Popular Posts

E-check deposit is the latest transaction tool which will change the way you bank's

04-02-2019

The online transactions which are easy and quick- e-check deposits

15-02-2019

Deposit E-check for hassle-free money transfer

05-03-2019

Garner benefits using E-checks

25-03-2019

Everything You Need to Know about Ach Transactions

26-03-2019

E-checks services are certainly instant fund services

28-03-2019

Now, pay instant checks through your phone!

04-04-2019

What all things to keep in mind while looking for Echeck Payment Services

10-04-2019

Going cashless, UPI and beyond

22-04-2019

Online payment fraud – the current dilemma and how to prevent it with the help of e-check deposits

29-04-2019

Insights on online payment methods.

13-05-2019

The benefits of using e-check payment by phone.

30-05-2019

Why prefer ACH payment over credit card payment

15-06-2019

Why is it Important to use E-check services when we can use online payments?

29-06-2019

Easy Steps Anyone Can Take to Stop Check Fraud

09-07-2019

The Lerner Guide to Accepting eCheck generated by eCheckDesposit

15-08-2019

eCheck Services Are Alive and growing vigorously

12-09-2019

What is an Electronic Check?

10-10-2019

What are electronic checks and what are the benefits?

08-11-2019

How Payment Processing Drives the Economy

17-12-2019

The Payment Processing Revolution: Why Your Company Needs to Stay at the Forefront

06-01-2020

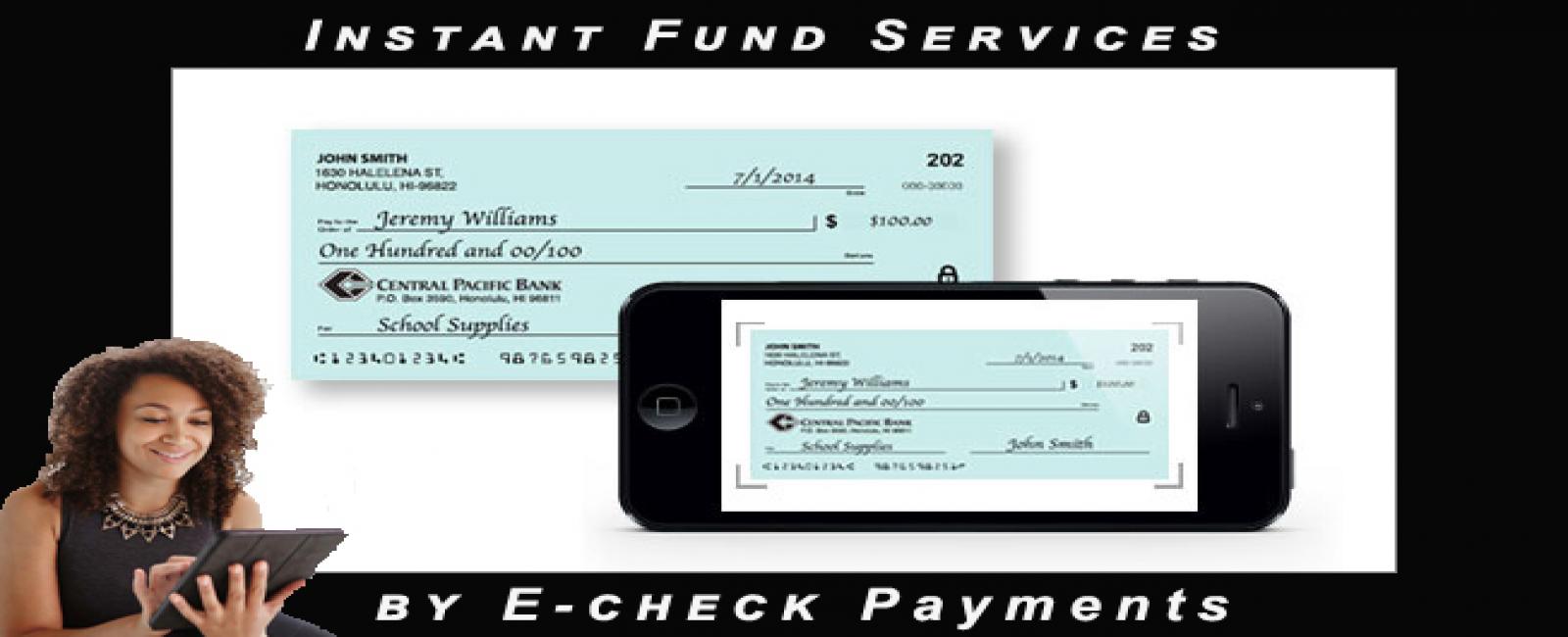

Now, pay instant checks through your phone!

- 04-04-2019

- 0

There is no need to carry a checkbook with you anymore; there is no need to pin down the account number and details of the person on the check. Echeck services have made it easy and convenient to make payment easily.

Yes, what you have read is right, it is instant. With the help of best e-check deposit services in the USA, make your payment instantly.

All you need to do is

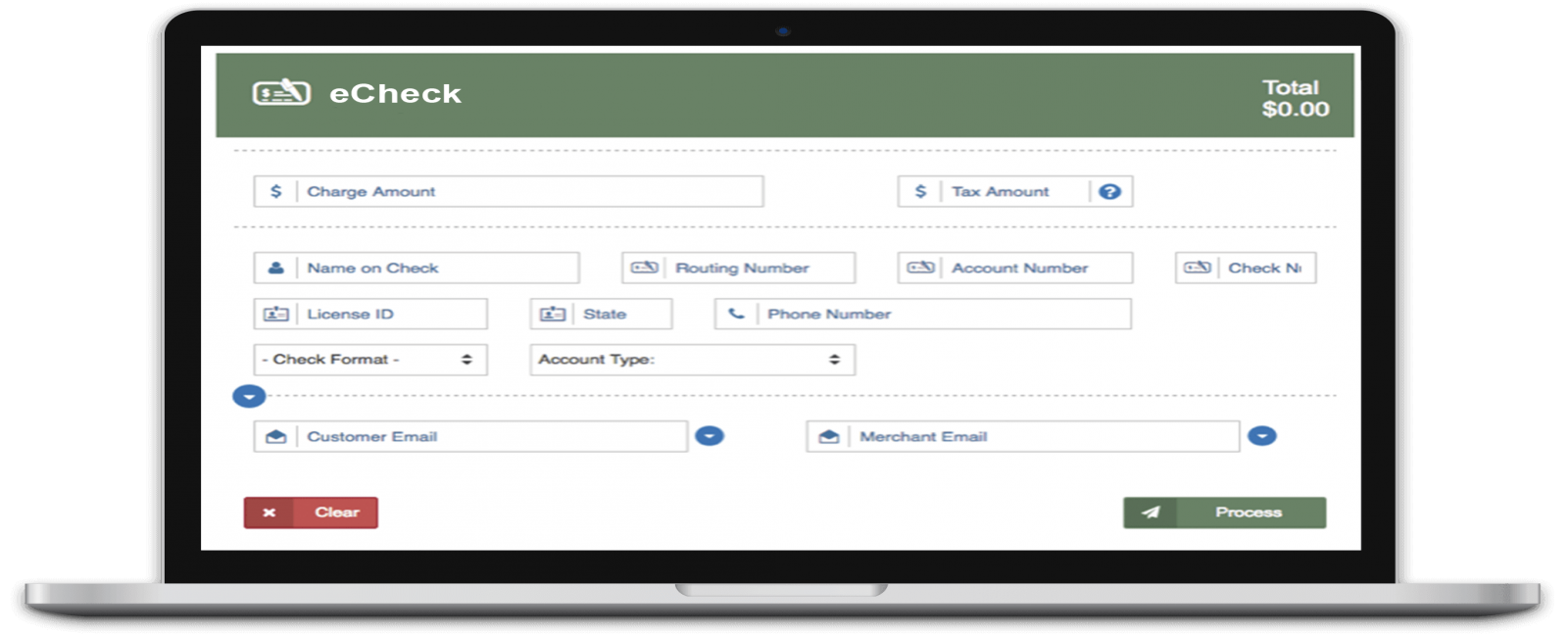

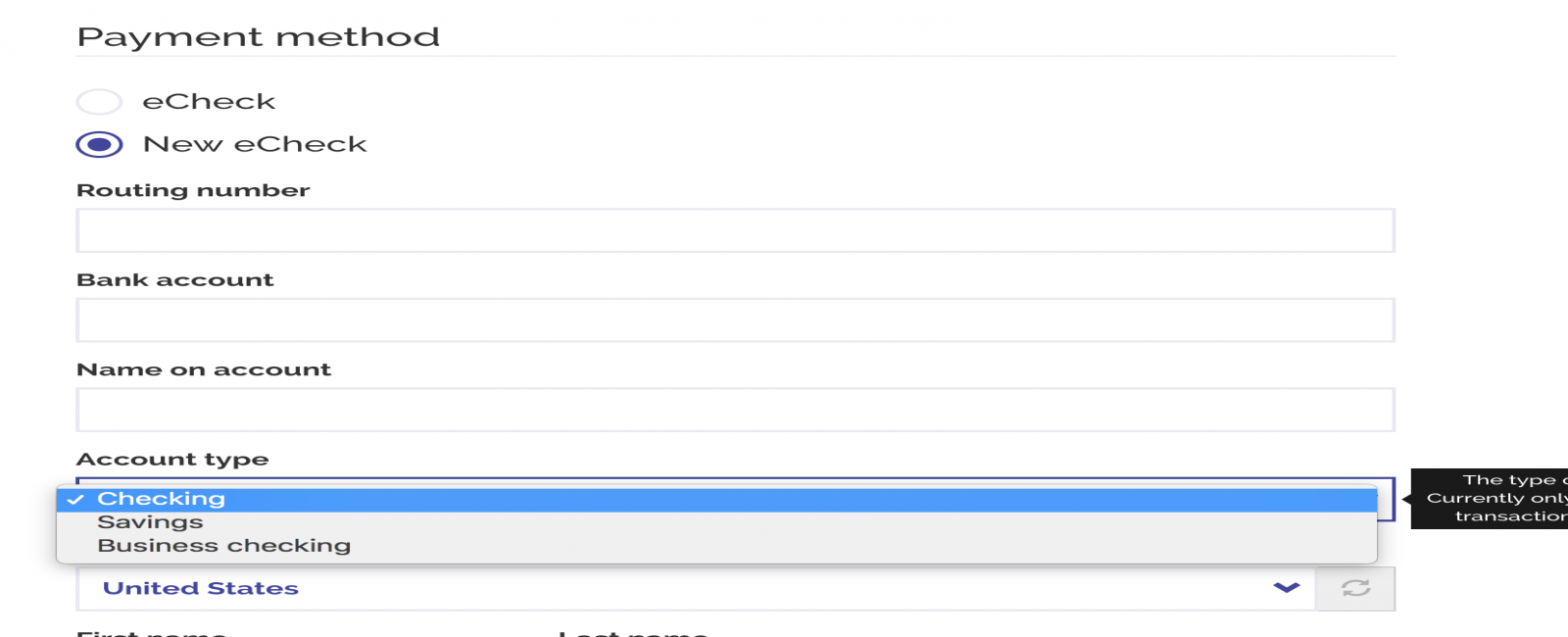

- Take bank information from the customer

- Enter the information into the system by phone

- Insert blank checks into the printer near you and print the check from it and deposit.

The whole process is paper check free. This new process will enable you to create your own e-checks instantly which are printable from your nearest printer. It does not ask for your signature also. Everything including from authorization of the transaction to printing an instant e-check payment is done with the help of phone and printer.

There are many benefits why I prefer E-check payment by phone; some of them are listed below.

- Instant customer satisfaction is acquired as we are reducing the amount of work which they need to do. Imagine how your customer feels when they send you an e-check using E-check payment services in USA sitting in their living room? This kind of thing will empower your business along with booting customer satisfaction.

- Minimum verification required. Unlike original checks where one needs to verify the account multiple times to make sure that everything functions smoothly. In this Echeck payment services, less amount of verification is required.

- E-check payment by the phone is a cost-effective option

- There are no extra charges to use e-checks by phone moreover; this way of payment actually eliminates the fee of check handling.

- It is fast and efficient. I personally like this method because of the simplicity and efficiency of the method. I felt amazed when I did my first E-check payment services in USA.

- Track the motion. From the time when I deposited the check by my phone, I was able to track the process from the very beginning to the end. This sort of transparency will make the customer feel comfortable to use e-check payment services. We can see our statement review; track our transaction history and fast access the details.

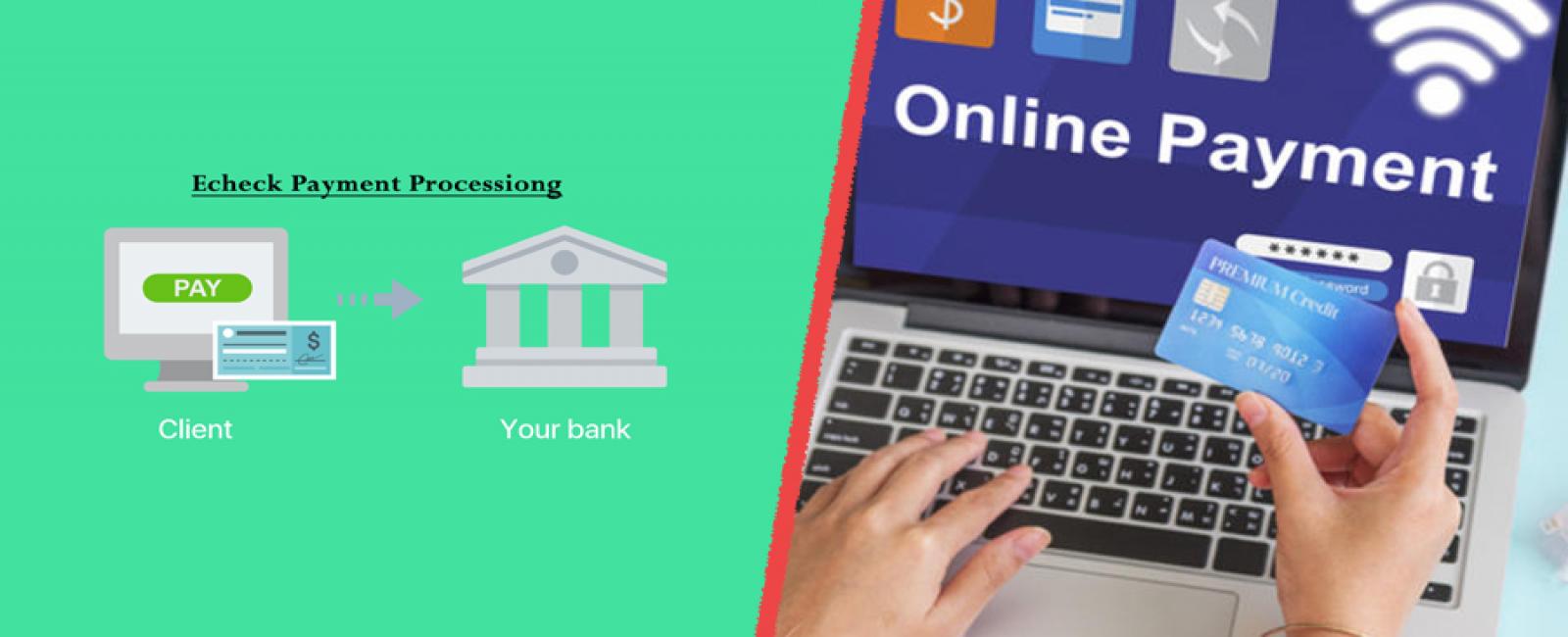

I was enough fascinated to dig about the method and technology used to enable E-check payment services. I will take you through the chain of steps to be followed which will be helpful for you next time when you pay e-check by phone

To make you understand better, I will explain it with an example

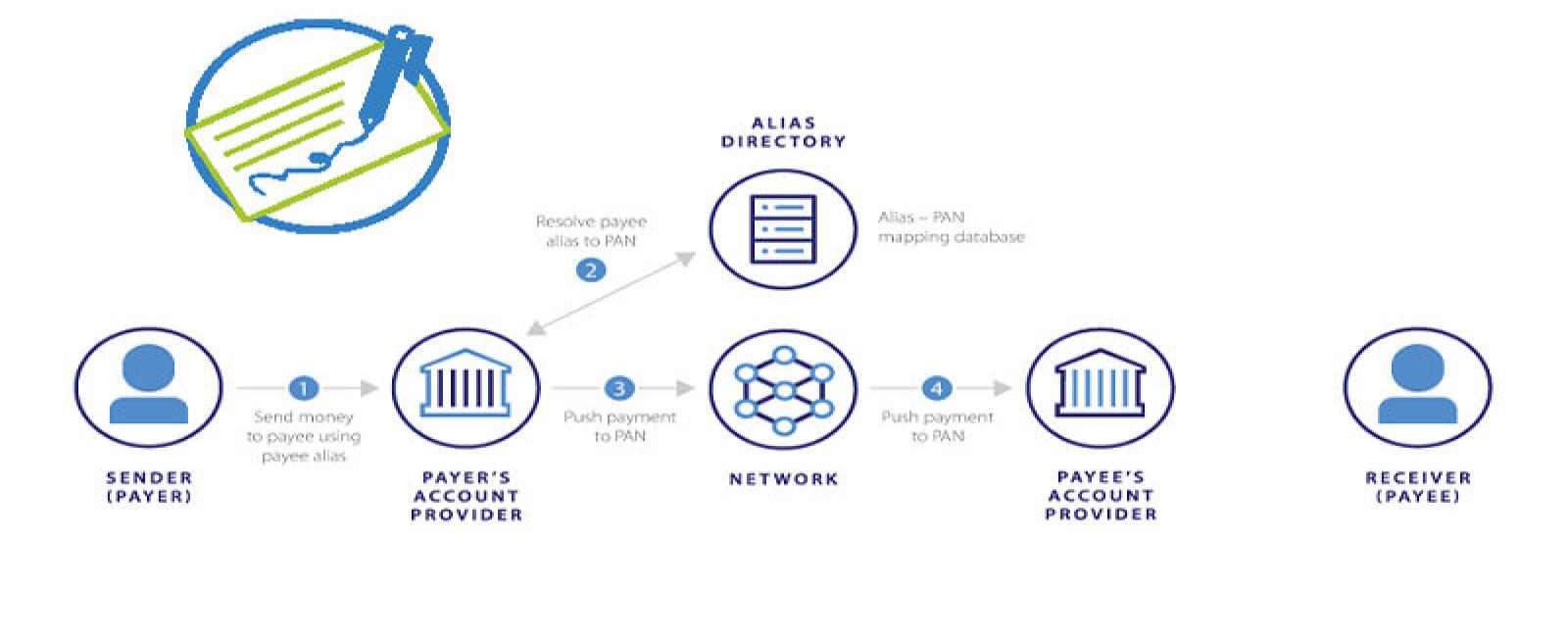

Consider x and Y where x is seller and y is a client, if x sells a product to y, y will tell x the check data over the call, x will check the date and enter the provided check data into safe company software database. The final step is to take the print of the check and deposit it into the x bank account. Their mutual banks will make the transaction. There will not be any difference in the number of processing days, even though here the authorization is done by phone only.

The funds will transfer into sellers account in three-four hours

- Place of use

- Electronic check processing is being used by almost all sorts of industries.

- Enterprise industry

- E-commerce industry

- Government

- Financial service industry

- Clubs and fitness

- Property management

- Non-profit industry

- Educational institutions

- Healthcare industry

- Insurance industry

Check through phone, check through fax services are legally approved. They are famously called “Draft check”, the use of draft check came to existence is 1996. The main authorization can be either verbal or written note. All the bank need to do is to check for the stamp of pre-authorization.

Overall the e-check services by phone proved to be revolutionizing in the operation of the banking segment making things easy for customer and business. Make effective use of e-check payment services in USA and forget going to banks.

Also read, How Ach Transactions work,