Popular Posts

E-check deposit is the latest transaction tool which will change the way you bank's

04-02-2019

The online transactions which are easy and quick- e-check deposits

15-02-2019

Deposit E-check for hassle-free money transfer

05-03-2019

Garner benefits using E-checks

25-03-2019

Everything You Need to Know about Ach Transactions

26-03-2019

E-checks services are certainly instant fund services

28-03-2019

Now, pay instant checks through your phone!

04-04-2019

What all things to keep in mind while looking for Echeck Payment Services

10-04-2019

Going cashless, UPI and beyond

22-04-2019

Online payment fraud – the current dilemma and how to prevent it with the help of e-check deposits

29-04-2019

Insights on online payment methods.

13-05-2019

The benefits of using e-check payment by phone.

30-05-2019

Why prefer ACH payment over credit card payment

15-06-2019

Why is it Important to use E-check services when we can use online payments?

29-06-2019

Easy Steps Anyone Can Take to Stop Check Fraud

09-07-2019

The Lerner Guide to Accepting eCheck generated by eCheckDesposit

15-08-2019

eCheck Services Are Alive and growing vigorously

12-09-2019

What is an Electronic Check?

10-10-2019

What are electronic checks and what are the benefits?

08-11-2019

How Payment Processing Drives the Economy

17-12-2019

The Payment Processing Revolution: Why Your Company Needs to Stay at the Forefront

06-01-2020

What all things to keep in mind while looking for Echeck Payment Services

- 10-04-2019

- 0

E-checks payment services in the USA are widely accepted it is fast and secure money transfer. E-checks are the latest payment collection method for a business house. Customers from different locations can pay using e-check deposit services by phone or mail. It will bring a required boost to your company.

E-checks do timely payments. Let’s read some common questions which pop up in the mind of a person new to e-checks.

What is e-check usage?

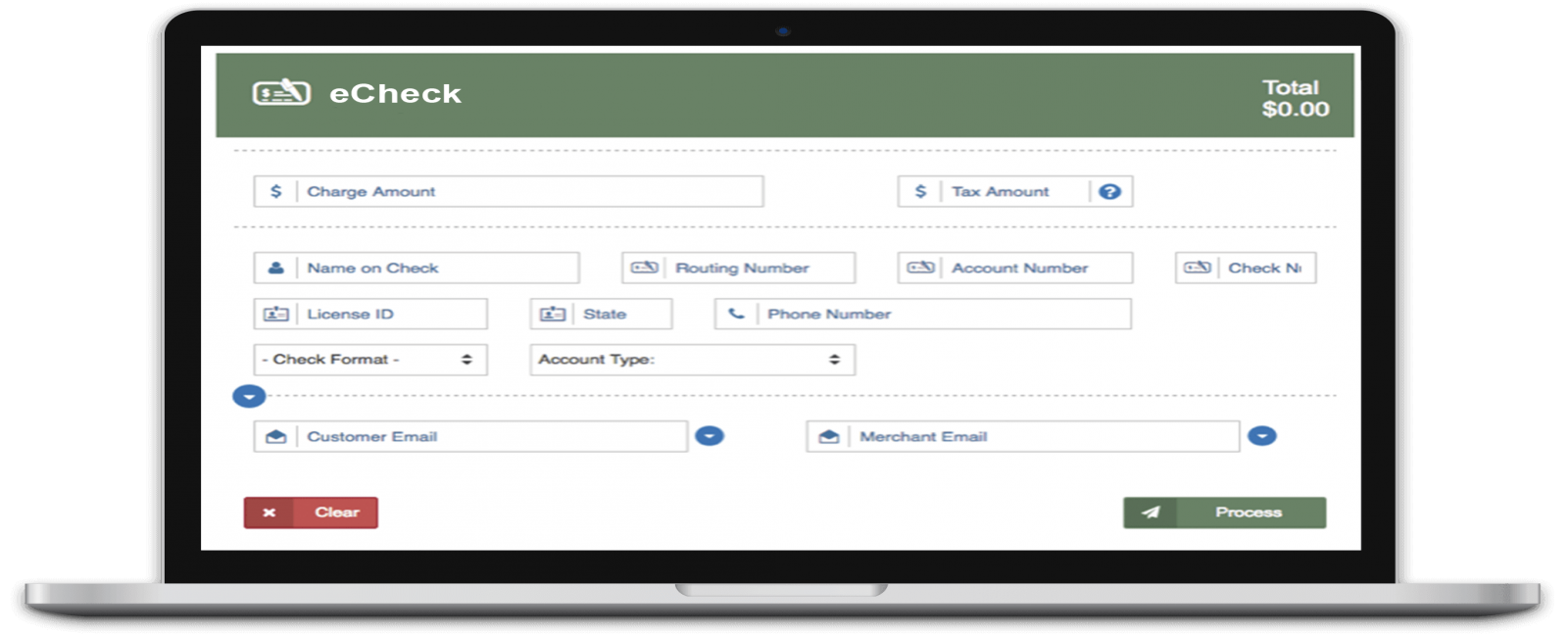

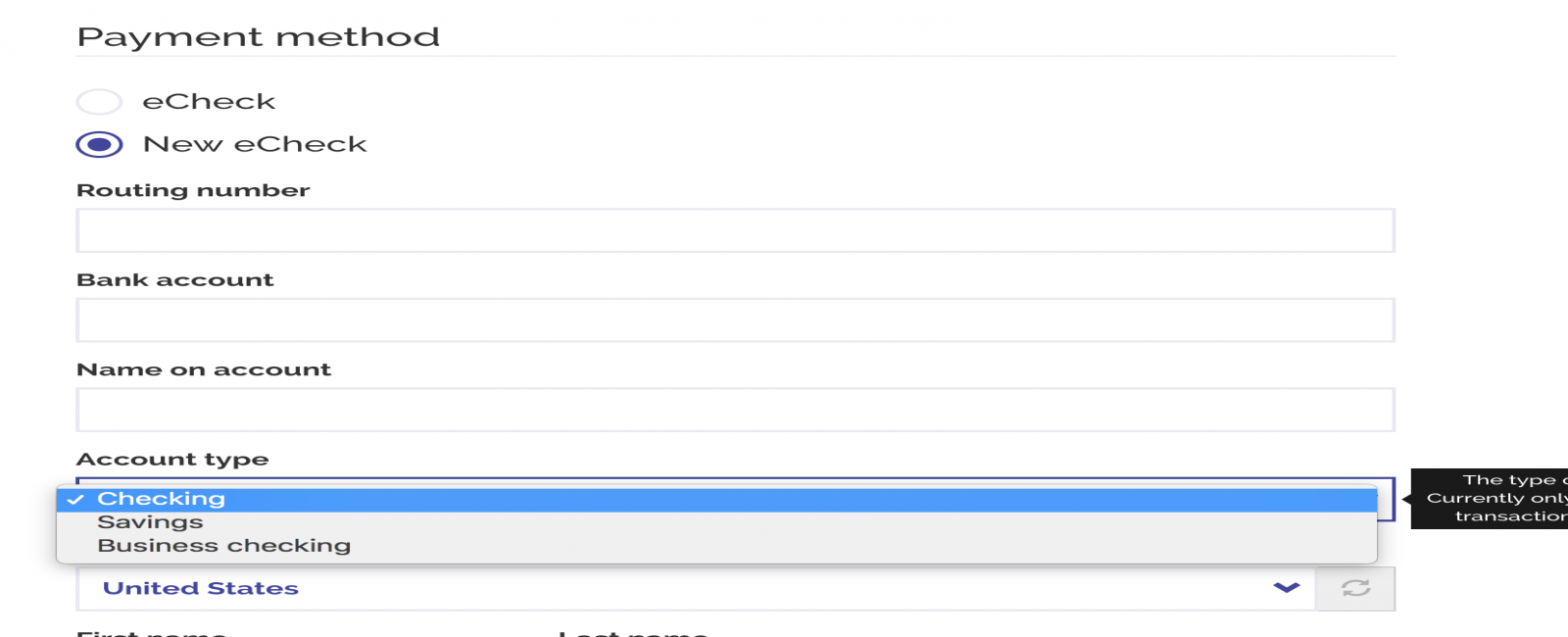

A customer uses E-check to pay for his purchase to the seller. It is convenient as a paper check is handed over or couriered. It requires extra time and effort. An E-check Payment is generated on the device like mobile and computer. It requires Internet connectivity on your gadget. Now money is transferred on a command initiated from one bank account to another. Echeck payment services in USA has become very popular because of its effectiveness and efficiency level.

How is an authorization for e-checks initiated?

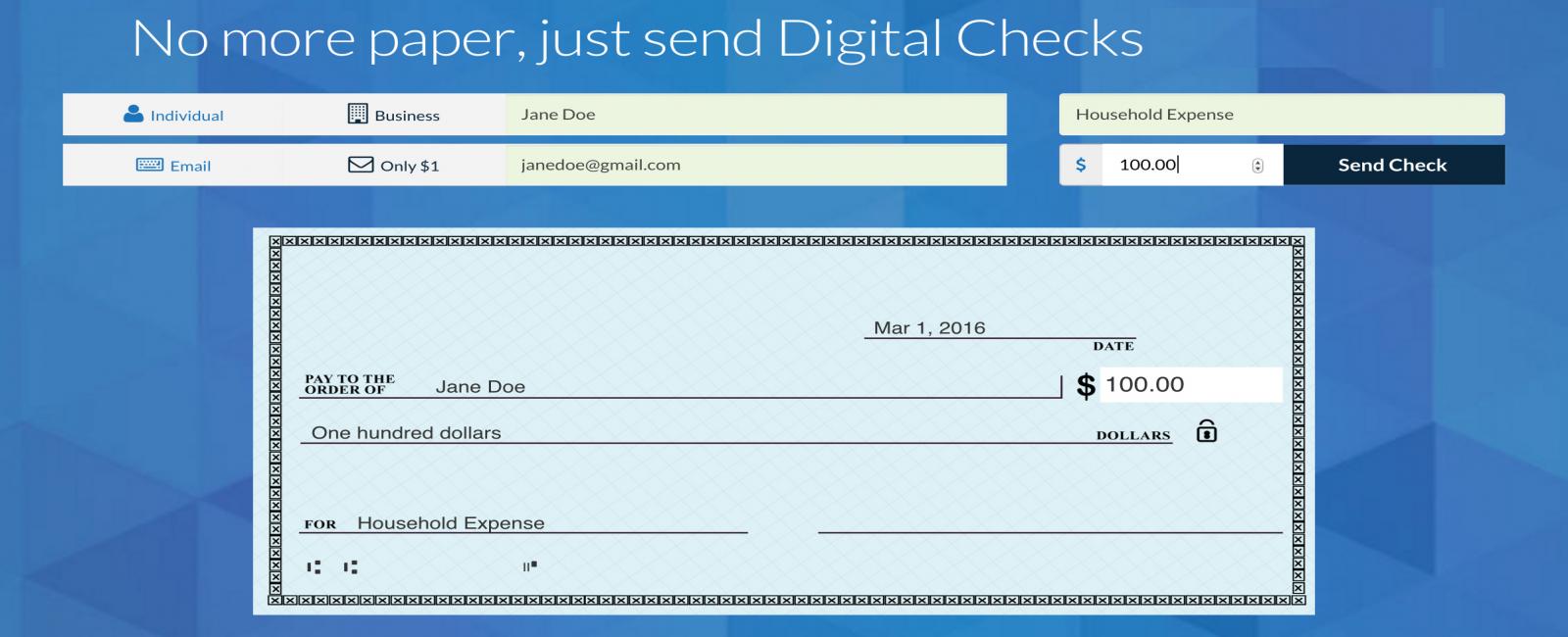

An e-check is authorized by the customer through the e-check payment website. After sign in, the customer writes the check in the name of the recipient. He punches the email address of the recipient. A echeck payment pdf will be sent to the email id. The recipient gets this pdf printed and goes to his bant directly for payment.

Explain e-check processing in brief?

The electronic check has the same process just like a paper check. The payee writes the check but on the website rather than paper. The bank account is linked to the e-check payment services in the USA. The buyer authorizes the website and bank account for money transfer.

What are ACH and ETF?

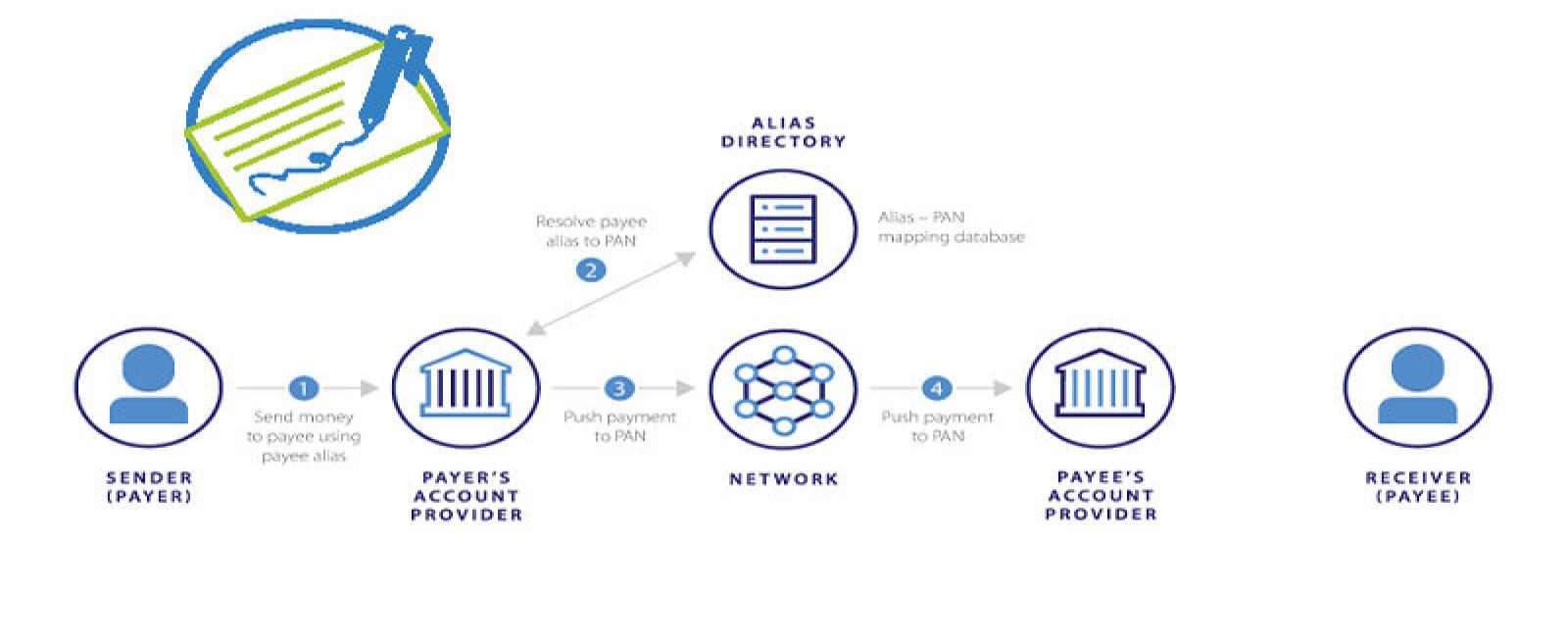

ACH (automated clearing house) means that the money can be directly transferred. ACH e-check processing in the USA has all the benefits of electronic payments. It is faster and security is high-end. The financial institutions all over the USA follow payment by e-check process.

ETF means electronic fund transfer. Yes, it is the same thing as money is sent to the valid account on the request of the payee.

What are the different types of payments that can be made by E-check payment services in the USA?

E-check is used by small as well as big businessmen. Merchants have to pay a convenience fee to get registered to e-check deposit online. They can avail e-check payment processing by phone also. Different payments like membership fees or monthly rent can be easily paid.

What is the duration for money transfer in e-checks?

After the initiation of e-check, money can be transferred in a time of minimum 3-4 hours. The verification of funds takes place on the first day. After that, the transfer of funds may take place.

What is the cost of operating an e-check account?

There is a monthly fee charged for e-check account. There is a trial period of 14 days. The payee gets 5 checks for the trial period. The charged differ from different companies. For your information, the average fee for a single e-check may vary from $0.30 to $ 1.50.

These are the few FAQs related to the echeck payment services in the USA.

Comments

Vivan

Thanks for sharing the information. Earlier my transactions were failed due to some errors and after reading this my transactions are successful.