Popular Posts

E-check deposit is the latest transaction tool which will change the way you bank's

04-02-2019

The online transactions which are easy and quick- e-check deposits

15-02-2019

Deposit E-check for hassle-free money transfer

05-03-2019

Garner benefits using E-checks

25-03-2019

Everything You Need to Know about Ach Transactions

26-03-2019

E-checks services are certainly instant fund services

28-03-2019

Now, pay instant checks through your phone!

04-04-2019

What all things to keep in mind while looking for Echeck Payment Services

10-04-2019

Going cashless, UPI and beyond

22-04-2019

Online payment fraud – the current dilemma and how to prevent it with the help of e-check deposits

29-04-2019

Insights on online payment methods.

13-05-2019

The benefits of using e-check payment by phone.

30-05-2019

Why prefer ACH payment over credit card payment

15-06-2019

Why is it Important to use E-check services when we can use online payments?

29-06-2019

Easy Steps Anyone Can Take to Stop Check Fraud

09-07-2019

The Lerner Guide to Accepting eCheck generated by eCheckDesposit

15-08-2019

eCheck Services Are Alive and growing vigorously

12-09-2019

What is an Electronic Check?

10-10-2019

What are electronic checks and what are the benefits?

08-11-2019

How Payment Processing Drives the Economy

17-12-2019

The Payment Processing Revolution: Why Your Company Needs to Stay at the Forefront

06-01-2020

E-check deposit is the latest transaction tool which will change the way you bank's

- 04-02-2019

- 0

An e-check is a form of transaction in the digital or electronic version. It is an alteration of a paper check.

What is an e-check?

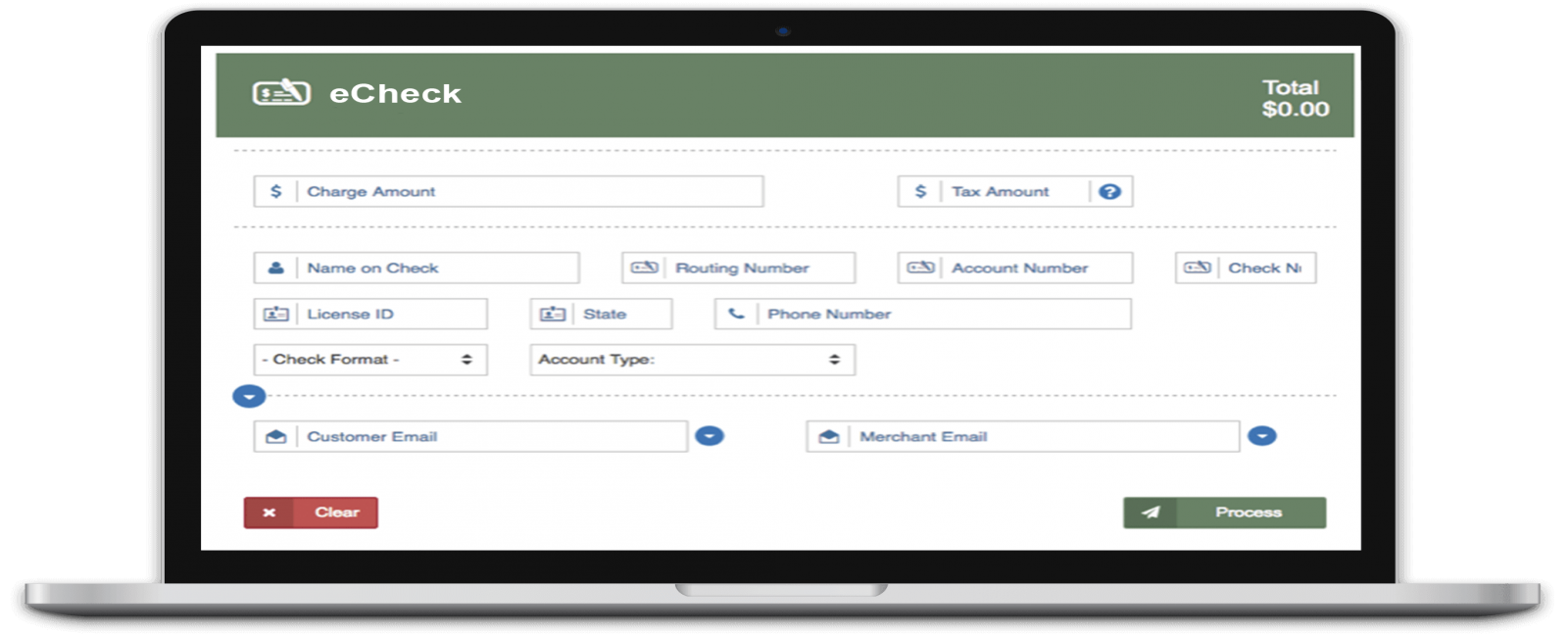

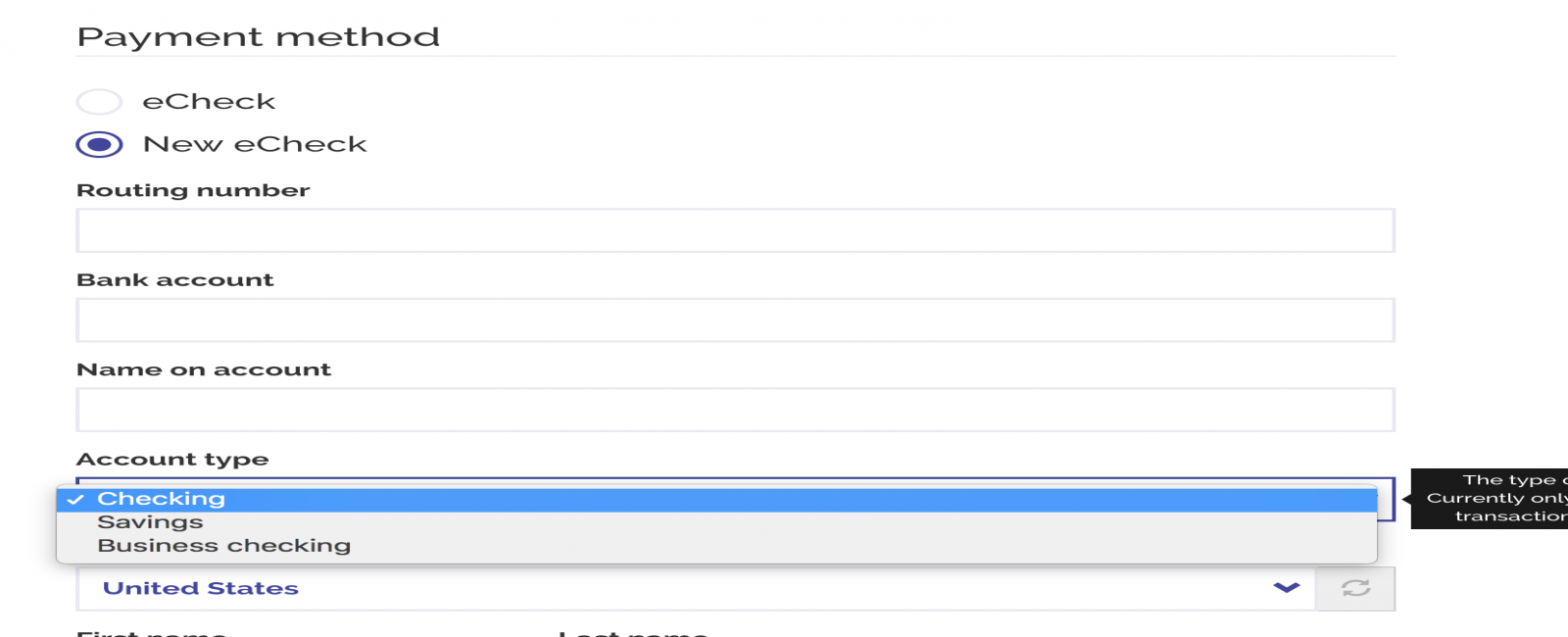

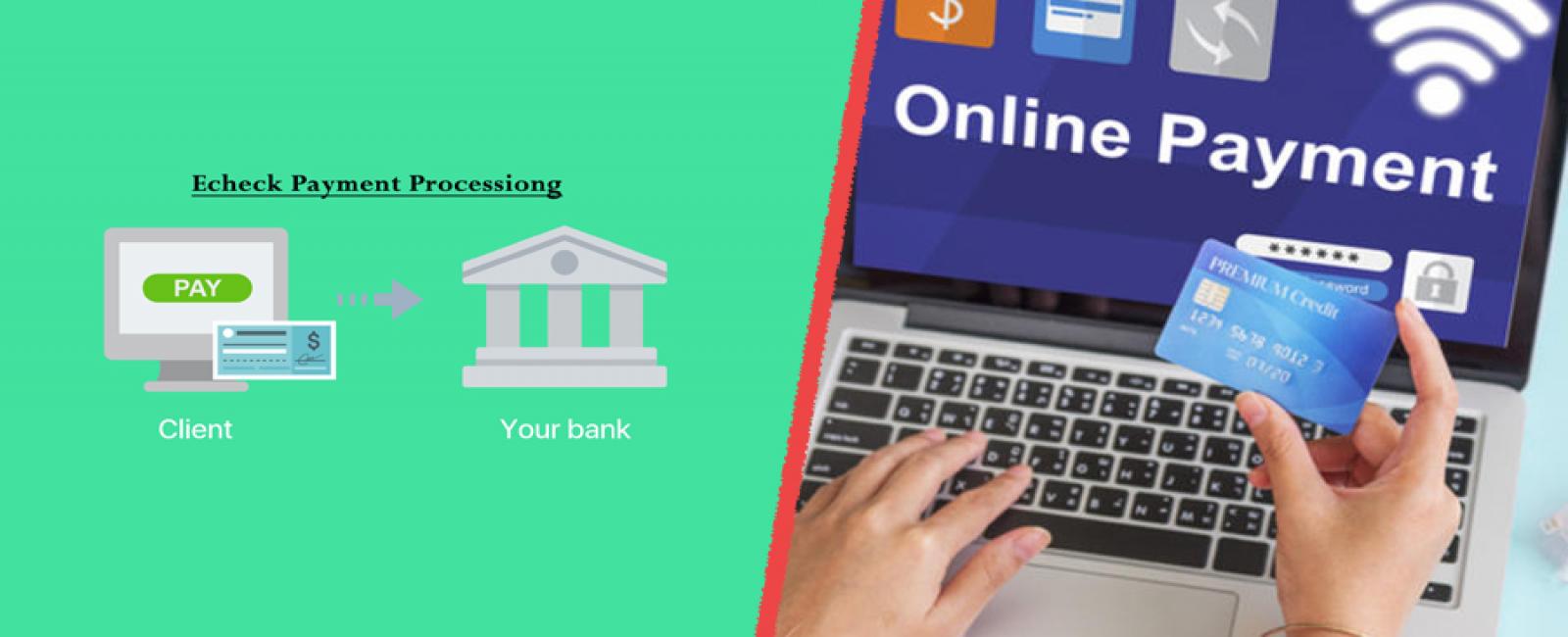

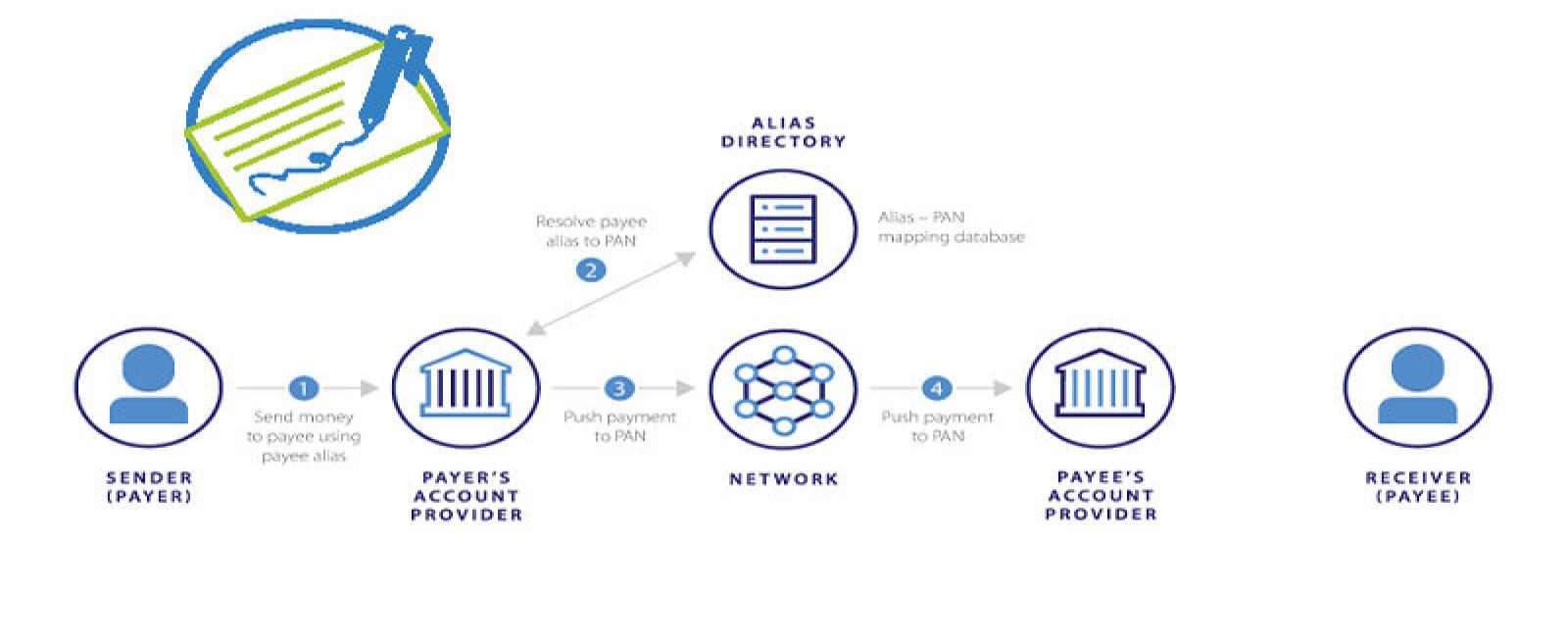

Similar to a paper check, an electronic check needs standard information to submit the e-check for payment. Particularly, an e-check contains a bank account number, a routing number, bank account name, endorsement and a signature. Also, e-checks include the same procedures of deposited and settled similar to paper checks. E-checks are submitted and processed in the same way to paper checks as well as are managed through similar regulation, but they offer more features and better security. They are usually processed much more quickly as compared to the paper checks.

While many paper check fundamentals are built-in in a digital check, the connections are very close at the physical point. An e-check is completely digital, and it permits the owner of a bank account to transfer payment directly through his or her account to the bank account of the other person without the participation of a physical device. With a paper check, you should confirm that you keep detailed records of your economic transactions. But as you’re possibly using the application to collect funds, manage invoices and track payments, you can also computerize the whole transaction process.

When you have the right device in your hand, then you don’t have to worry about maintain your records because you already have an e-banking log where you can track your data at any time. With it, you can develop this procedure to arrange more complicated workflows. You can say that e-checks provide you the main accounting medium that you utilize to arrange your books. You can configure a payment processing application, which you can use to create direct payment from your bank account to the other person’s bank account.

You can also check your invoice’s status which is dependent on the abilities of your payment handing out software. They also allow the customers to read their follow-ups and the money in the process which is pending for clearance. If you want you can request or receive e-checks in your banking software. When you configure the capability to receive e-checks and you can allow credit card transactions as well.

Following are a few advantages to go for e-checks which are worth to change your way of banking:

Lower Costs

When you use e-checks for payment, then they are less costly as compared to a paper check. In reality, the standard cost of a paper check is very high than an electronic check. With e-checks there, you can save more than paper checks!

Time-Saving and Convenient

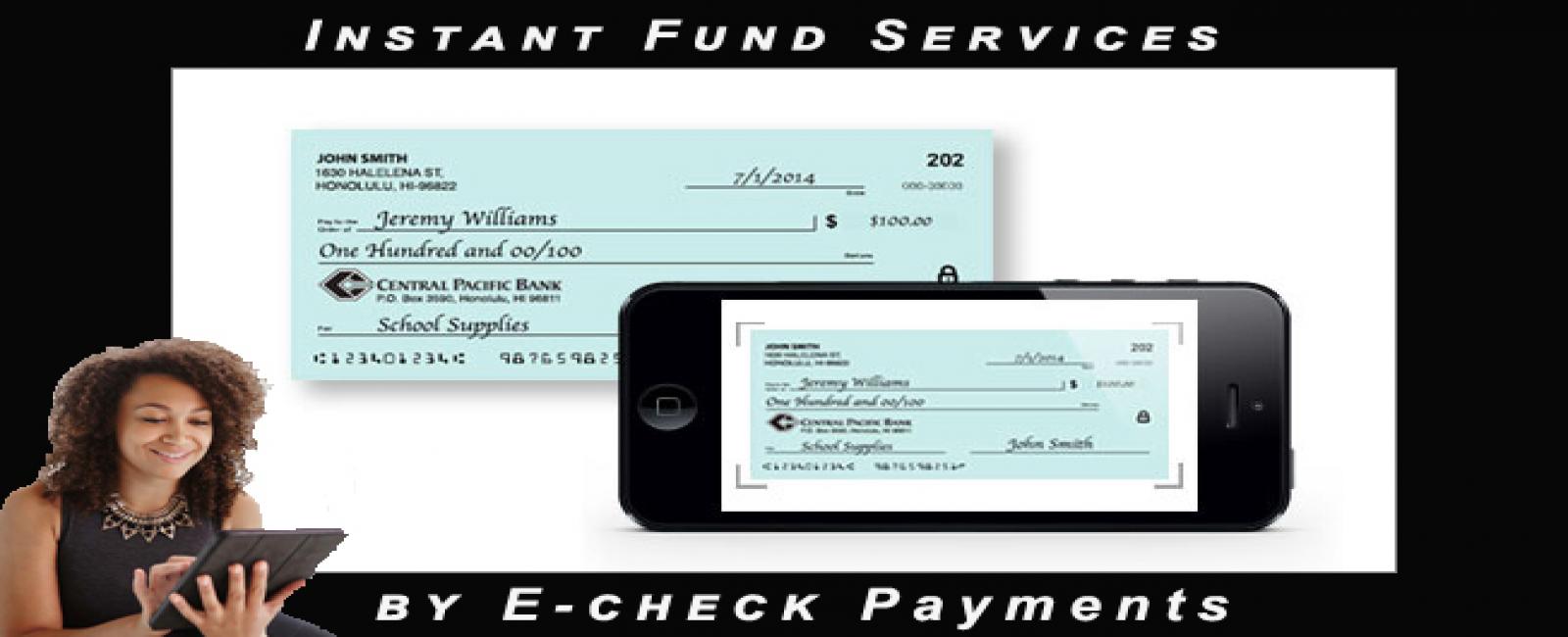

When you use e-checks or make transactions through e-checks, then they save a lot of your time and are more convenient. You don’t have to keep your checks books all the time with you. Moreover, the receiver is also not required to visit the bank physically as he or she can do it through the software sitting anywhere and anytime.

Reliability and Security

The electronic checks are extremely safe as compared to a paper check. E-checks come among an encryption benefit which is responsible for verifying the account number, check, amount of money is going to be paid through the account.

Faster Processing

E-checks offer faster processing feature which is a benefit for business holders. When we pay through paper checks, then they have to go through various to transfer money from one account to another account and it consumes more time. An e-check payment often takes half time to process the money, which means that money can be transferred in less time.

Electronic checks payment include the potential to reduce approximately all administrative difficulties that anyone faces while getting paid. There are no more doubts if your customers remitted the payment or received your invoice. With e-checks, you can bring your business forward in the directions of new opportunities.

Comments

mayank singh

good blog.....