Popular Posts

E-check deposit is the latest transaction tool which will change the way you bank's

04-02-2019

The online transactions which are easy and quick- e-check deposits

15-02-2019

Deposit E-check for hassle-free money transfer

05-03-2019

Garner benefits using E-checks

25-03-2019

Everything You Need to Know about Ach Transactions

26-03-2019

E-checks services are certainly instant fund services

28-03-2019

Now, pay instant checks through your phone!

04-04-2019

What all things to keep in mind while looking for Echeck Payment Services

10-04-2019

Going cashless, UPI and beyond

22-04-2019

Online payment fraud – the current dilemma and how to prevent it with the help of e-check deposits

29-04-2019

Insights on online payment methods.

13-05-2019

The benefits of using e-check payment by phone.

30-05-2019

Why prefer ACH payment over credit card payment

15-06-2019

Why is it Important to use E-check services when we can use online payments?

29-06-2019

Easy Steps Anyone Can Take to Stop Check Fraud

09-07-2019

The Lerner Guide to Accepting eCheck generated by eCheckDesposit

15-08-2019

eCheck Services Are Alive and growing vigorously

12-09-2019

What is an Electronic Check?

10-10-2019

What are electronic checks and what are the benefits?

08-11-2019

How Payment Processing Drives the Economy

17-12-2019

The Payment Processing Revolution: Why Your Company Needs to Stay at the Forefront

06-01-2020

The Lerner Guide to Accepting eCheck generated by eCheckDesposit

- 15-08-2019

- 0

It seems as though there are new developments everyday in the business world. All of which claim to be life changing and a quintessential aspect for advancement.

It seems as though there are new developments everyday in the business world. All of which claim to be life changing and a quintessential aspect for advancement. The overwhelming feeling of attempting to keep up can lead one to ignore developments that may appear trendy. eCheckDeposit, however, are the future and there will be no need to look back once implementing them into everyday business. From freelance to corporate, eCheckDeposit have made their way around the block and for good reason. To begin, one must first be aware of what eCheckDeposit are and what makes them such a great asset.

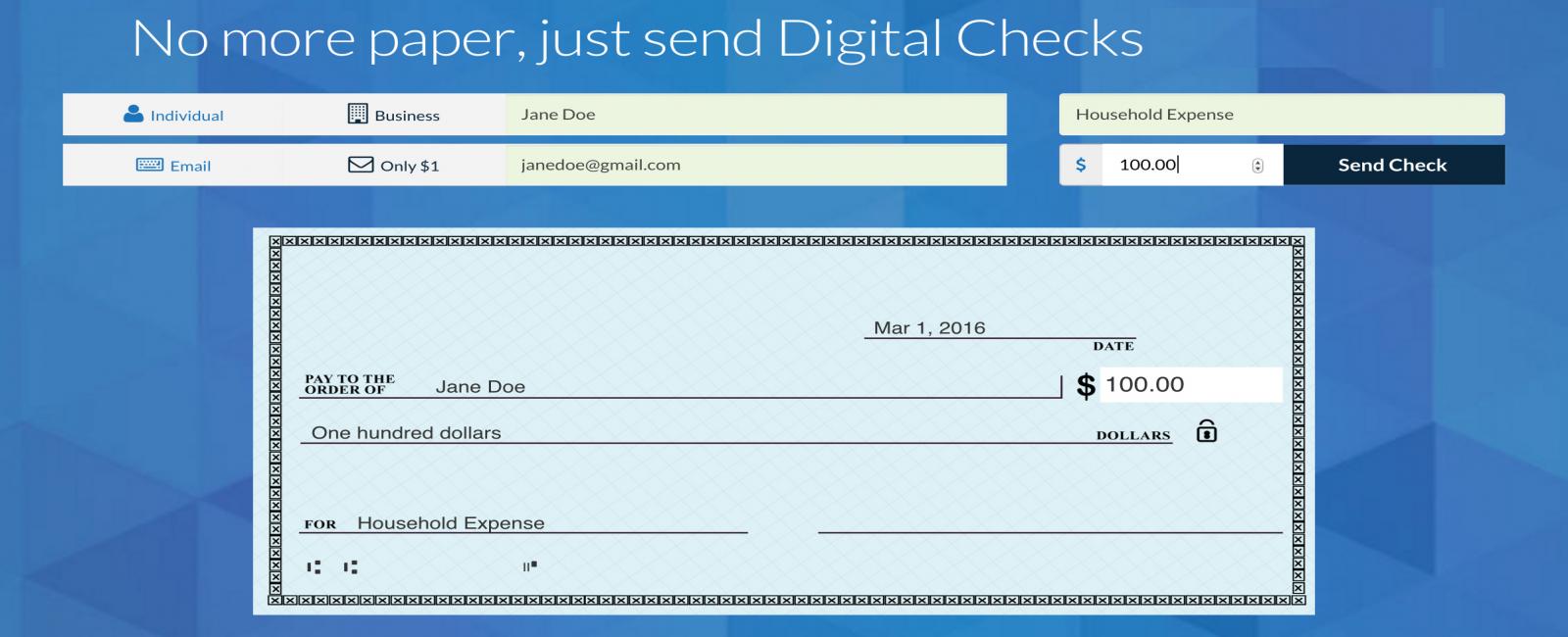

Originally as a way to replace paper checks, eCheck are an electronic fund transfer typically used for direct deposit by employers. With online purchases and remote employment taking over the consumer market, online payments and transactions are more popular than ever before. When making a decision for a company, advantages always need to be weighed to decide if the implementation will give any sort of advantage. Before shaking your head at the thought, eCheckDeposit have made payments simpler and also more accessible. To further elaborate, this payment method has become rapidly known for its exceptional convenience, guaranteed safety features and secure design all with reasonably low fees. Expanding your clientele worldwide is not an issue with the eChecks system as it has been used to pay or receive payments from all across the globe.

Advantage of eCheckDeposit

An additional advantage of updating payment methods is the window that attracts the next generation of employees and consumers. Online payments are practically second nature to the Millennial generation and will be even more so for the generation following. Modernizing the payment methods now will open the door to attract the right consumers and employees to the business. A company does not want to fail to prepare and watch the competitors gain opportunities that could have been available in their own backyard had they acted sooner.

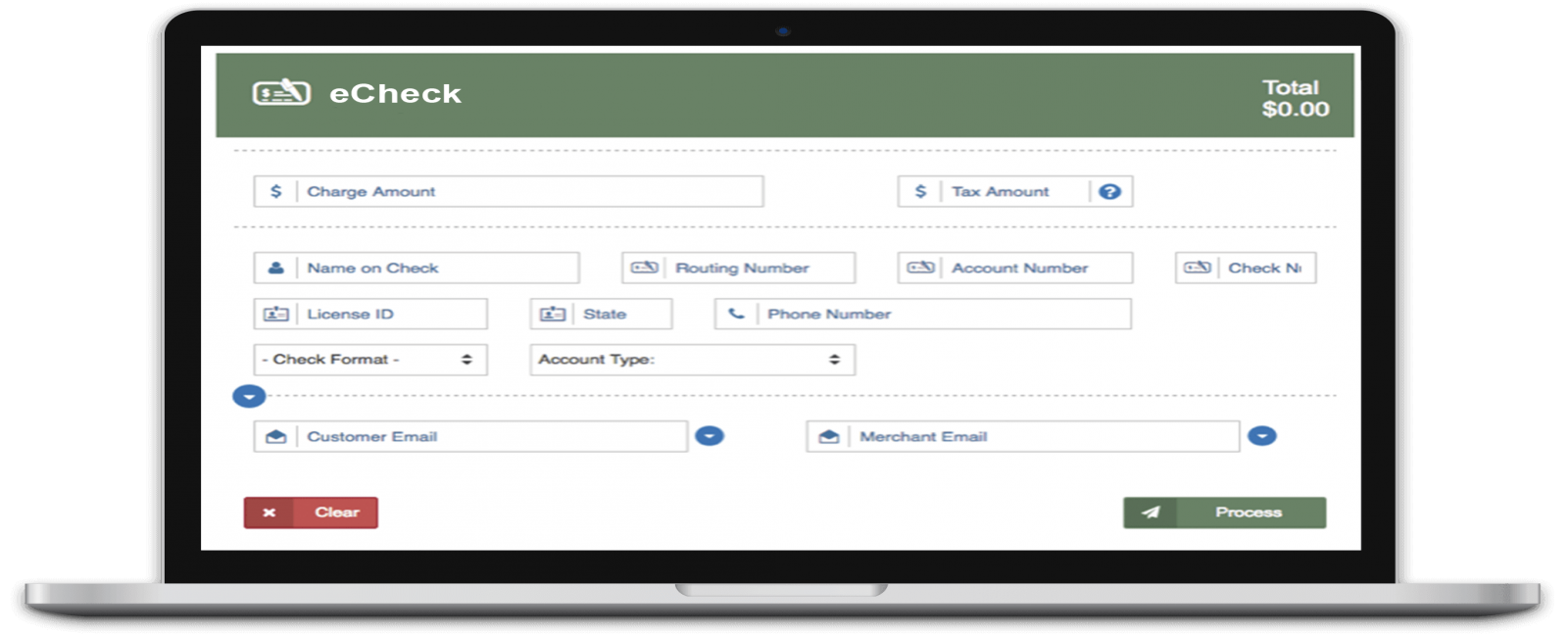

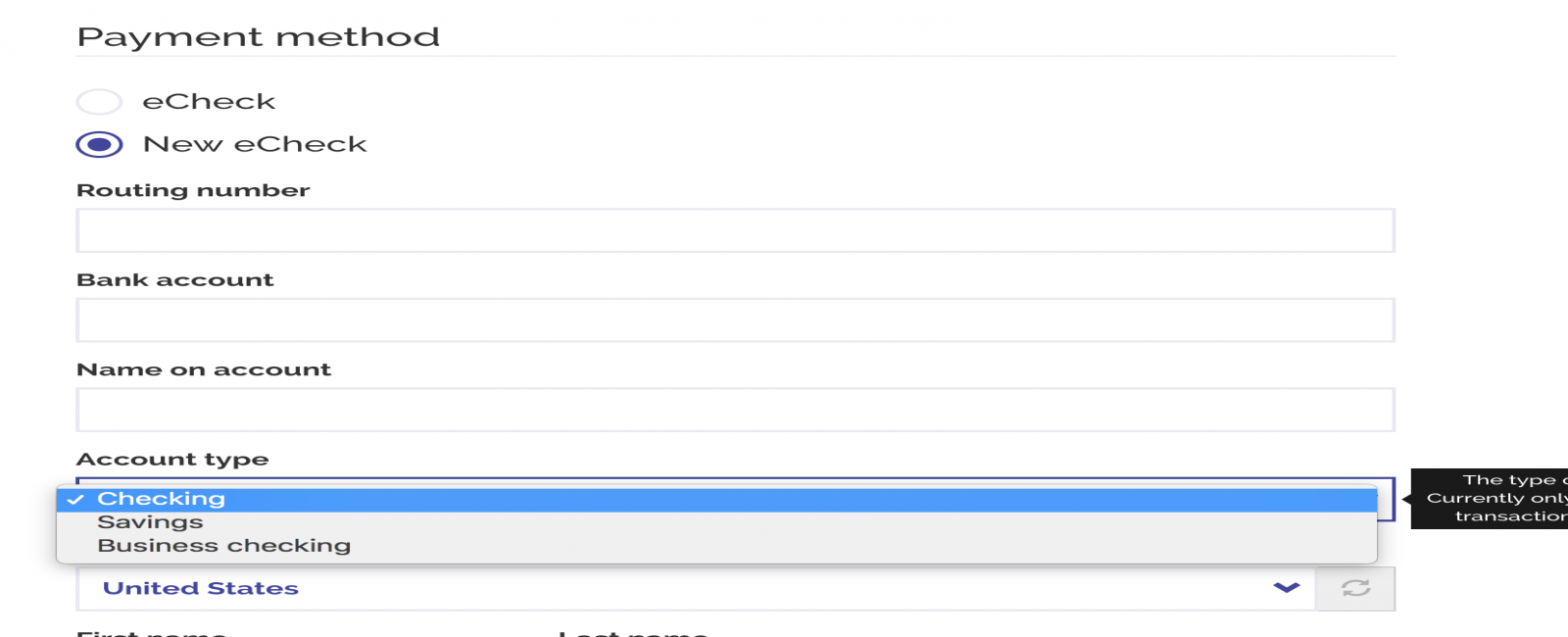

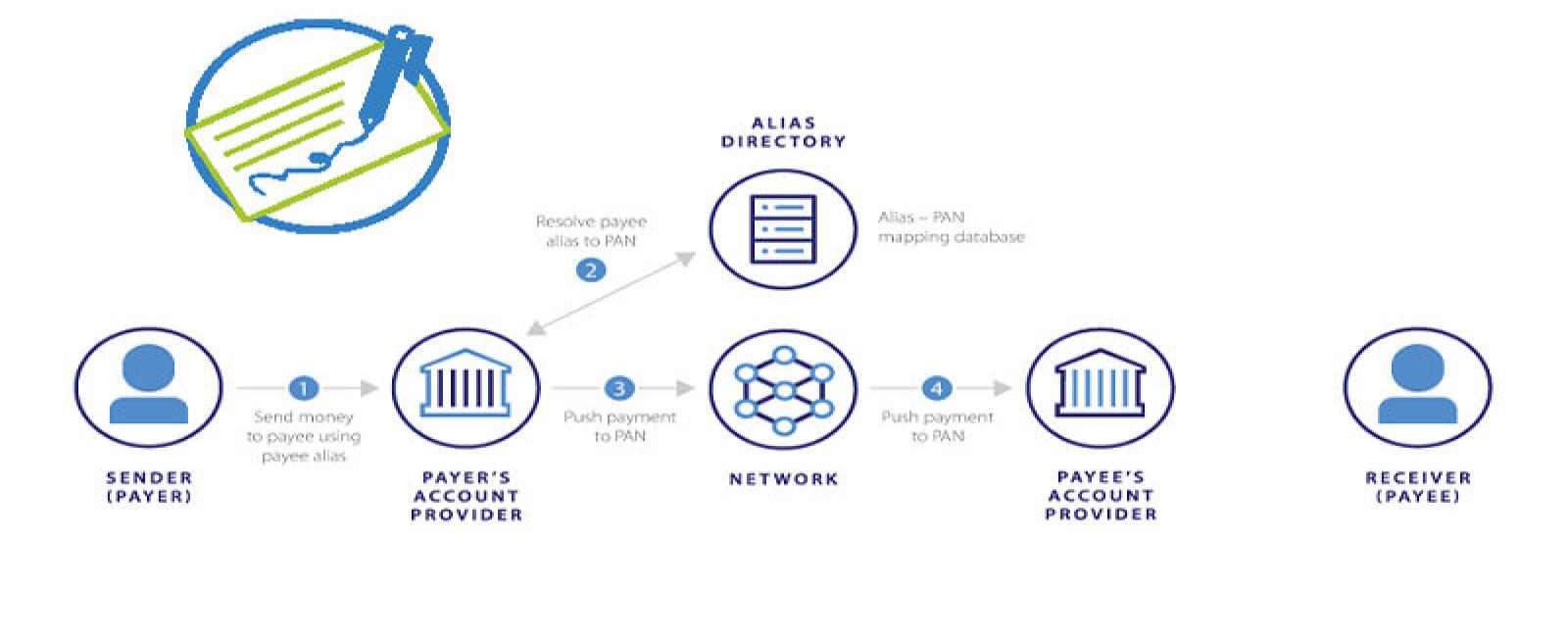

Now that the groundwork of what an eCheck is and its advantages have been outlined, accepting eChecks are the next part of the development. Perhaps the process sounds interesting but creates a bit of concern as to how one would seamlessly receive payment. The good news is that there are a variety of options as to how to accept eCheck generated by eCheckDeposit. The options include using a merchant account provider or a separate entity. To be specific, this includes either a bank or standalone ACH processor. A simpler explanation is to imagine the process one step at a time. The process begins in the payer’s account, travels through the ACH network on to the payee’s bank and finally lands in the payee’s bank account. Since an eCheck is essentially a physical check in digital form, all of the necessary information will be provided just as it has been in the past. Put away the hassle of paper checks and accept eCheck with open arms as you take in all of what the payment method of today and tomorrow has to offer.