Popular Posts

E-check deposit is the latest transaction tool which will change the way you bank's

04-02-2019

The online transactions which are easy and quick- e-check deposits

15-02-2019

Deposit E-check for hassle-free money transfer

05-03-2019

Garner benefits using E-checks

25-03-2019

Everything You Need to Know about Ach Transactions

26-03-2019

E-checks services are certainly instant fund services

28-03-2019

Now, pay instant checks through your phone!

04-04-2019

What all things to keep in mind while looking for Echeck Payment Services

10-04-2019

Going cashless, UPI and beyond

22-04-2019

Online payment fraud – the current dilemma and how to prevent it with the help of e-check deposits

29-04-2019

Insights on online payment methods.

13-05-2019

The benefits of using e-check payment by phone.

30-05-2019

Why prefer ACH payment over credit card payment

15-06-2019

Why is it Important to use E-check services when we can use online payments?

29-06-2019

Easy Steps Anyone Can Take to Stop Check Fraud

09-07-2019

The Lerner Guide to Accepting eCheck generated by eCheckDesposit

15-08-2019

eCheck Services Are Alive and growing vigorously

12-09-2019

What is an Electronic Check?

10-10-2019

What are electronic checks and what are the benefits?

08-11-2019

How Payment Processing Drives the Economy

17-12-2019

The Payment Processing Revolution: Why Your Company Needs to Stay at the Forefront

06-01-2020

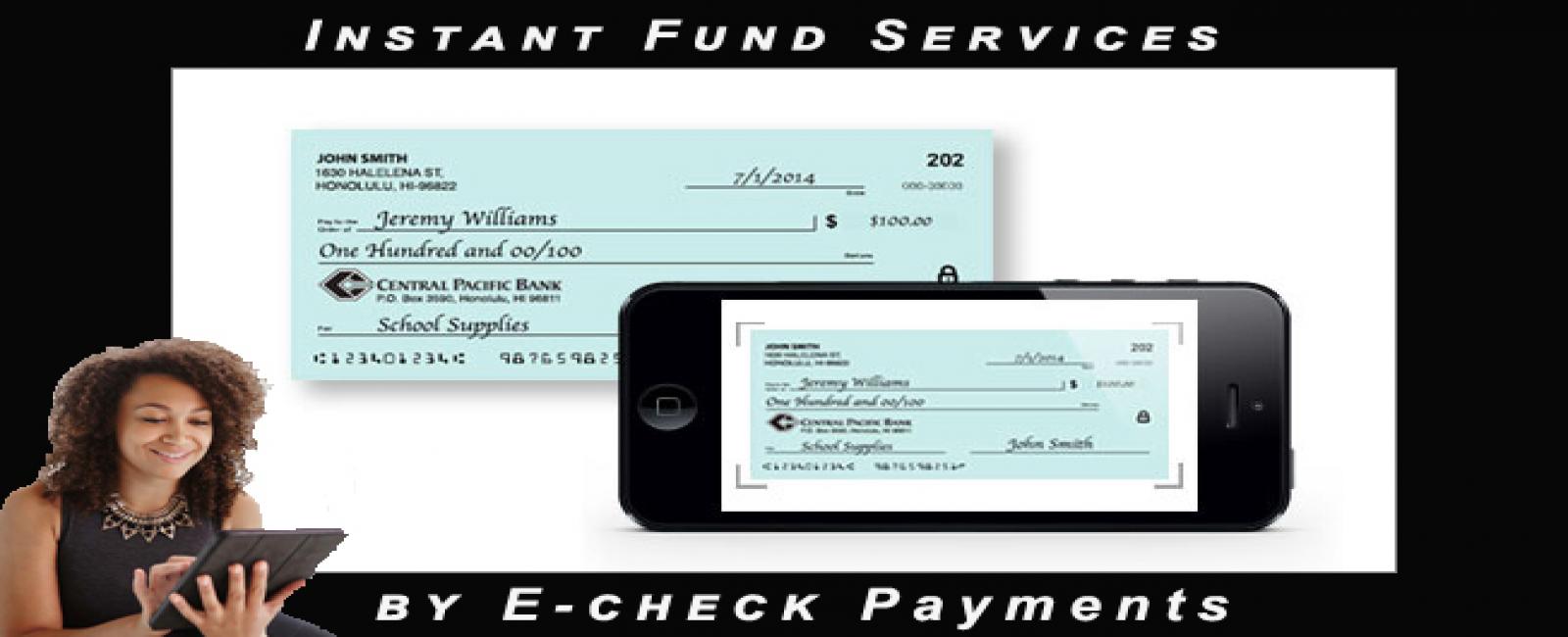

E-checks services are certainly instant fund services

- 28-03-2019

- 0

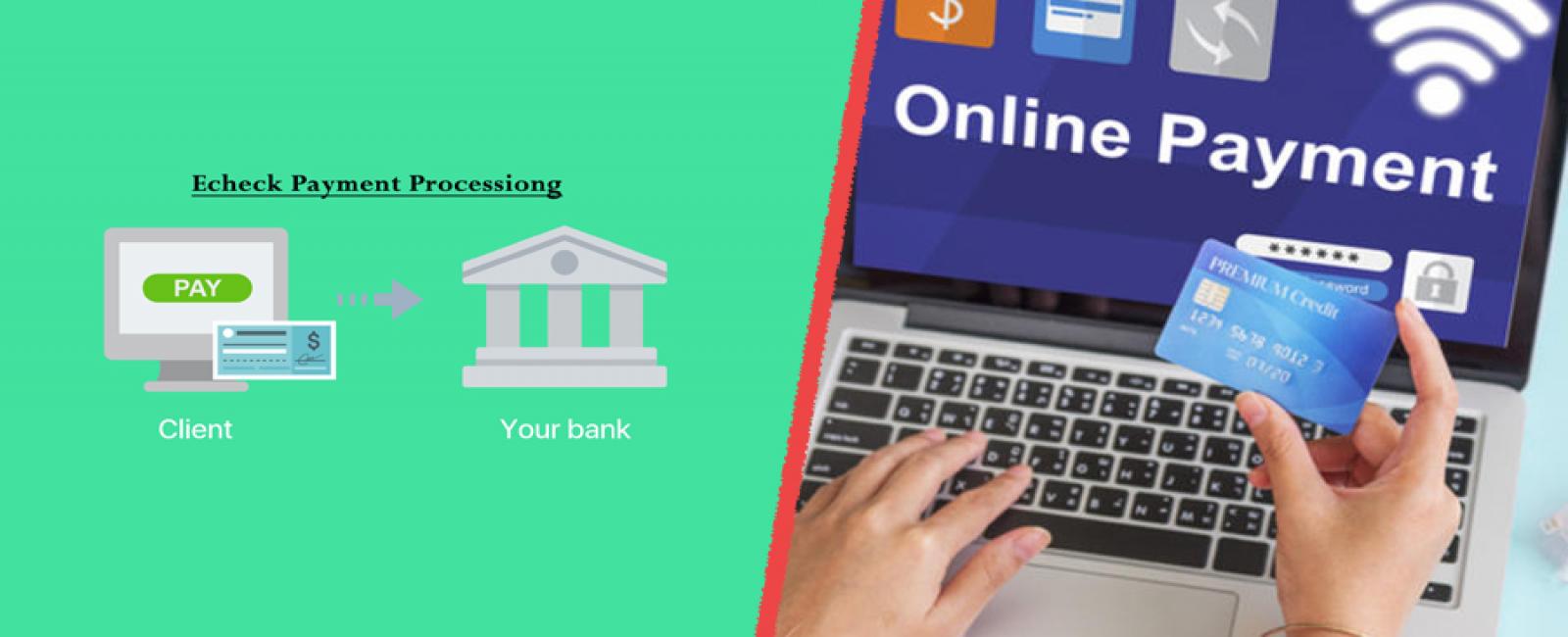

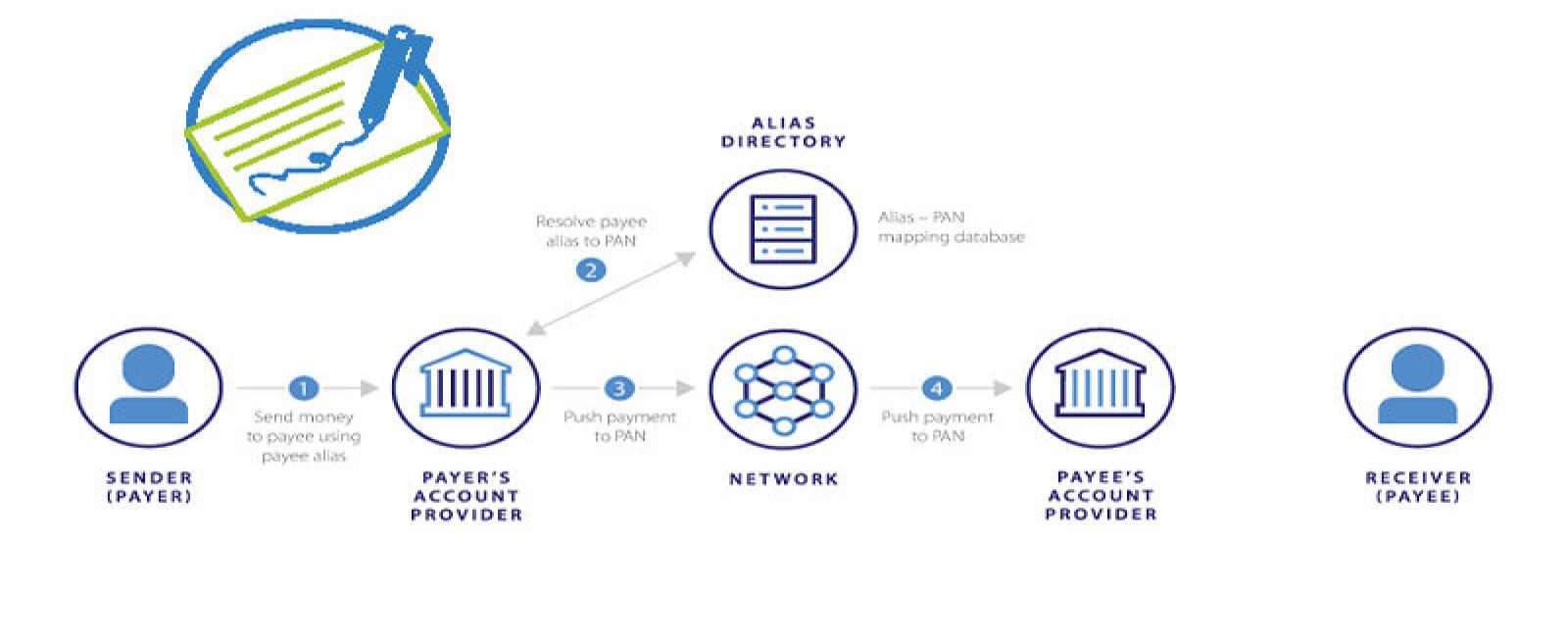

An electronic or e-check payment processing is a very simple procedure that takes place through electronic devices. A fast mode of money transfer as it is known is dependent on instant funds.

What are instant funds?

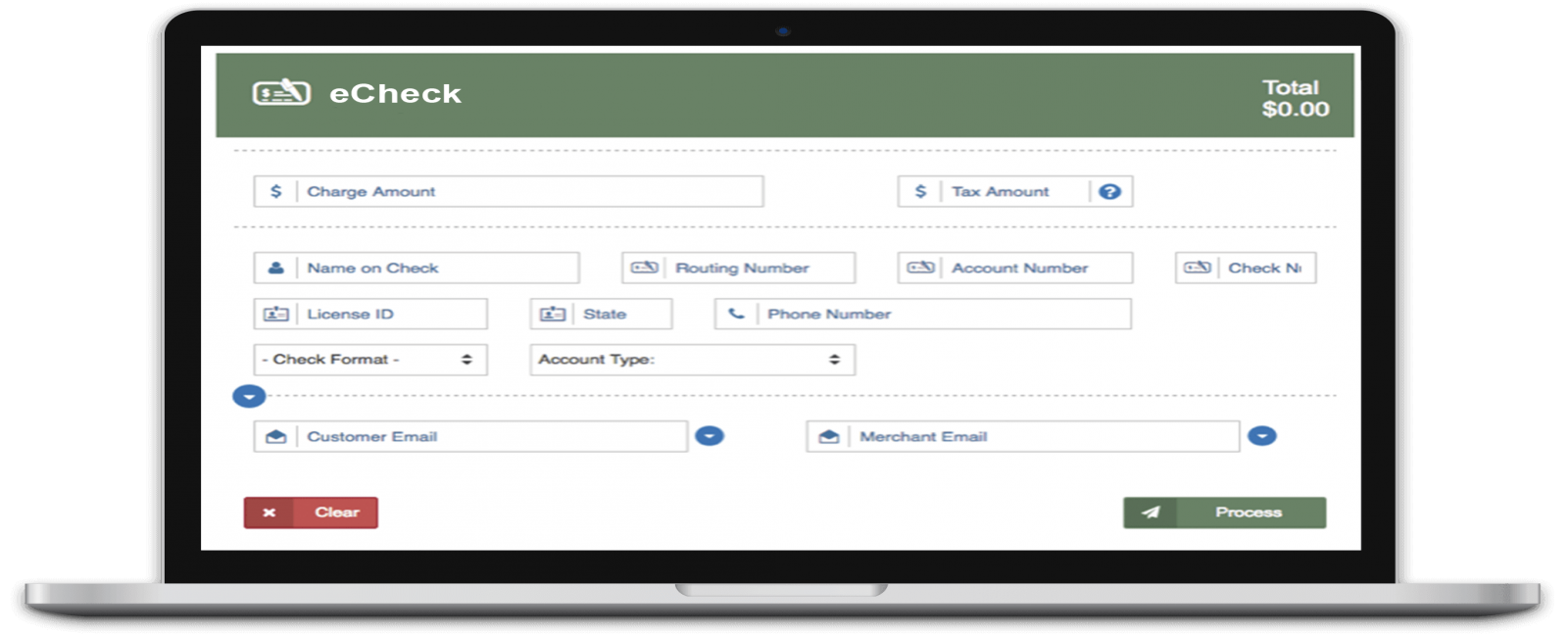

E-check services in the USA have a convenient method of qualifying the checks for payment through instant funds*. This way the e-check recipient can encash his check with a fee of 2.99%. Instant funds* which are under Hyperwallet are available with this convenience fee. This fee will be levied on the bearer of the check. When the funds are transferred to the bank account, the fee amount is notified before the confirming of the transaction. This means that the bearer knows about it when he accepts payment by e-check.

This can be explained as for example the amount $100 of a check is issued to the bearer, for instant funds i.e.in 30 minutes time. The bearer will get $97.1 deposited in his account. This is the convenience fee which is equal to $2.99 only.

How much is the e-check issuer charged?

The e-check sender is charged the monthly fee for handling e-checks. He is not charged with extra fees if the recipient gets the payment cleared with instant funds. This service is free for the e-check sender. They are not levied with an extra fee. The bearer has to incur this fee because it is an optional service. The bearer has the option to get the money in a day or two. So, access to instant funds may or may not be chosen by the recipient.

Let us read some reasons due to which the E-checks services in the USA may not qualify for instant funds:

- There are always some limits for the amount on an e-check. Only four-digit check can be written as an e-check. Similarly, there is also a limit for the total sum of e-checks written. So, once this limit is reached, further transactions do not qualify for instant funds.

- Each money transaction through e-check is unique. So, there are several individual requirements for the e-check to qualify for instant funds. This simply means that each check will not get instant funds.

- Sometimes the e-check sender gives the instruction of stopping instant fund transfer. This case is a special one and is found rare also.

So, e-check service providers in the USA have this instant fund facility for the sender and the recipient.

But how can one sign up for an e-check instant fund facility?

- E-check payment services in the USA have a lockbox service for instant funds. It’s a very fast and easy process which takes hardly 1 minute. Yes, an e-check account which is opened with an e-check deposit online has instant funds, powered by a Hyperwallet. Thus, the e-check account holder and the recipient require an e-check Receive Lockbox account. This account- e-checks receive lockbox account is free to open. It takes just one minute to log in and add all the requisite information like name, phone number, and email address, you are ready to go and create a password for yourself.

- A debit card is required which should be associated with a bank in the USA. Make sure it is not a credit card.

"Must Read About HOW ECHECK DEPOSIT SERVICES WORK "