Popular Posts

E-check deposit is the latest transaction tool which will change the way you bank's

04-02-2019

The online transactions which are easy and quick- e-check deposits

15-02-2019

Deposit E-check for hassle-free money transfer

05-03-2019

Garner benefits using E-checks

25-03-2019

Everything You Need to Know about Ach Transactions

26-03-2019

E-checks services are certainly instant fund services

28-03-2019

Now, pay instant checks through your phone!

04-04-2019

What all things to keep in mind while looking for Echeck Payment Services

10-04-2019

Going cashless, UPI and beyond

22-04-2019

Online payment fraud – the current dilemma and how to prevent it with the help of e-check deposits

29-04-2019

Insights on online payment methods.

13-05-2019

The benefits of using e-check payment by phone.

30-05-2019

Why prefer ACH payment over credit card payment

15-06-2019

Why is it Important to use E-check services when we can use online payments?

29-06-2019

Easy Steps Anyone Can Take to Stop Check Fraud

09-07-2019

The Lerner Guide to Accepting eCheck generated by eCheckDesposit

15-08-2019

eCheck Services Are Alive and growing vigorously

12-09-2019

What is an Electronic Check?

10-10-2019

What are electronic checks and what are the benefits?

08-11-2019

How Payment Processing Drives the Economy

17-12-2019

The Payment Processing Revolution: Why Your Company Needs to Stay at the Forefront

06-01-2020

Easy Steps Anyone Can Take to Stop Check Fraud

- 09-07-2019

- 0

When most people think about identity theft or fraud risk exposure they probably think of digital threats like hackers gaining access to their bank account. Most people don’t concern themselves with the prevalence of check fraud because they assume it is an issue of the past. But, the reality is, check fraud is a major problem!

When most people think about identity theft or fraud risk exposure they probably think of digital threats like hackers gaining access to their bank account. Most people don’t concern themselves with the prevalence of check fraud because they assume it is an issue of the past. But, the reality is, check fraud is a major problem!

While physical check writing and use continues to decline, check fraud persists. According to the most recent statistical findings from the American Bankers Association, “Fraud against bank deposit accounts cost the industry approximately $2.2 billion in losses in 2016, according to ABA estimates…In addition to the estimated fraud loss amount, banks’ prevention measures stopped another $17 billion in fraudulent transactions.”

The next thing you are likely to wonder is – just what portion of fraudulent transaction activity is check fraud? A study published by the Association for Financial Professionals noted that in 2017, 74% of financial institutions surveyed reported that their organization’s check payments were exposed to fraud. That is staggering! Fortunately, there are simple steps any individual or business can take to stop check fraud.

Use Checks Integrated with Positive Pay

Positive Pay is a fraud detection tool that more and more people are becoming familiar with, which is good, because it is highly useful. Offered by the Cash Management Department of most banks, Positive Pay is a fraud-detection service that has three critical components: it matches the account number, check number, and dollar amount of each check that is presented for payment with a list of check that were previously authorized and issued by a company. In order to be protected by Positive Pay, all three components must match exactly or no payment will be issued. Positive Pay essentially makes a check far more secure than it would be otherwise and helps dramatically cut the rate of fraud-related financial loss.

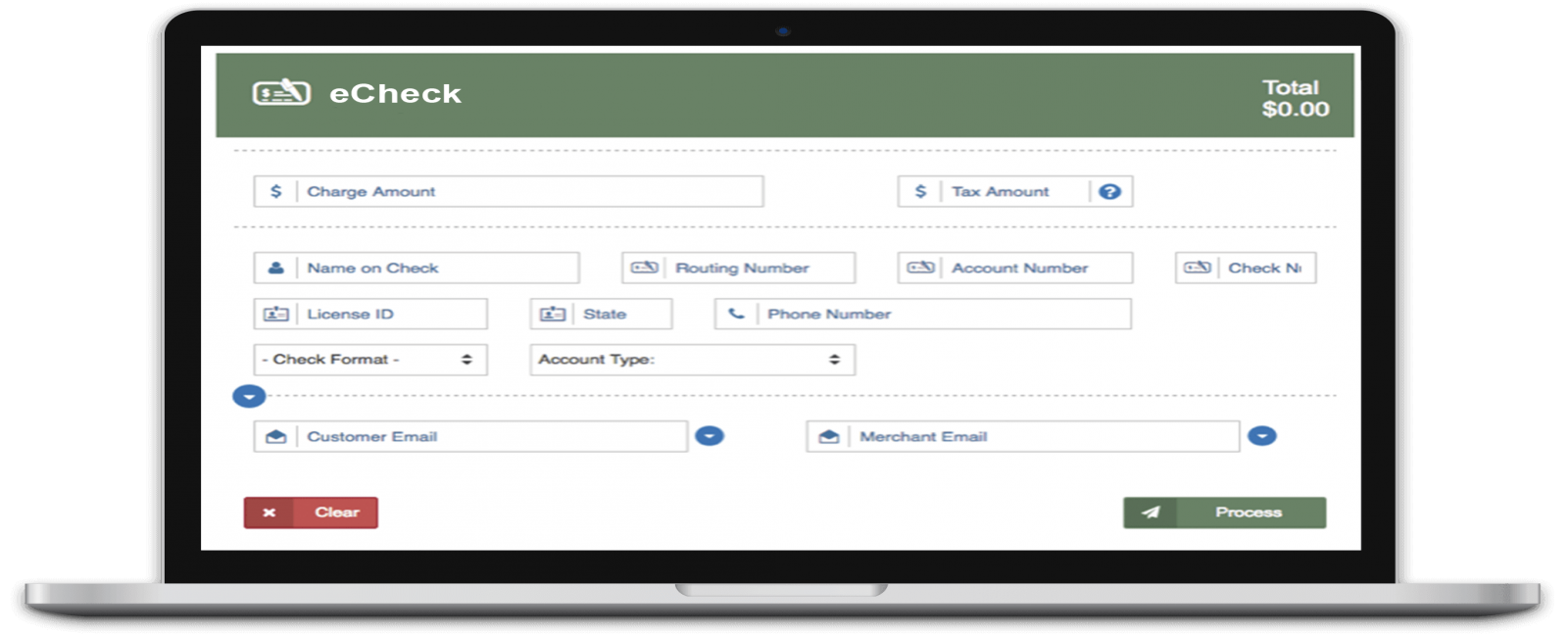

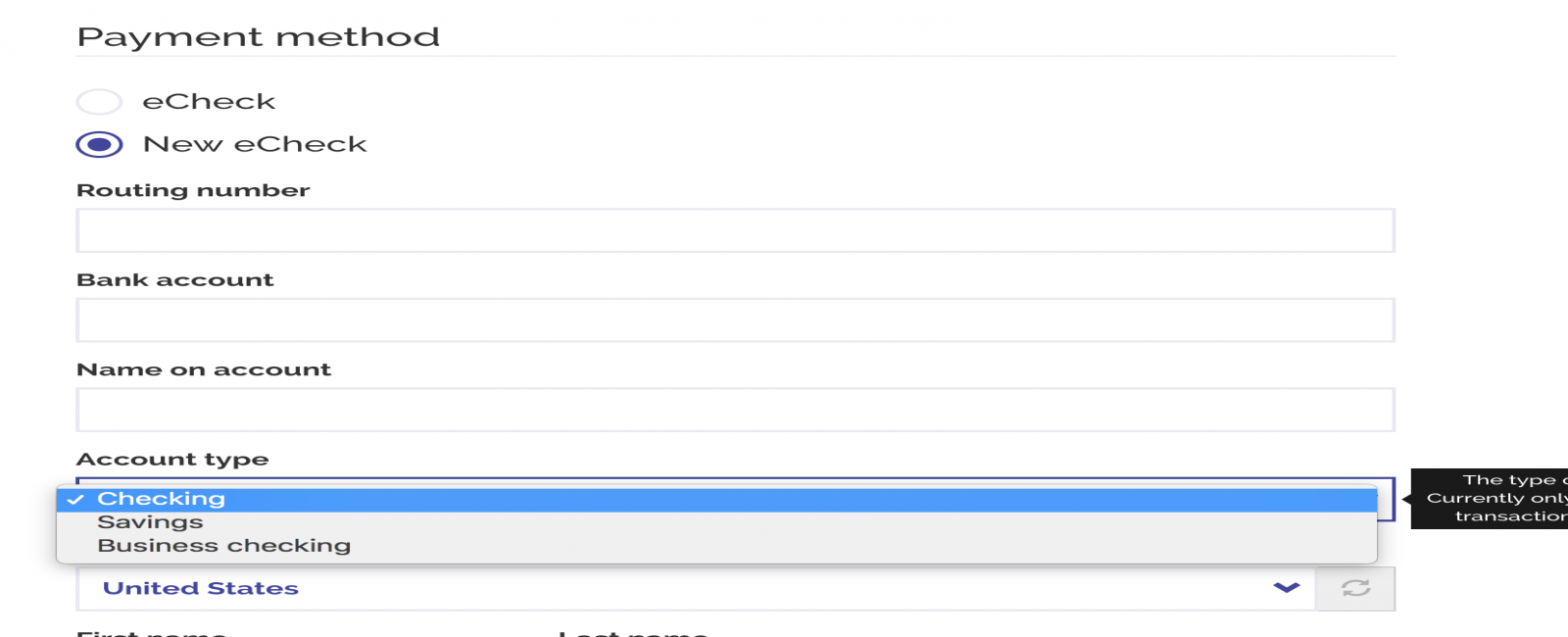

Only Use Online Checks When Possible

Blank paper checks/checkbooks are easy to forge or lose. And, there is very little means for verifying if the check is forged or not which means it is not only easy to forge but likely to be cashed because all someone needs is identification. Believe it or not, online or eChecks are far more secure than paper checks, particularly when they are paired with Positive Pay. There are many more layers of identity and authenticity verification with an eCheck issued with Positive Pay.

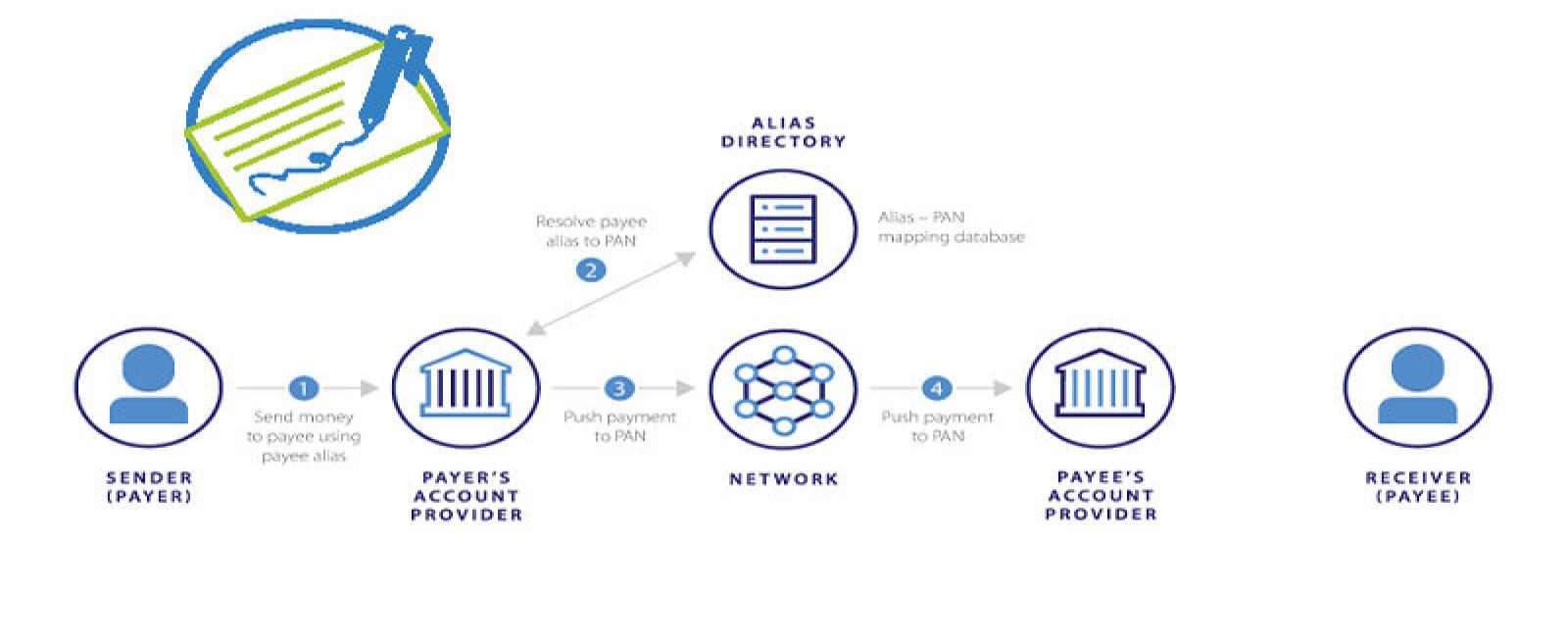

Never Transmit Bank Information Between Check Issuer and Issuee

When bank information is digitally transmitted between issuer and issuee, it is exposed to potential interception that could lead to identity theft and fraud. High-quality eCheck software, such as the eCheckDeposit software, does not require bank information to be transmitted between the issuer and issues – ever. With ECheckDeposit, your eCheck only has two points of contact – the sender and the receiver. By doing this, it eliminates 6 additional touch points that the average paper check goes through. ECheckDeposit are sent with a notification and link to the secure eCheckDeposit system where the recipient is able to safely access the check. ECheckDeposit software, paired with Positive Pay, offers clients the ultimate peace of mind that their eChecks have multiple complex layers of security and protection that they would not have with competitors or paper checks