Popular Posts

E-check deposit is the latest transaction tool which will change the way you bank's

04-02-2019

The online transactions which are easy and quick- e-check deposits

15-02-2019

Deposit E-check for hassle-free money transfer

05-03-2019

Garner benefits using E-checks

25-03-2019

Everything You Need to Know about Ach Transactions

26-03-2019

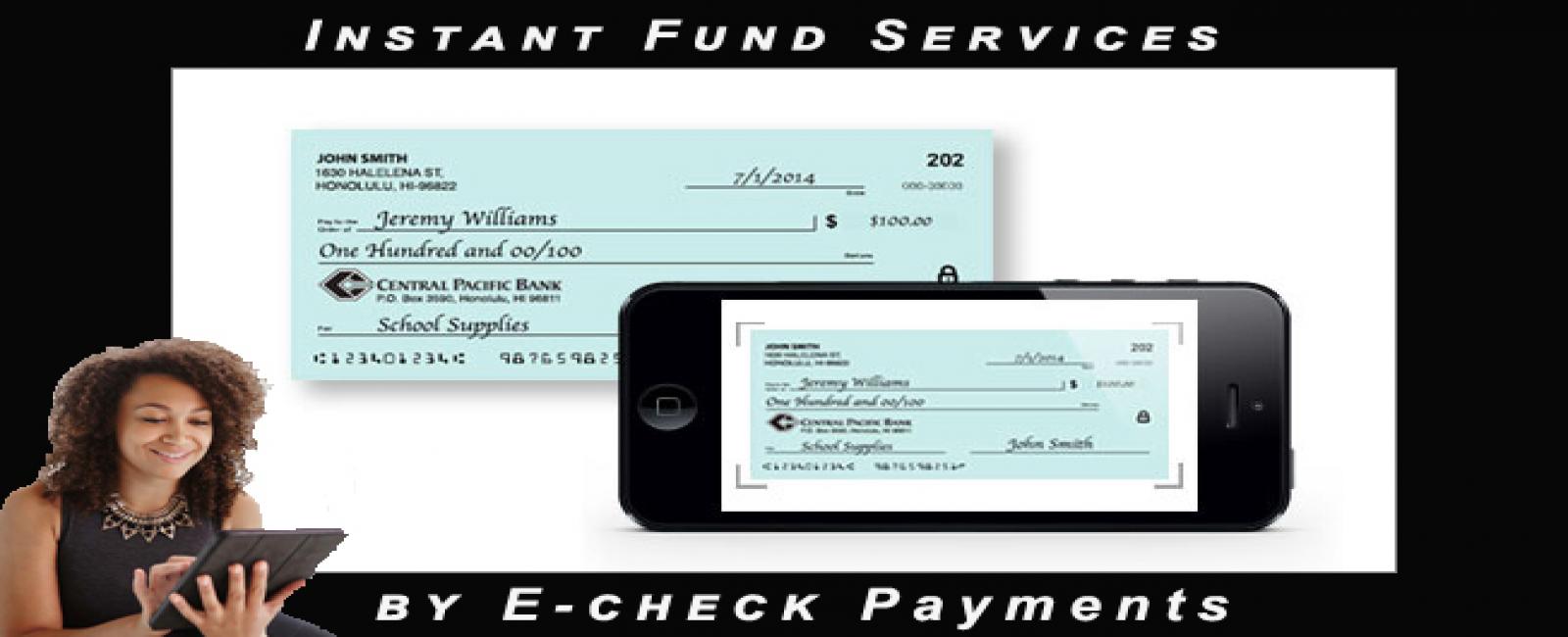

E-checks services are certainly instant fund services

28-03-2019

Now, pay instant checks through your phone!

04-04-2019

What all things to keep in mind while looking for Echeck Payment Services

10-04-2019

Going cashless, UPI and beyond

22-04-2019

Online payment fraud – the current dilemma and how to prevent it with the help of e-check deposits

29-04-2019

Insights on online payment methods.

13-05-2019

The benefits of using e-check payment by phone.

30-05-2019

Why prefer ACH payment over credit card payment

15-06-2019

Why is it Important to use E-check services when we can use online payments?

29-06-2019

Easy Steps Anyone Can Take to Stop Check Fraud

09-07-2019

The Lerner Guide to Accepting eCheck generated by eCheckDesposit

15-08-2019

eCheck Services Are Alive and growing vigorously

12-09-2019

What is an Electronic Check?

10-10-2019

What are electronic checks and what are the benefits?

08-11-2019

How Payment Processing Drives the Economy

17-12-2019

The Payment Processing Revolution: Why Your Company Needs to Stay at the Forefront

06-01-2020

Garner benefits using E-checks

- 25-03-2019

- 0

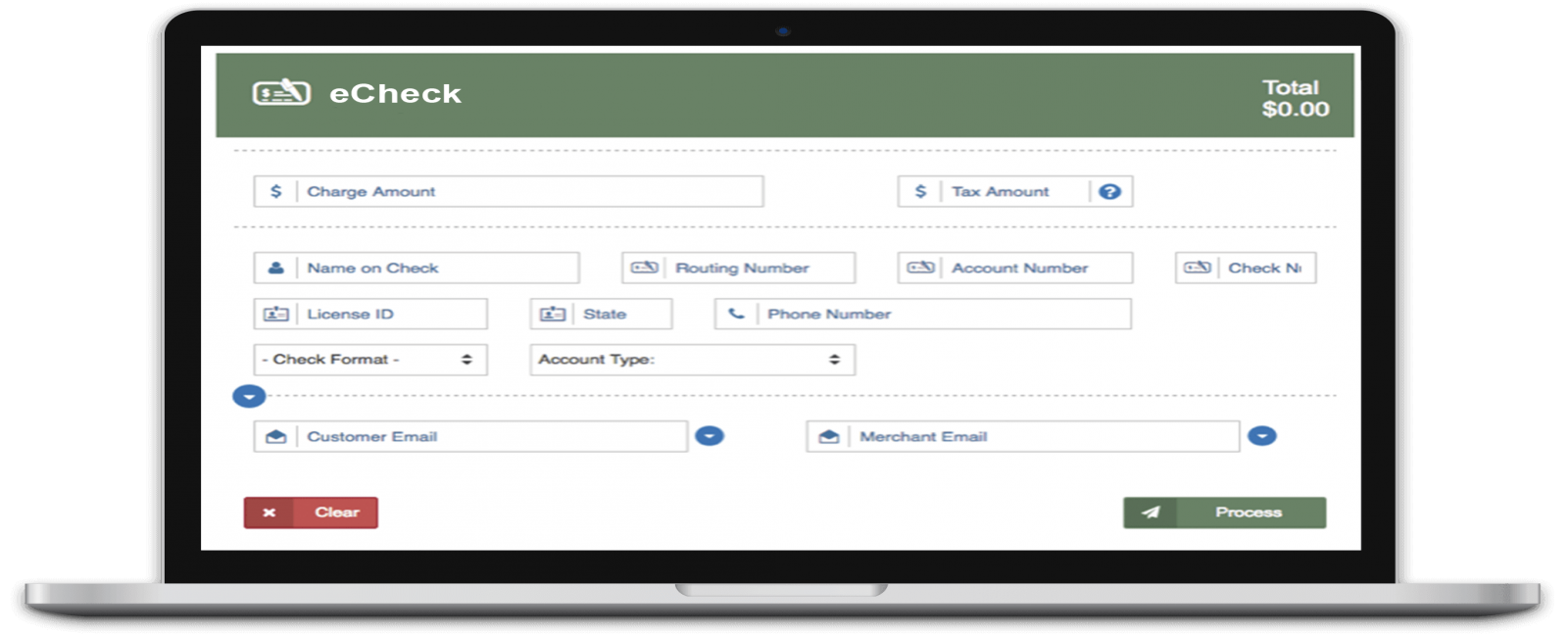

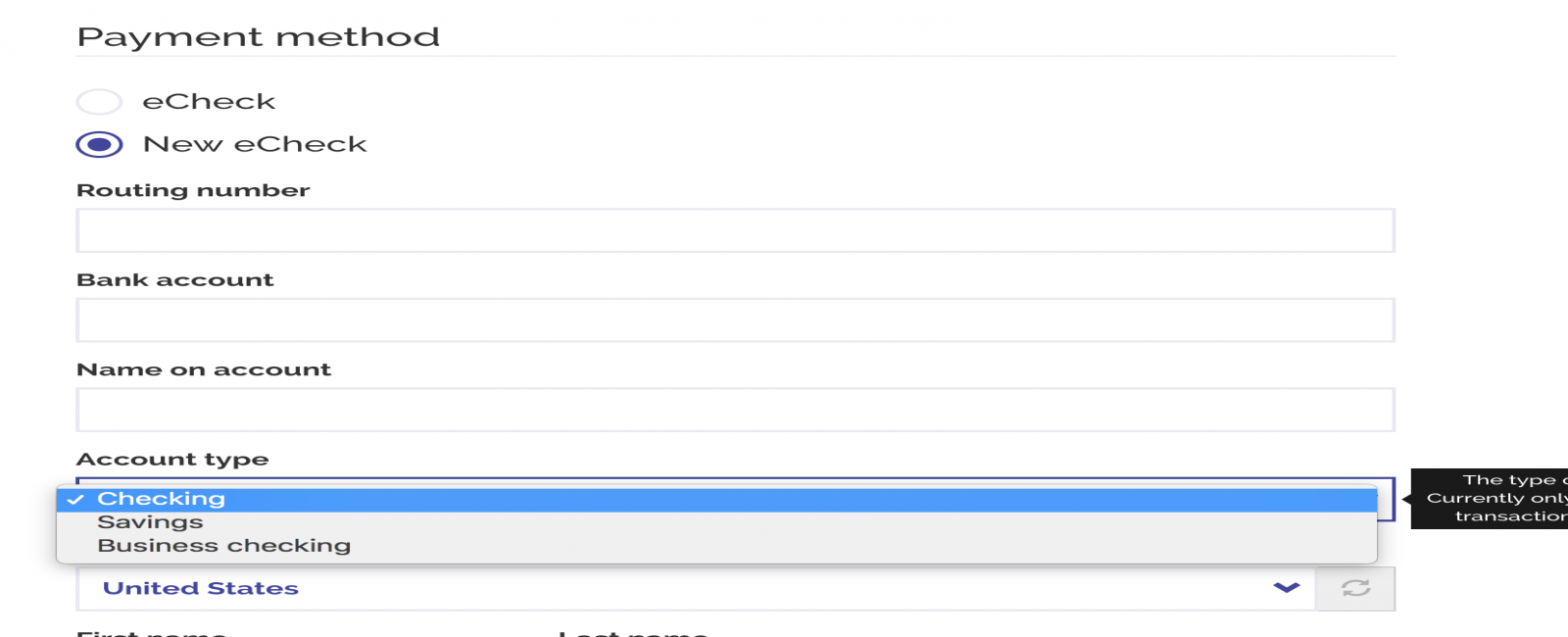

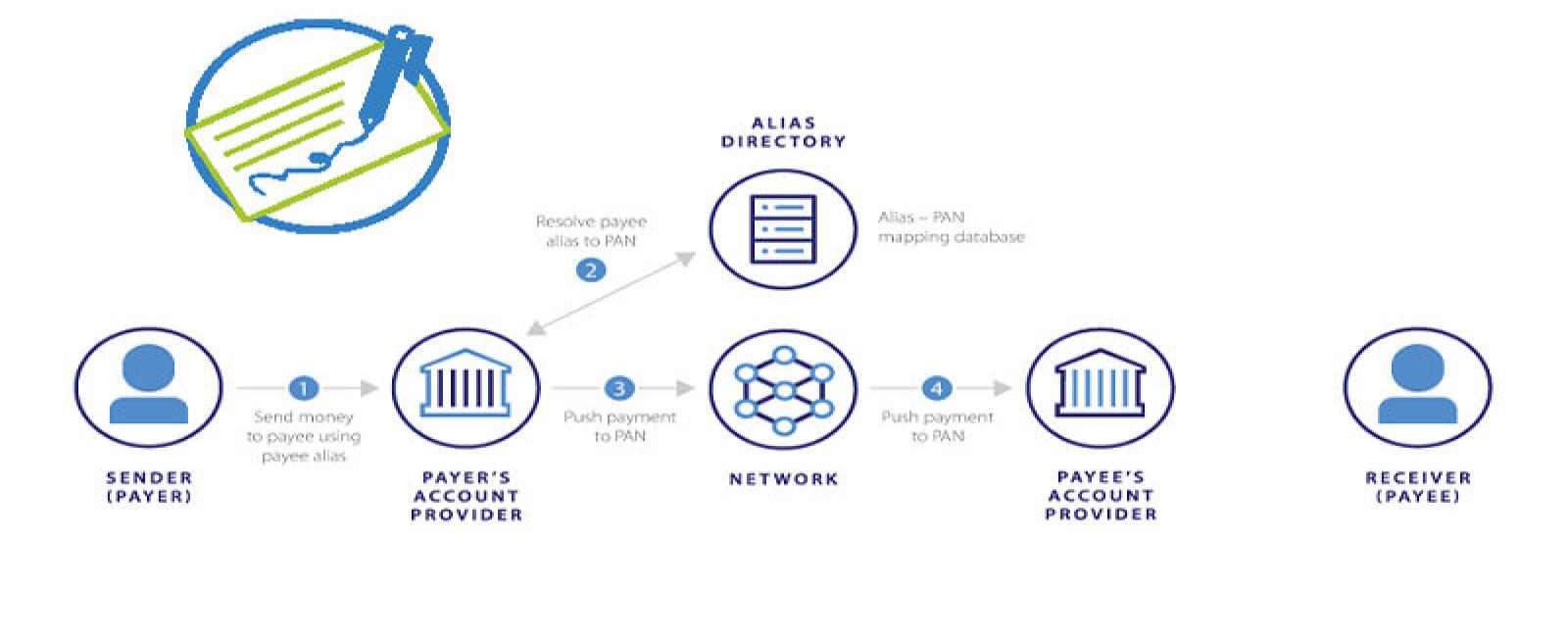

E-check is an electronic check which is funded by the bank account of the customer. It uses the information provided by the initiator of the e-check. It is processed by ACH (automated clearing house) process. The ACH payment services in the USA are beneficial for the common man and also for the businessman to scale up his enterprise.

ACH e-check processing in the USA is a simple process. The challenges are there but this new payment processing method ease doing the business as the customers can buy the products from wherever they want to. The business done in today's world is supported by mobiles, e-commerce and phone transactions. This is a new versatile form of shopping which is sure to give your business a hassle free dealing.

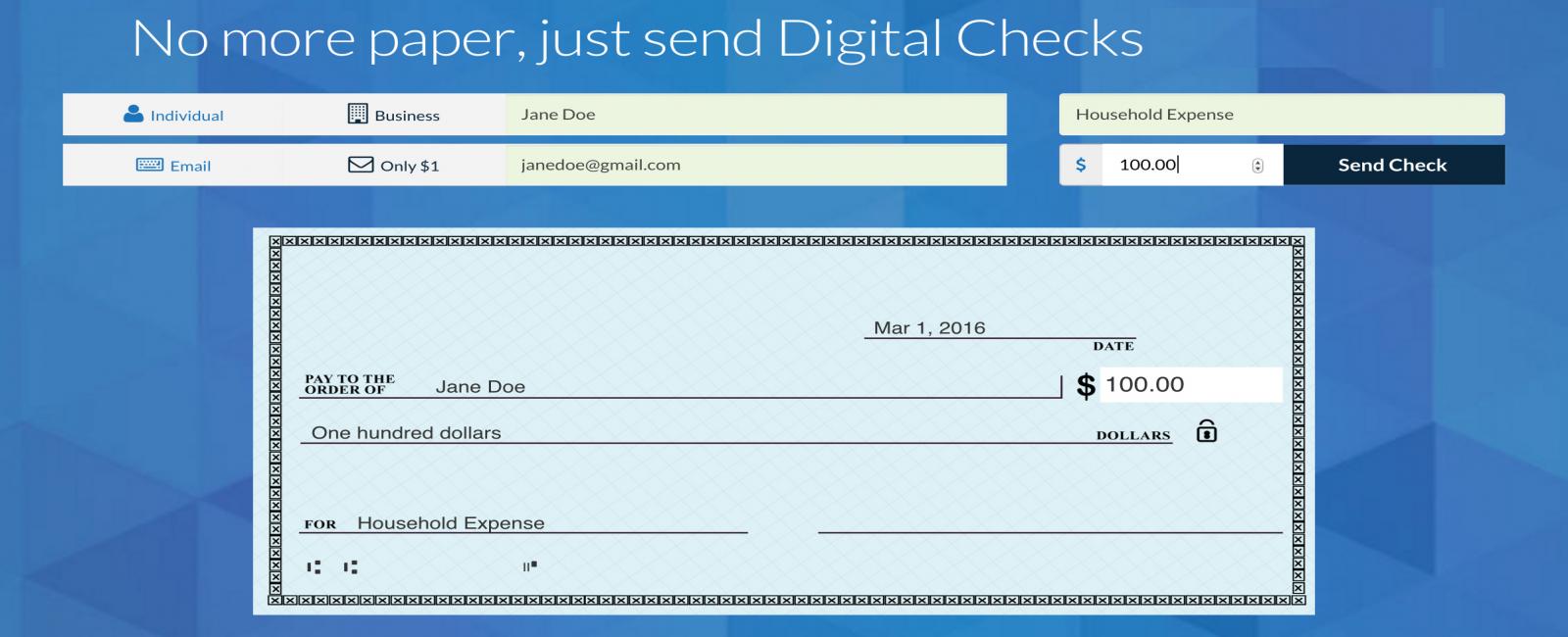

The governing body of the e-checks is similar to the paper checks. But, the method of e-check payment is advantageous than the traditional paper check method. It is cheaper because the cost of handling the paper checks is reduced. Even printing and mailing costs are also negligible. This virtual platform is rapid in transferring funds from the buyer to the seller.

Business houses are reaping a lot of benefits as they can control their cash flow with e-check payment services in the USA. These are authentic services which accept checks by the internet. Their foremost feature is security. It simply means that money is transferred without a threat of fraud. It is true that with ongoing demands of electronic money transfers, hacking and fraud are increasing. But, the security feature of e-checks is awesome. It also adds to its credibility. This check cannot be stolen or lost, because it is a computer generated statement. It is not in the paper form. It takes the headache out of money dealings.

The process of creation of electronic checks:

- After sign in on e-check deposit online, the bank account information is fed on the system . this way an electronic check is initiated.

- A pdf is generated through this command which is sent by email to the recipient.

- A print out of this pdf is surrendered to the bank by the seller.

- Payment transfers are done without any hassles within a short time period.

An electronic mode of payment is the fastest mode in which it accepts e-check on the internet. Since many businesses need money transfers the same day, it is easier and convenient. This mode of payment even saves the cost of writing a paper check. The paper checks are no more used in modern business due to difficulty in its transportation. In this fast-paced business, e-check payment services in the USA is a mantra to save time as it no longer needs to be taken to the seller. They can get the printout at their own computer kiosk.

ACH payment is used by all financial institutions for e-check processing in the USA. It is the best way to pay for rents, mortgage, car insurance payments and other high-cost memberships. Although they are easy payment for current payments, recurring payments can also be made using e-checks. The rent or monthly auto EMI can be deducted from your account if e-check is initiated by you.

The cost of handling e-cheks is different with different companies who handle e-check merchant accounts. This fee may be per transaction or a package or monthly fee can be also levied. The average fee may range from $0.30 to $1.50 for single e-check. Making the comparison of the nominal fee and services, select the best ACH e-check payment services in the USA for obtaining growth and robustness in your business.