goods and services, which is both good for businesses and a boost to the economy.

Increase in the Number of Jobs

When consumers increase spending, more jobs are subsequently created. An increase in spending leads to an increase in the purchase of goods. This means that the number of goods produced must be increased which requires more manpower, thus increasing the number of jobs needed to fulfill the product capacity. In many cases, higher wages and benefits are able to be offered to employees by companies that are more prosperous. There is a trickle-down effect.

Let the Numbers Speak for Themselves

According to Moody’s Analytics, over a five year period, $296 billion was added to Gross Domestic Product (GDP) because of electronic payments, which is the equivalent of creating an astounding 2.6 million jobs each year! This is greatly beneficial to any economy.

A Payment Processing System that Works for Your Business

eCheckDeposit is a premier payment processor that offers fast, secure and reliable payment processing solutions. Whether your business is big or small, our specialists can set up a system to meet your needs and make sure transactions between your business and customers are seamless. Contact us today and let us help you take the hassle out of payment processing.