Popular Posts

E-check deposit is the latest transaction tool which will change the way you bank's

04-02-2019

The online transactions which are easy and quick- e-check deposits

15-02-2019

Deposit E-check for hassle-free money transfer

05-03-2019

Garner benefits using E-checks

25-03-2019

Everything You Need to Know about Ach Transactions

26-03-2019

E-checks services are certainly instant fund services

28-03-2019

Now, pay instant checks through your phone!

04-04-2019

What all things to keep in mind while looking for Echeck Payment Services

10-04-2019

Going cashless, UPI and beyond

22-04-2019

Online payment fraud – the current dilemma and how to prevent it with the help of e-check deposits

29-04-2019

Insights on online payment methods.

13-05-2019

The benefits of using e-check payment by phone.

30-05-2019

Why prefer ACH payment over credit card payment

15-06-2019

Why is it Important to use E-check services when we can use online payments?

29-06-2019

Easy Steps Anyone Can Take to Stop Check Fraud

09-07-2019

The Lerner Guide to Accepting eCheck generated by eCheckDesposit

15-08-2019

eCheck Services Are Alive and growing vigorously

12-09-2019

What is an Electronic Check?

10-10-2019

What are electronic checks and what are the benefits?

08-11-2019

How Payment Processing Drives the Economy

17-12-2019

The Payment Processing Revolution: Why Your Company Needs to Stay at the Forefront

06-01-2020

Online payment fraud – the current dilemma and how to prevent it with the help of e-check deposits

- 29-04-2019

- 0

With e-commerce businesses reeling from various form of online frauds, including fraudulent chargebacks, the news that the industry often has to deal with the loss of revenue, exceeding 9$ billion each year is indeed shocking, to say the least.

This has prompted several governments t set up work study groups to assess the risk posed by online payment options and to come up with viable alternatives, such as electronic check payment processing and to effectively curb any and all forms of online payment fraud. But before that, it is time that you took a closer look at the various forms of online payment fraud, to understand the situation better.

Various types of online frauds

- Phishing/ spoofing: Phishing or spoofing is where dubious websites or dubious email links are often used to gather personal information, which is later used to hack into the user’s system. You may even be directed to make payments at dubious websites, such as emails informing you that you are behind in your tax payments etc. One of the reasons that most phishing emails are often taken at face value is that they contain a certain amount of personal information, which makes them all the more credible.

- Data theft: At times, you may come across a web link and click on the same, but often end up downloading and installing malicious code. The malware is designed to steal important pieces of information, data which is later on used to hack into the user’s various accounts

- Chargeback: Chargeback is when a user purchases a product from an online retailer and then claims that it was fraudulently purchased and issues a chargeback. The company in question faces a loss of revenue and undue hassle;

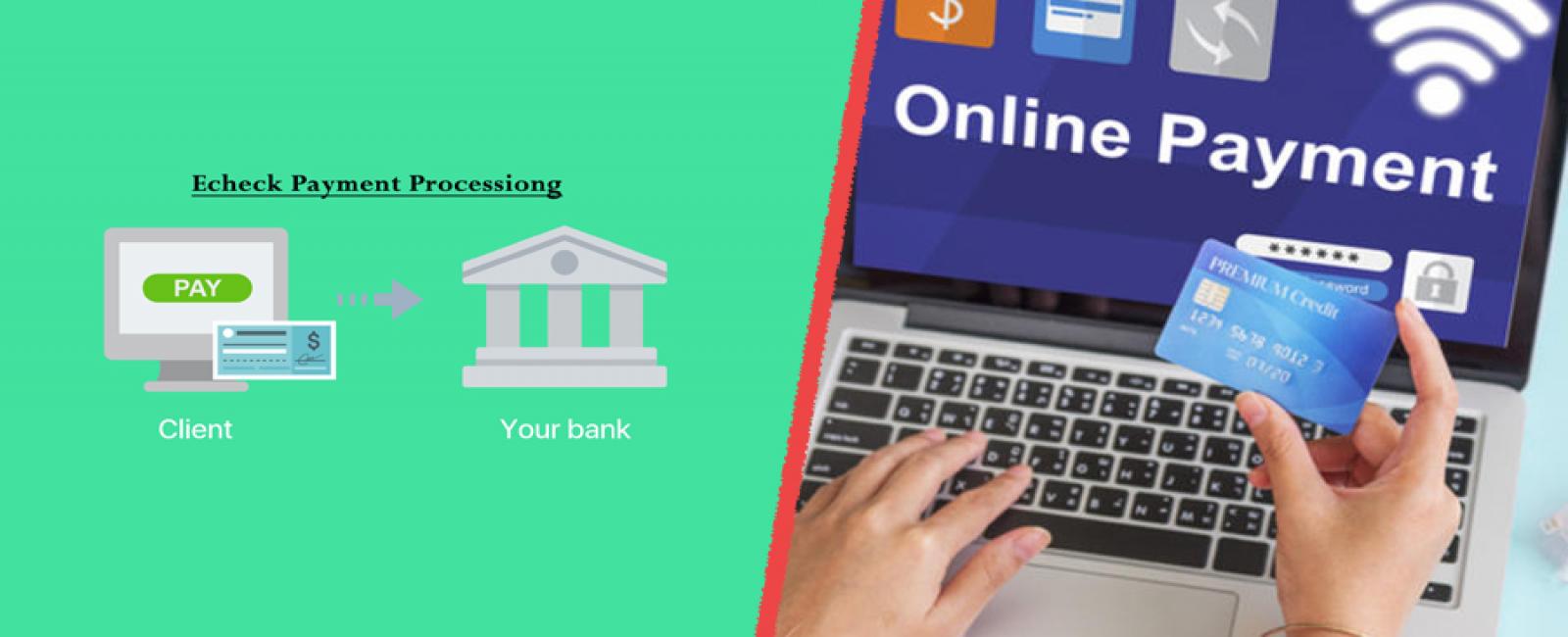

Electronic check payment processing

In fact, most online businesses have become aware of the fact that e-check payments in the USA can be utilized effectively to combat payment frauds like chargebacks. In fact, some of the top retailers have started introducing this option as one of the top online payment options - for example, if you happen to be purchasing an item online from an online retailer in Colorado, you are bound to come across ‘echeck services in Colorado’ or ‘accept payments or send payments by E-check’ as one of the many payment options, when checking out.

How it works-

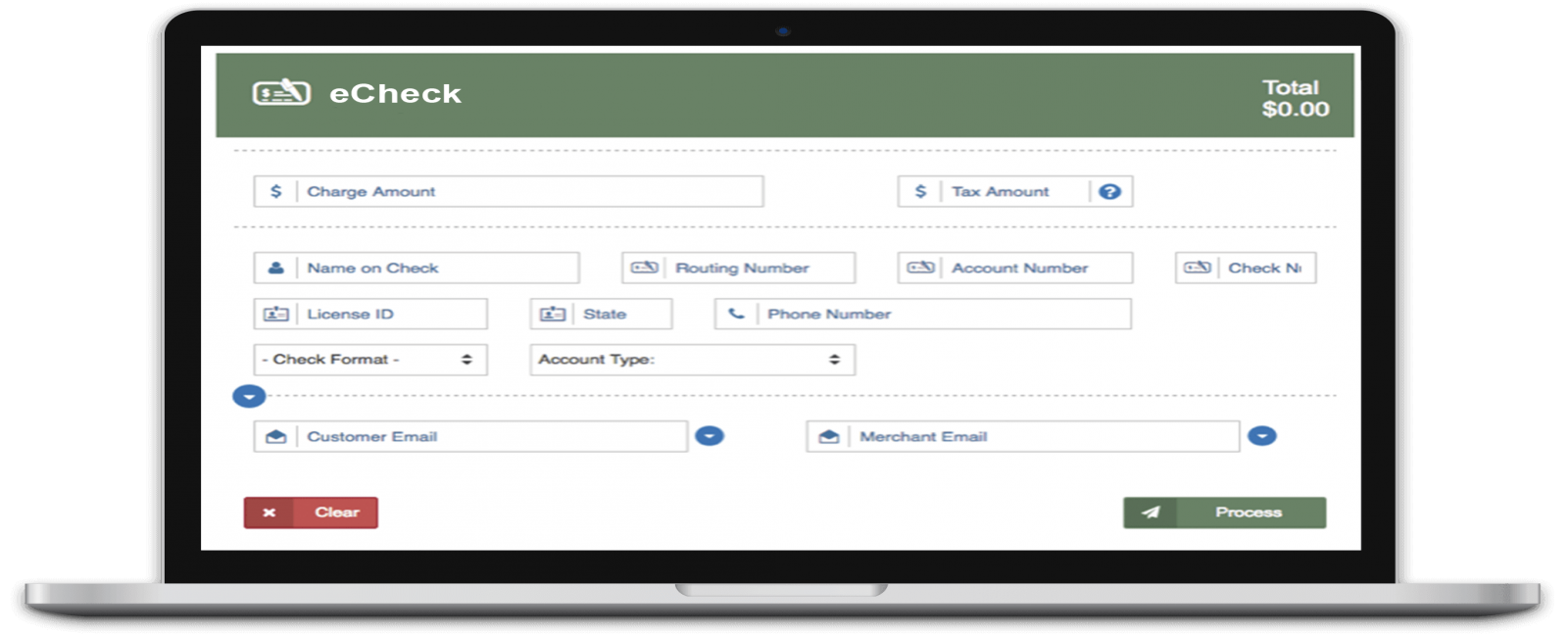

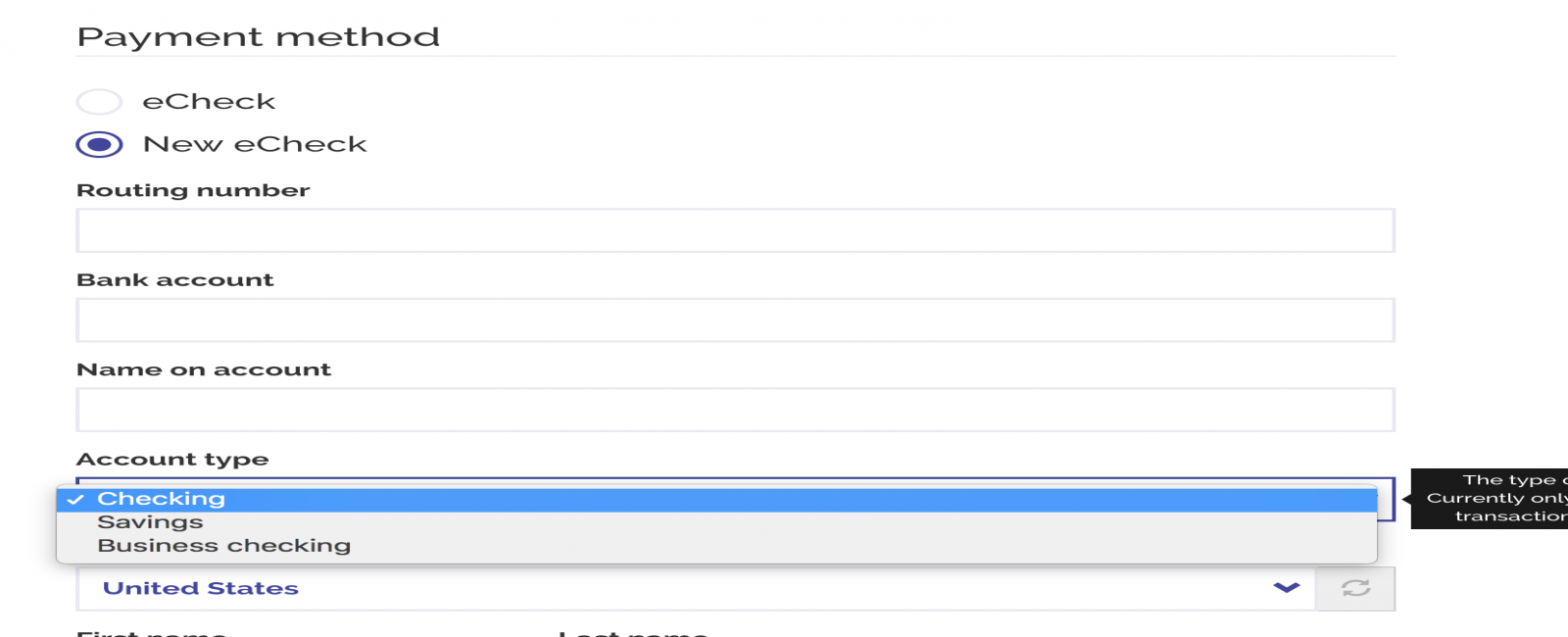

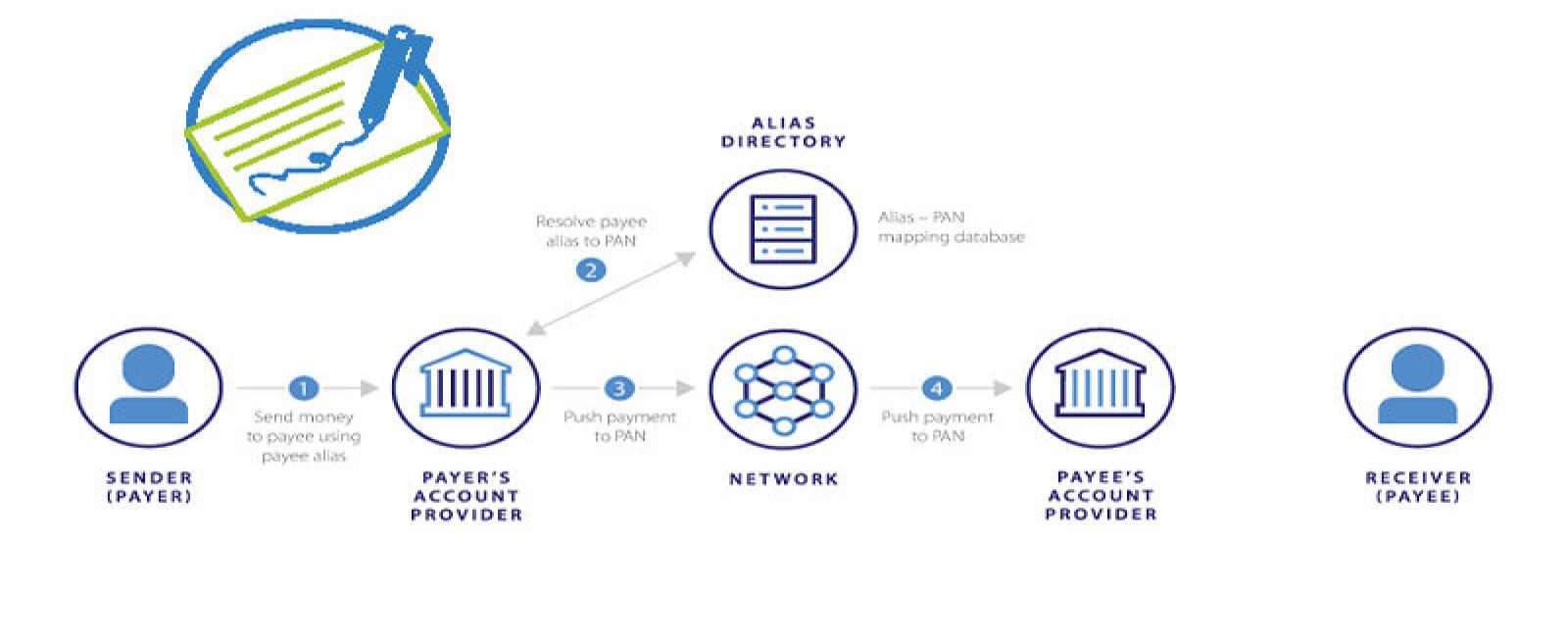

E-check processing in the USA basically works like this – when a consumer wants to purchase a certain item with an online retailer and chooses e-checks as one of the payment options, he is immediately prompted to enter his bank’s details including routing number and his checking account. He would also be required to add some personal ID such as his license for validation. The system then automatically verifies the bank information and validates and confirms the user’s identity as well. Then, a specified algorithm assesses the user’s risk profile and based on that, approves or declines the transaction.

After this, the electronic check payment processing moves to the next stage where the online retailer asks the user to verify and confirm the transaction. And on the confirmation, the retailer immediately withdraws the amount from the user’s checking account. It is that simple and at no point of time is the online retailer exposed to any fraud online. The merchant usually receives the funds in his bank account, by the next banking day. It is that fast, effective and free from any undue risk. And you can see why most online retailers prefer electronic checks as one of the many payment options.

As you can see, when it comes to online payment frauds, such as chargebacks, E-Check services in the USA happen to be one of the most effective methods there is, to combat online payment frauds, and why you may want to start shopping at retailers that display a payment option for the same.

ALSO READ ABOUT: The online transactions which are easy and quick- e-check deposits