Popular Posts

E-check deposit is the latest transaction tool which will change the way you bank's

04-02-2019

The online transactions which are easy and quick- e-check deposits

15-02-2019

Deposit E-check for hassle-free money transfer

05-03-2019

Garner benefits using E-checks

25-03-2019

Everything You Need to Know about Ach Transactions

26-03-2019

E-checks services are certainly instant fund services

28-03-2019

Now, pay instant checks through your phone!

04-04-2019

What all things to keep in mind while looking for Echeck Payment Services

10-04-2019

Going cashless, UPI and beyond

22-04-2019

Online payment fraud – the current dilemma and how to prevent it with the help of e-check deposits

29-04-2019

Insights on online payment methods.

13-05-2019

The benefits of using e-check payment by phone.

30-05-2019

Why prefer ACH payment over credit card payment

15-06-2019

Why is it Important to use E-check services when we can use online payments?

29-06-2019

Easy Steps Anyone Can Take to Stop Check Fraud

09-07-2019

The Lerner Guide to Accepting eCheck generated by eCheckDesposit

15-08-2019

eCheck Services Are Alive and growing vigorously

12-09-2019

What is an Electronic Check?

10-10-2019

What are electronic checks and what are the benefits?

08-11-2019

How Payment Processing Drives the Economy

17-12-2019

The Payment Processing Revolution: Why Your Company Needs to Stay at the Forefront

06-01-2020

The Payment Processing Revolution: Why Your Company Needs to Stay at the Forefront

- 06-01-2020

- 0

The payments solutions sector is one of the fastest-changing industries todays. Consumers today expect fast and seamless transactions from the places where they do business, no matter what the transaction is for. They also have come to expect a wide range of convenient digital payment options.

The Payment Processing Revolution: Why Your Company Needs to Stay at the Forefront

The payments solutions sector is one of the fastest-changing industries todays. Consumers today expect fast and seamless transactions from the places where they do business, no matter what the transaction is for. They also have come to expect a wide range of convenient digital payment options.

Business owners that utilize payment processors are increasingly seeking payments solutions companies that are comprehensive and offer the options they need to streamline their businesses, and that their customers want. It is subsequently imperative that businesses stay ahead of both domestic and international payment processes. Let’s take a look at industries that are leaders in the payment revolution, why now is the time for payment changes and how eCheckDeposit is helping businesses stay at the forefront of the payment industry.

Industries Experiencing a Payment Revolution

There are many different reasons why industries undergo payment revolutions. The cannabis, construction and transportation industries (sometimes considered “high-risk” industries) are some that are at the forefront of payment revolutions, each for different reasons.

Businesses in high-risk industries have a more difficult time gaining the cooperation of financial institutions such as banks and payment firms because of regulations or the tendencies to exchange large sums of money. Without the cooperation of these financial firms or the development of alternative processing solutions, businesses in high-risk sectors are often left only being able to accept cash. This is severely limiting and puts these businesses at a higher risk of falling victim to frauds and scams. This has led to the need for changes in the payment industry.

Businesses in the cannabis industry are leading this revolution. Cannabis companies are considered high-risk due to the fact that cannabis itself has yet to be legalized in all 50 states and there is still a great amount of disapproval, stigmas and skepticism within the population. Banks worry that the cannabis industry is more of a fad that will not endure in the long-run, and for this reason cannabis companies must look for non-banking payment firms to work with.

The construction industry is another sector that is experiencing a payment revolution. The issue in the construction industry is that companies are receiving slow pay for materials. In fact, many suppliers tend to be willing to discount their invoices a certain percentage if they received payment within a shorter amount of time. The utilization of digital forms of payment processing allows vendors to receive payments more quickly. These vendors are then able to offer builders discounts which help the builders save money, therefore also saving the money of their consumers.

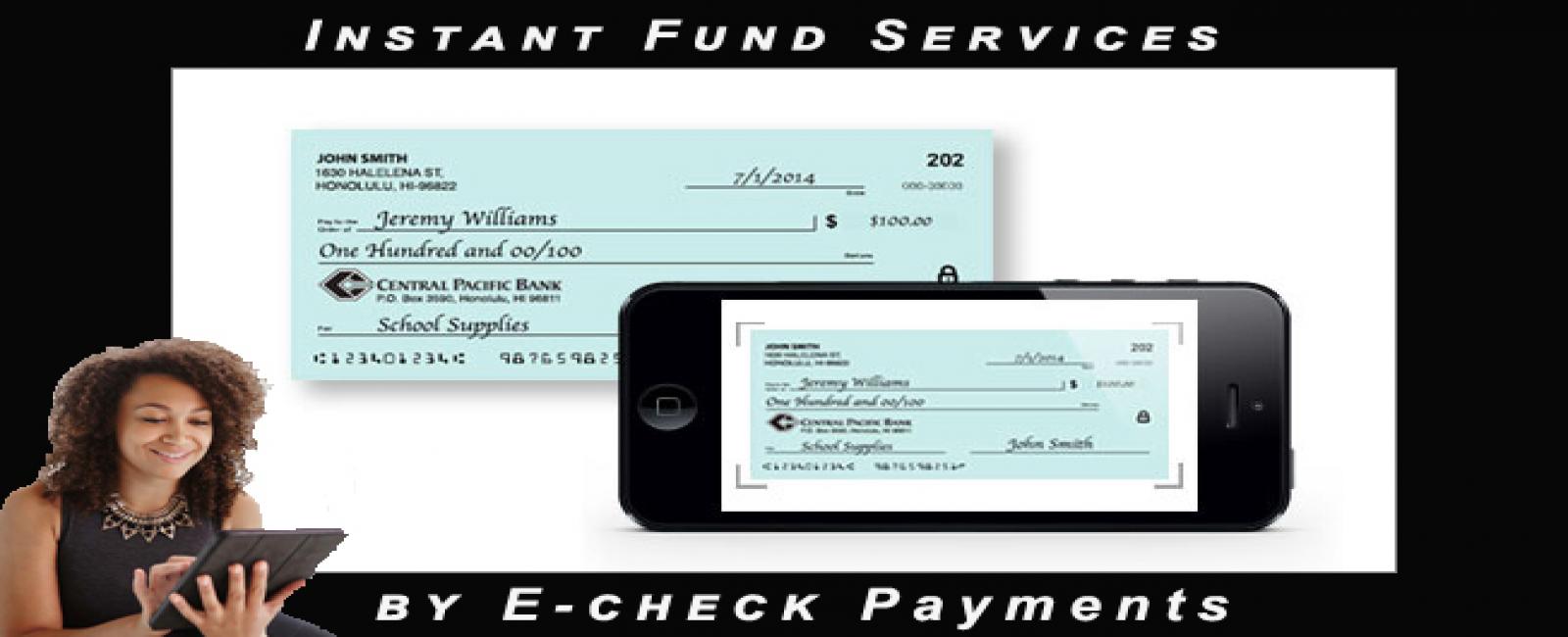

Paid parking lots and public transportation may be one of the industry sectors that will see the most changes in payment processing. More and more parking facilities are moving toward digital forms of payment as opposed to physical tickets. Now, customers will be able to link their payment information with the facility’s account and let smart terminals handle the rest. Public transportation companies are making a move towards allowing users to request, schedule, reserve and pay for transportation from their mobile devices.

Why Now is the Time to Make Payment Processing Changes?

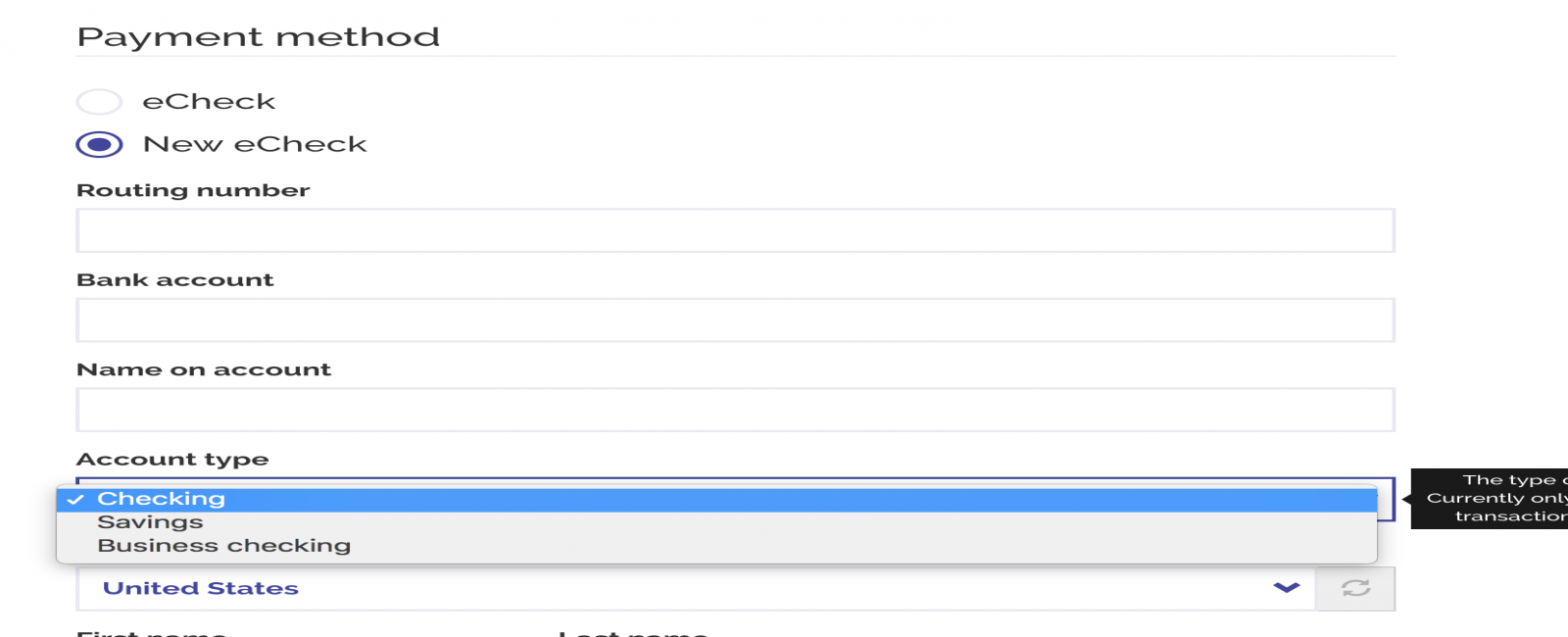

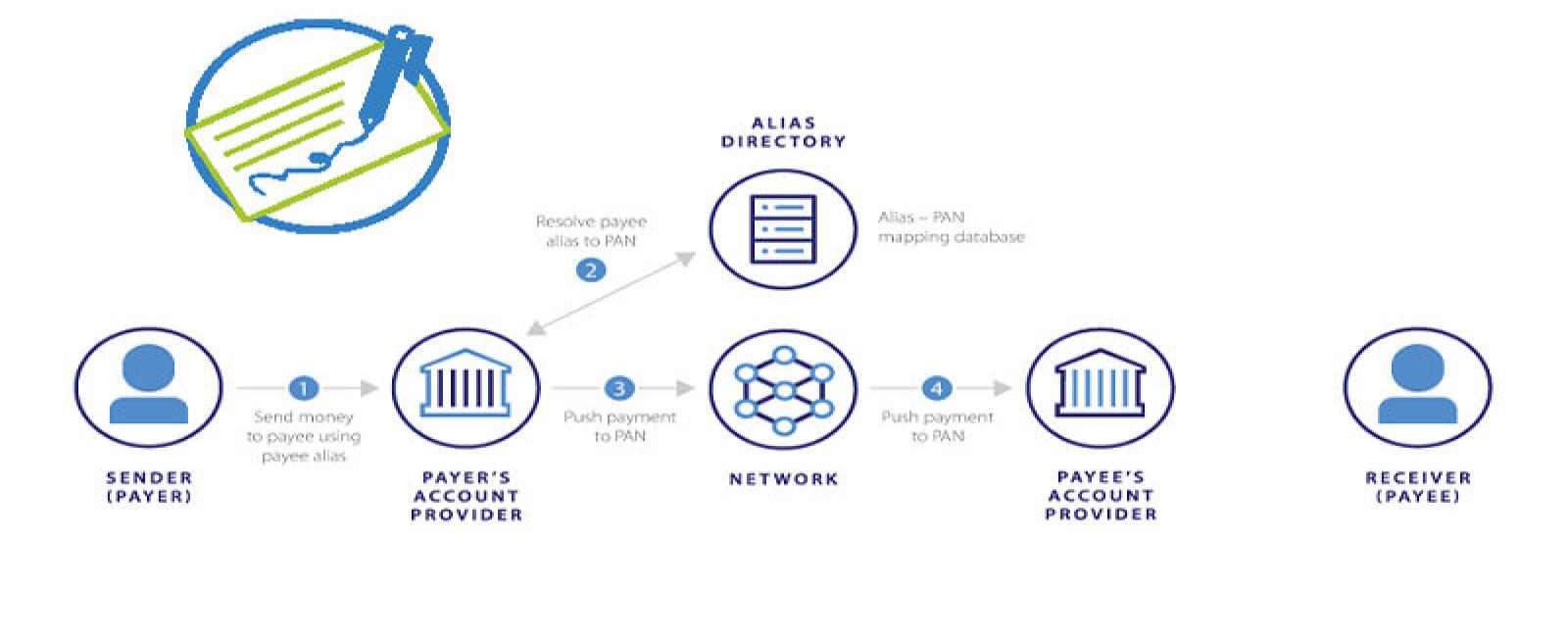

A huge opportunity awaits in the payment processing sector of the economy. Gone are the days of only having the option to use cash, checks, credit or debit cards from either a traditional checking or savings account. Payment institutions such as PayPal and Stripe are changing the way customers are able to purchase goods. With Apple Pay, Samsung Pay and many others, consumers can digitally purchase goods without the need for a physical card, check, or cash. And the increasing use of ACH payment processing allows for funds to be transferred from one account to another without the need to handle paper checks, cash, cards or devices.

With the growing demand for more convenient ways to purchase goods and services, investors are taking notice, and more money than ever is being invested in the payment industry.

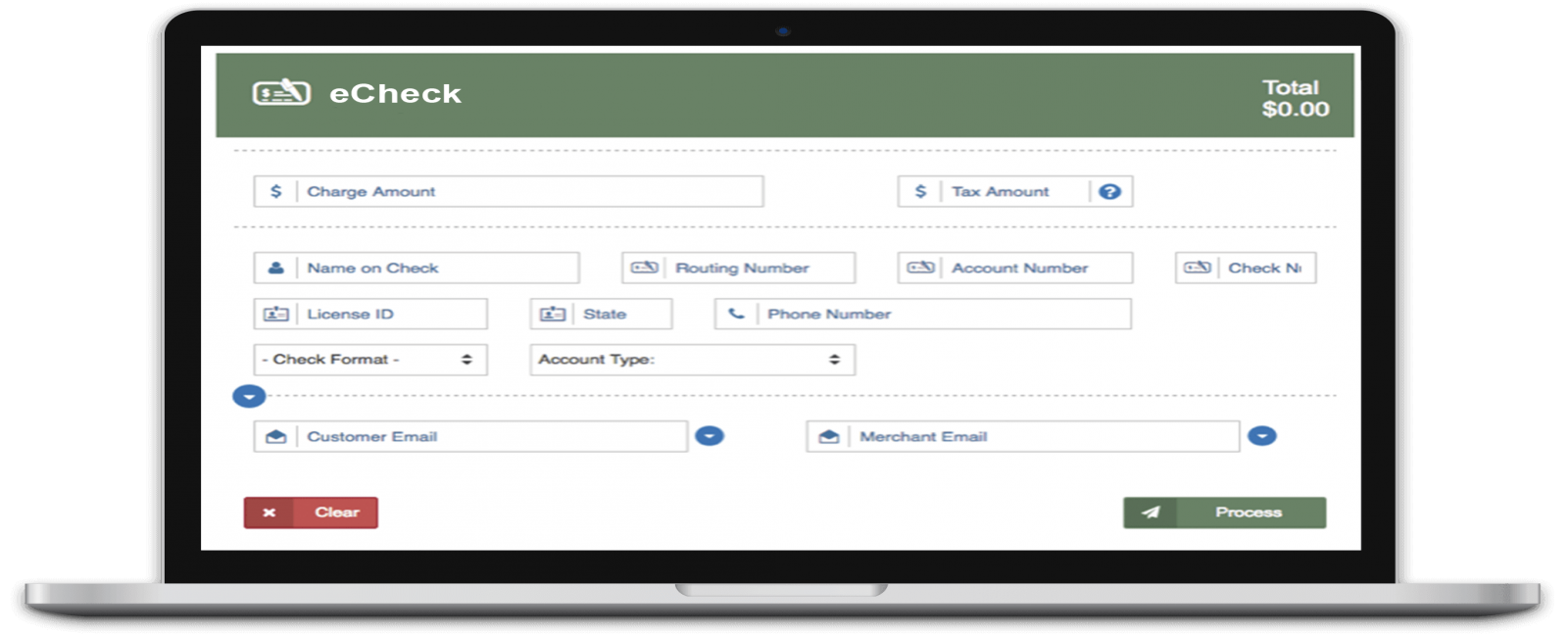

How is eCheckDeposit the Front Runner in Payment Processing?

The world of payment processing is quickly changing. In order to appeal to and attract more of your target audience, you must be able to stay at the forefront of these changes. eCheckDeposit offers businesses innovative payment processing technology and has been a leader in the space for more than three decades. We pride ourselves on being one of the few financial technology companies that has a person at the end of your customer service phone call, and offers 24/7 customer service. Companies who choose eCheckDeposit can rest assured that they will have the ability to offer businesses and consumers state-of-the-art payment processing.

Offering Digital Payment Options

Expanding payment options to include digital non-bank related digital options will give your consumers more payment options that better suit their preferences. Digital non-banking firms are quickly gaining prominence in the payment industry and should be incorporated in your business model.

Leading the International Payments Demand

Making international payments has been a pain point of international commerce for quite some time. These payments are difficult to track, leaving buyers more vulnerable to scams. There is also the issue of slow payment times when sending transactions across international lines. Offering models that allow for more transparent international commerce will make consumers feel safer purchasing products overseas and therefore increase sales.

Increase sales, decrease your bottom line, and attract more consumers by using eCheckDeposit for payment processing. Contact us today for more information.