Popular Posts

E-check deposit is the latest transaction tool which will change the way you bank's

04-02-2019

The online transactions which are easy and quick- e-check deposits

15-02-2019

Deposit E-check for hassle-free money transfer

05-03-2019

Garner benefits using E-checks

25-03-2019

Everything You Need to Know about Ach Transactions

26-03-2019

E-checks services are certainly instant fund services

28-03-2019

Now, pay instant checks through your phone!

04-04-2019

What all things to keep in mind while looking for Echeck Payment Services

10-04-2019

Going cashless, UPI and beyond

22-04-2019

Online payment fraud – the current dilemma and how to prevent it with the help of e-check deposits

29-04-2019

Insights on online payment methods.

13-05-2019

The benefits of using e-check payment by phone.

30-05-2019

Why prefer ACH payment over credit card payment

15-06-2019

Why is it Important to use E-check services when we can use online payments?

29-06-2019

Easy Steps Anyone Can Take to Stop Check Fraud

09-07-2019

The Lerner Guide to Accepting eCheck generated by eCheckDesposit

15-08-2019

eCheck Services Are Alive and growing vigorously

12-09-2019

What is an Electronic Check?

10-10-2019

What are electronic checks and what are the benefits?

08-11-2019

How Payment Processing Drives the Economy

17-12-2019

The Payment Processing Revolution: Why Your Company Needs to Stay at the Forefront

06-01-2020

Insights on online payment methods.

- 13-05-2019

- 0

Online payment services are services that enable you to pay for goods or services on the Internet or through a mobile application without using banknotes. Usually carried out directly on the website or in the seller’s mobile app.

What types of online payments are available?

1. Internet acquiring

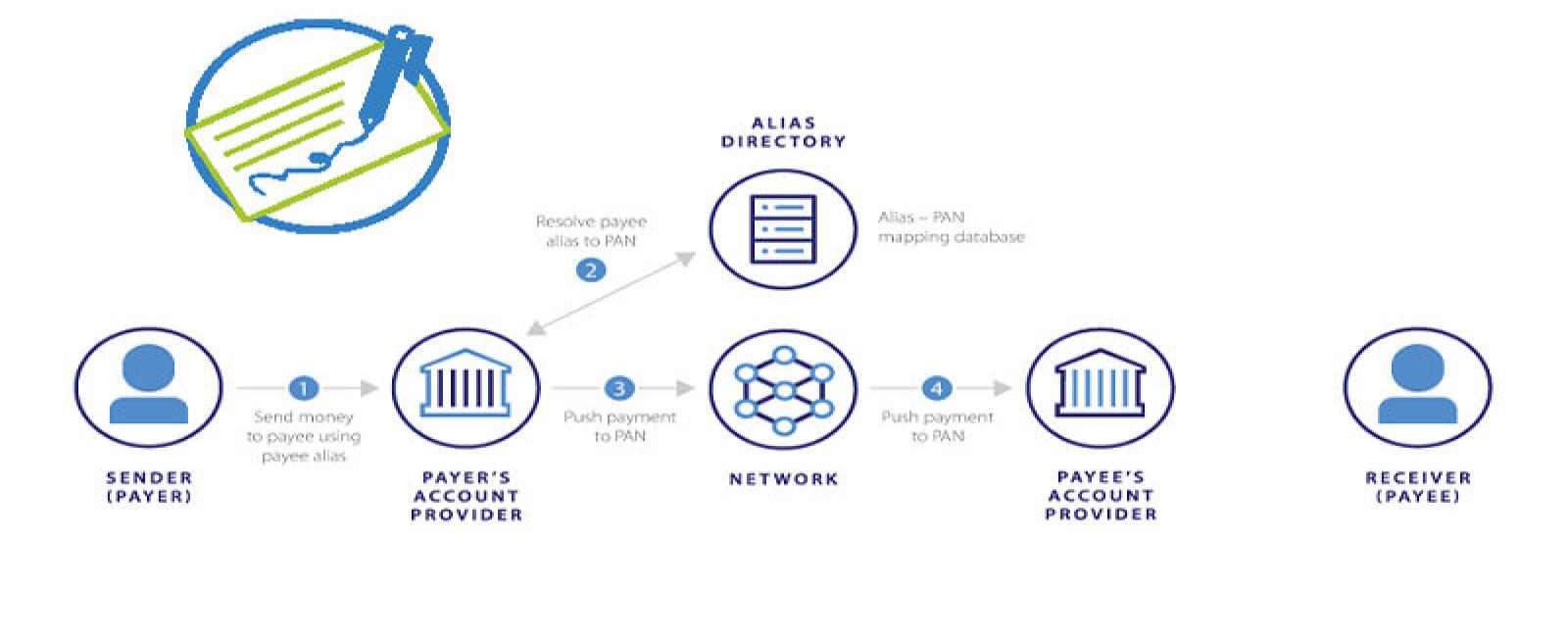

This is a transfer of funds from the buyer's bank card to the seller’s account with the participation of the acquiring bank and the processing company, that is, online payment by phone on the site using a special interface. The bank that issued the card is the issuer, and the bank that accepted the request to authorize the transaction is the acquirer. It can be the same bank or two different. The acquiring bank always works in conjunction with the processing center that performs the clearing procedure - debiting/crediting funds from one account to another. The interaction interface is provided by the processing center, which can be a structural unit of the bank or an independent company. To provide online payment services between an online store and a credit institution or payment processing, an appropriate agreement must be concluded, therefore, only legal entities or individual entrepreneurs can qualify for acquiring. A bank or processing center charges a fee for an operation, the amount of which often depends on the volume of transactions performed during online payment services.

2. Payment gateways

These are Internet-acquiring providers, hardware-software complexes that process electronic transactions, acting as a payment router. One way or another, all acquirer banks and companies that accept payment by phone are connected to their own or third-party payment gateways. Electronic payment online gateway can be compared with a payment terminal that authorizes payments and links together a buyer, seller, bank. The encryption of personal data takes place using SSL (Secure Socket Layer), which ensures the security of the exchange. To use the payment gateway for online payment services, the client needs an account in the corresponding system. For the buyer to use for free, the seller lists the percentage of transactions. Leading payment gateways: Assist, PayOnline, ChronoPay, CyberPlat, Uniteller, UCS (United Card Services).

3. Payment systems - operators of electronic money (EMF)

These are online payment services that are made to the site directly. The online store that accepts payments by phone applies and signs an agreement with the payment system, after which it integrates its software with the payment system and the bank. The seller has full access to the program, and therefore, an idea of what processes and when they occur. The speed of movement of money is high, a maximum of 3 days after the operation. The absence of intermediaries allows you to set a minimum commission. Besides, online payment services increase customer confidence, since there are no transitions to questionable sites - only to the website of the payment system or payment gateway. Among the downsides is a long check by payment systems (several days or even weeks), the need to write software requires the involvement of a technical specialist.

4. Payment aggregators.

These are services that allow you to combine several online payment services without accumulating client funds. It is a convenient way for small and even medium-sized online businesses. Many refer to the disadvantages of payment aggregators tariffs, since the commission may be charged both from the buyer when making a payment, and from your company when withdrawing funds. However, it is worth remembering that the cost depends primarily on the monthly turnover and the type of activity of your company. So, if a month you have 0 rubles of turnover, then 0% of the commission.

The most important factors that should be considered when organizing for online payment services acceptance on the site are the conversion and resiliency parameters on a particular interface of interaction with the payer. Both usability, anti-fraud settings, query routing parameters, and 3D-S sensitivity should not impede payment. All these points should be taken into account by the provider of payment services, systems, or Internet acquiring to which you turned.