Popular Posts

E-check deposit is the latest transaction tool which will change the way you bank's

04-02-2019

The online transactions which are easy and quick- e-check deposits

15-02-2019

Deposit E-check for hassle-free money transfer

05-03-2019

Garner benefits using E-checks

25-03-2019

Everything You Need to Know about Ach Transactions

26-03-2019

E-checks services are certainly instant fund services

28-03-2019

Now, pay instant checks through your phone!

04-04-2019

What all things to keep in mind while looking for Echeck Payment Services

10-04-2019

Going cashless, UPI and beyond

22-04-2019

Online payment fraud – the current dilemma and how to prevent it with the help of e-check deposits

29-04-2019

Insights on online payment methods.

13-05-2019

The benefits of using e-check payment by phone.

30-05-2019

Why prefer ACH payment over credit card payment

15-06-2019

Why is it Important to use E-check services when we can use online payments?

29-06-2019

Easy Steps Anyone Can Take to Stop Check Fraud

09-07-2019

The Lerner Guide to Accepting eCheck generated by eCheckDesposit

15-08-2019

eCheck Services Are Alive and growing vigorously

12-09-2019

What is an Electronic Check?

10-10-2019

What are electronic checks and what are the benefits?

08-11-2019

How Payment Processing Drives the Economy

17-12-2019

The Payment Processing Revolution: Why Your Company Needs to Stay at the Forefront

06-01-2020

Everything You Need to Know about Ach Transactions

- 26-03-2019

- 0

ACH transactions are known as a type of payment which is generally used by individuals and businesses in the USA. At present, Industries of all sizes can offer a range of payment choices that benefit both them as well as their customers.

Now you can increase your business merely with the help of various payment options you provide: when you create it easy for the consumers to pay using the same mode that they want to. While checks, credit cards, and debit cards are all the best mix to offer, ACH payments give you the potential to increase profits as well as even more flexibility. In USA various businesses provide ACH Payment services to their clients.

Here are the benefits of opting the ACH Payments:

- Offer your customers with an option to checks and credit cards

- Provide lower-cost payment as compared to either credit cards or checks

- Faster transactions as compared to the checks

How Does ACH Work?

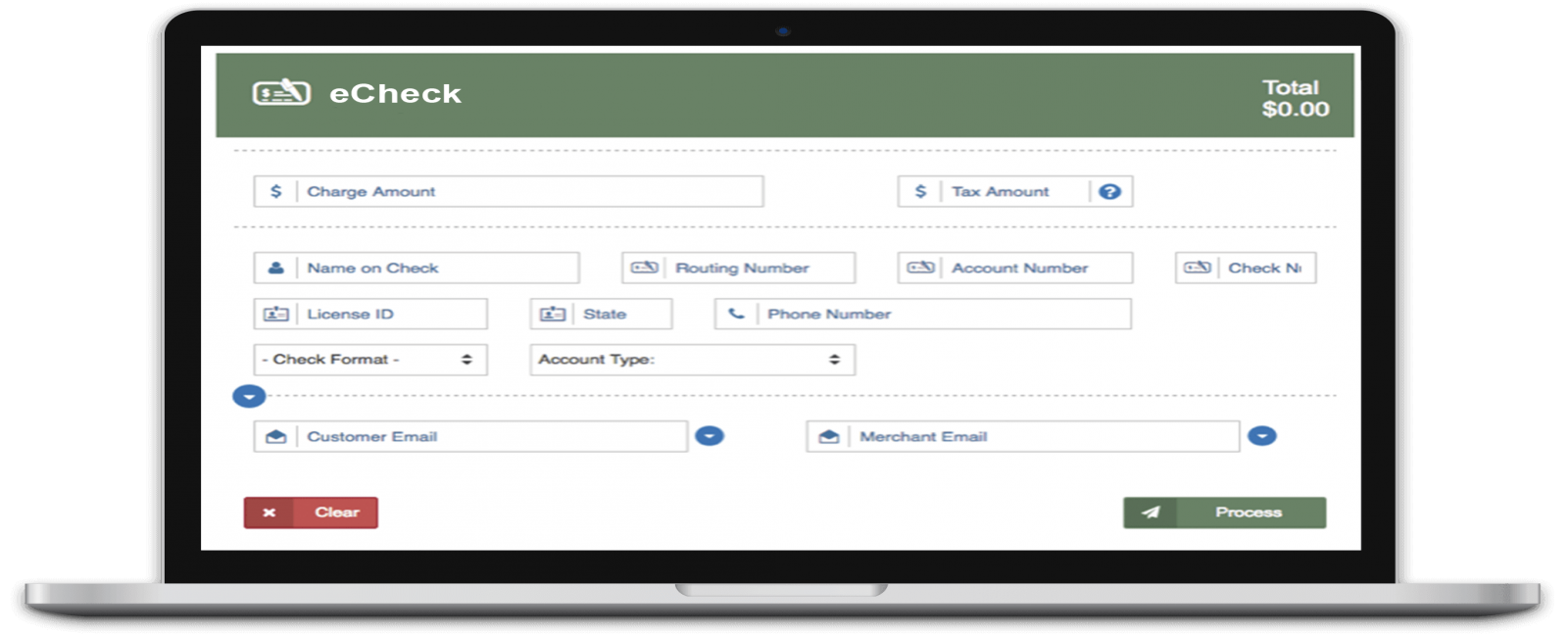

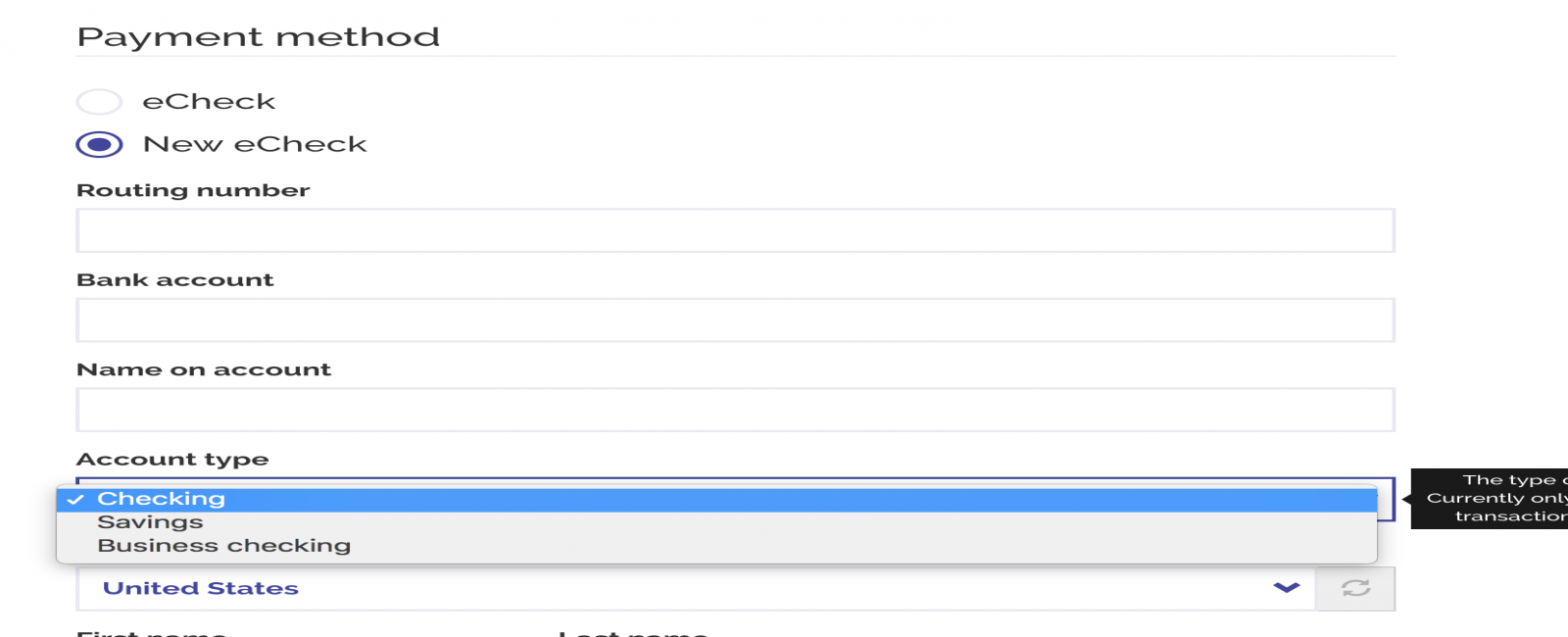

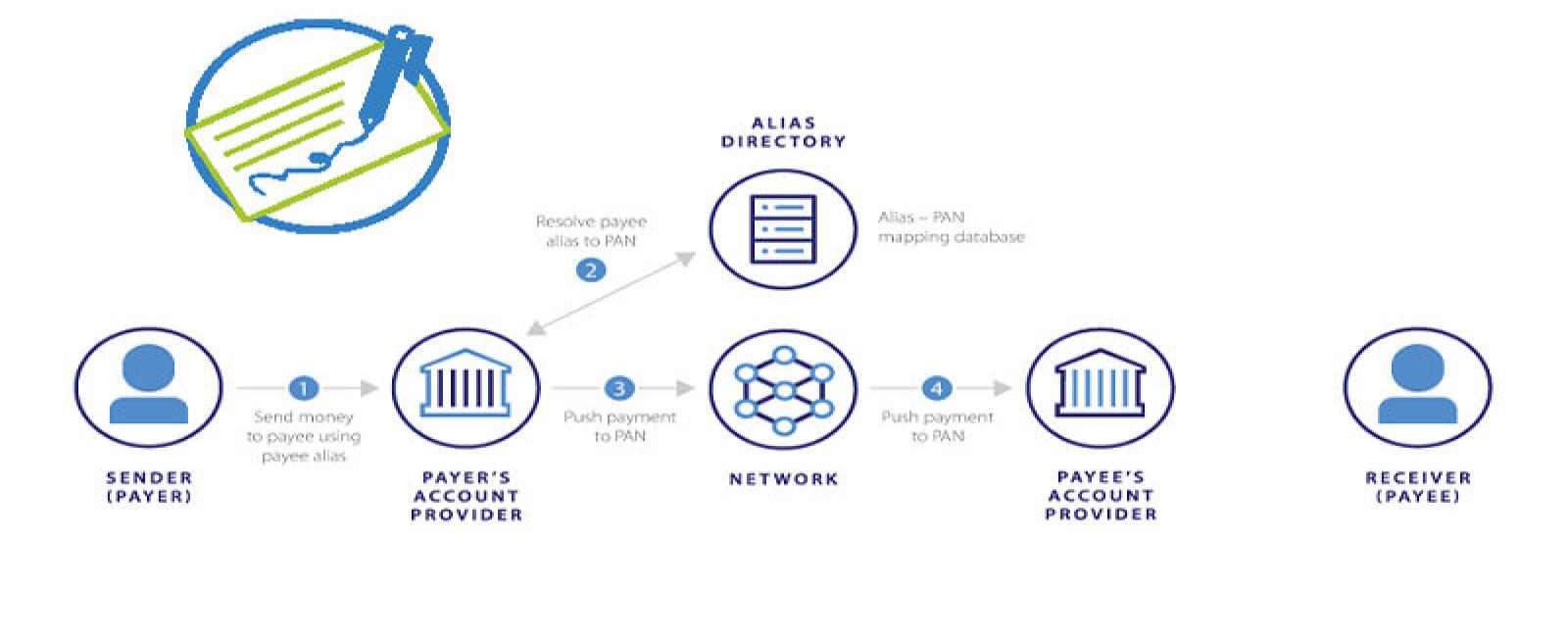

ACH payments are the mode of electronic payments which are created as the clients gives an originating corporation, institution, or additional customer agreement to debit openly from the saving or checking account of the customer for the aim of bill payment. ACH payments accept checks via the internet and by the web.

Users who select ACH payment processing should first allow you to withdrawal their bank account for the due money. The agreement should match to the needs of the ACH Operating Rules as well as should be either signed and written, or displayed electronically.

At present, organizations accept the following online ACH Payments:

- Electronic Check - WEB and TEL payments

- Check Conversion – RCK, POP, and ARC payments

Who Runs the ACH?

The ACH payment is an electronic mode of payment used for financial transactions. Many not-for-profit companies or organizations process the ACH e-checks and offer e-check services in the USA to their customers for easy transactions. Organizations into the ACH Network give fees yearly as well as per transaction to help cover the administration costs of the ACH.

Why Use ACH Payments?

Physical checks are considered as the main option for e-checks payments. People have worked with checks for years; also their work is done for sure. But ACH payments are more reliable, cheaper, faster as well as more secure. With the help of e-checks payment service, you don’t have to be anxious regarding the expenses of purchasing, printing as well as processing the e-checks. Also, you don’t have to hang around for e-checks to go from the dispatcher to the post office as well as then to the recipient.

Conclusion

The main thing to make out is that E-check payments belong to electronic payments. These transactions have turned into the standard as the world is moving toward the more computer-based and online banking. And, the result? You don’t have to worry more for writing the checks as well as sending them via the e-mail. Ultimately, E-check payments have made the transactions safer, easier and faster to receive and send payments.