Popular Posts

E-check deposit is the latest transaction tool which will change the way you bank's

04-02-2019

The online transactions which are easy and quick- e-check deposits

15-02-2019

Deposit E-check for hassle-free money transfer

05-03-2019

Garner benefits using E-checks

25-03-2019

Everything You Need to Know about Ach Transactions

26-03-2019

E-checks services are certainly instant fund services

28-03-2019

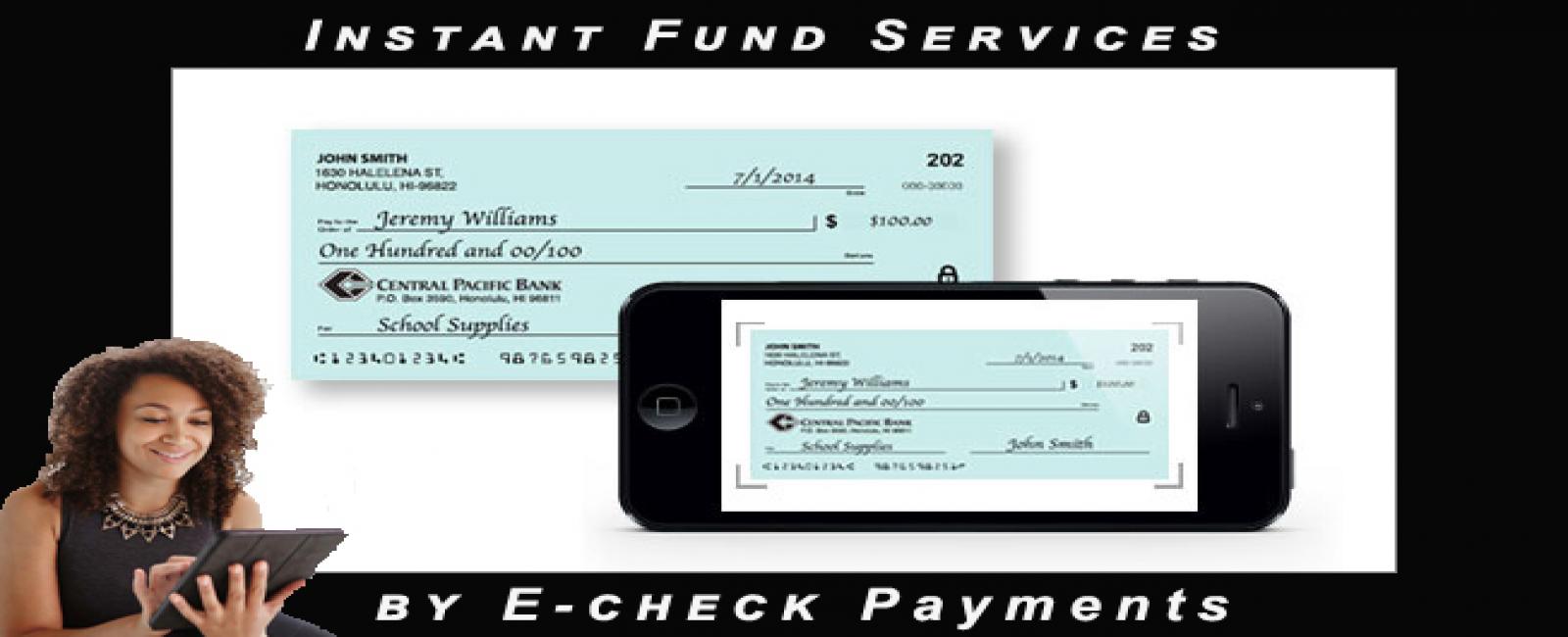

Now, pay instant checks through your phone!

04-04-2019

What all things to keep in mind while looking for Echeck Payment Services

10-04-2019

Going cashless, UPI and beyond

22-04-2019

Online payment fraud – the current dilemma and how to prevent it with the help of e-check deposits

29-04-2019

Insights on online payment methods.

13-05-2019

The benefits of using e-check payment by phone.

30-05-2019

Why prefer ACH payment over credit card payment

15-06-2019

Why is it Important to use E-check services when we can use online payments?

29-06-2019

Easy Steps Anyone Can Take to Stop Check Fraud

09-07-2019

The Lerner Guide to Accepting eCheck generated by eCheckDesposit

15-08-2019

eCheck Services Are Alive and growing vigorously

12-09-2019

What is an Electronic Check?

10-10-2019

What are electronic checks and what are the benefits?

08-11-2019

How Payment Processing Drives the Economy

17-12-2019

The Payment Processing Revolution: Why Your Company Needs to Stay at the Forefront

06-01-2020

The online transactions which are easy and quick- e-check deposits

- 15-02-2019

- 0

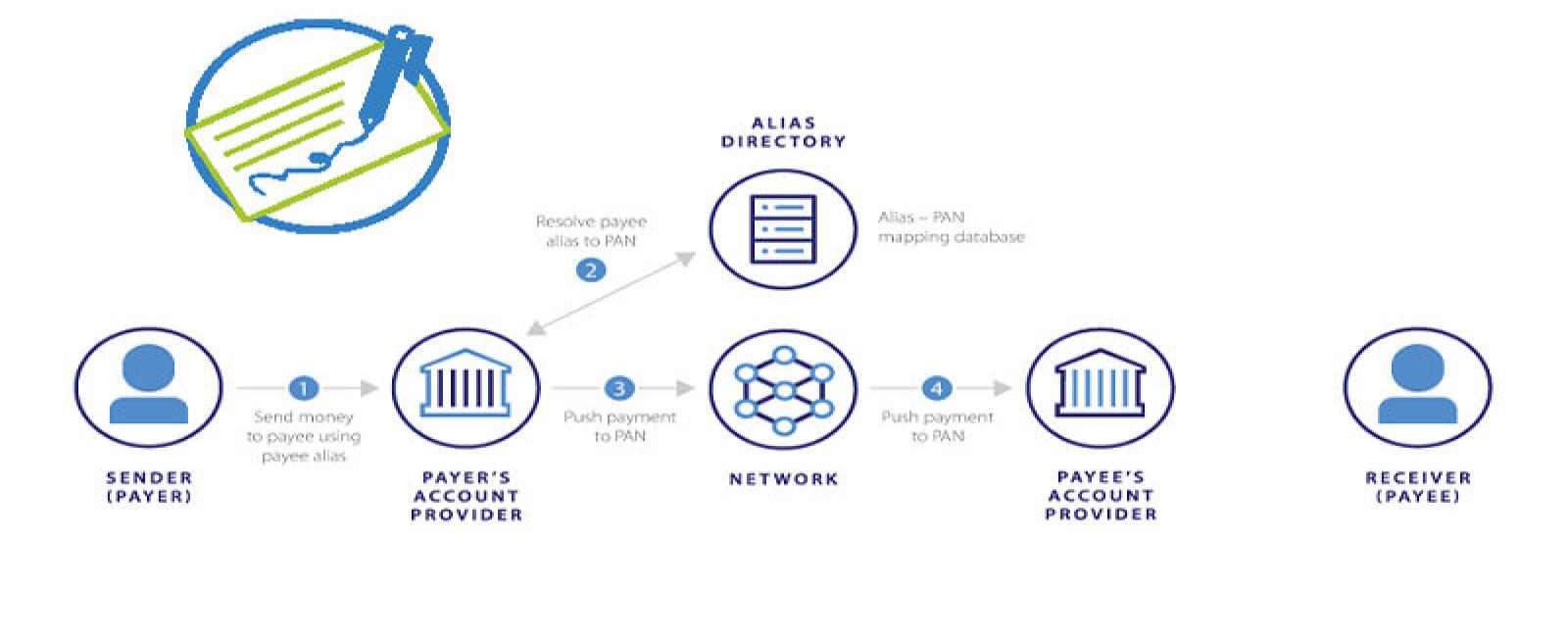

The Electronic checks debit payments from a buyers bank account and deposit the funds into the seller's account. Surely they are the smart way to automate recurring payments, including loan and insurance payments.

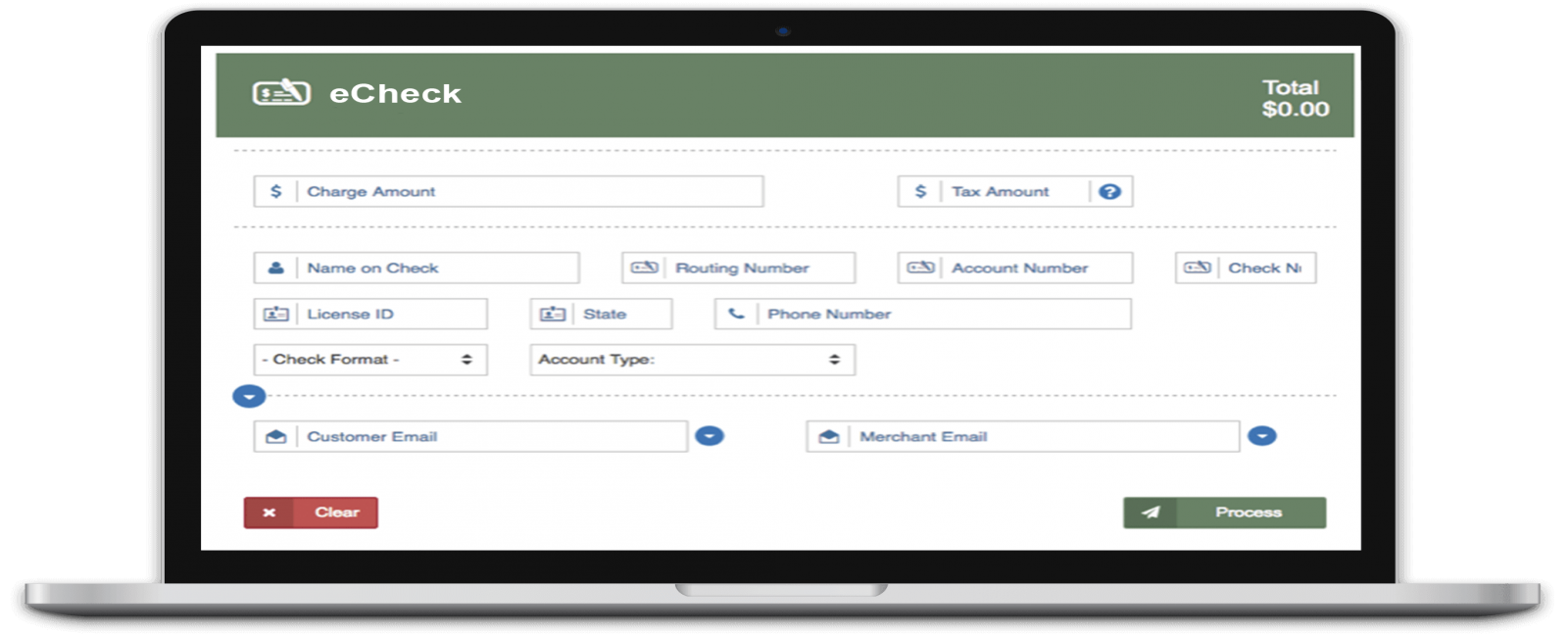

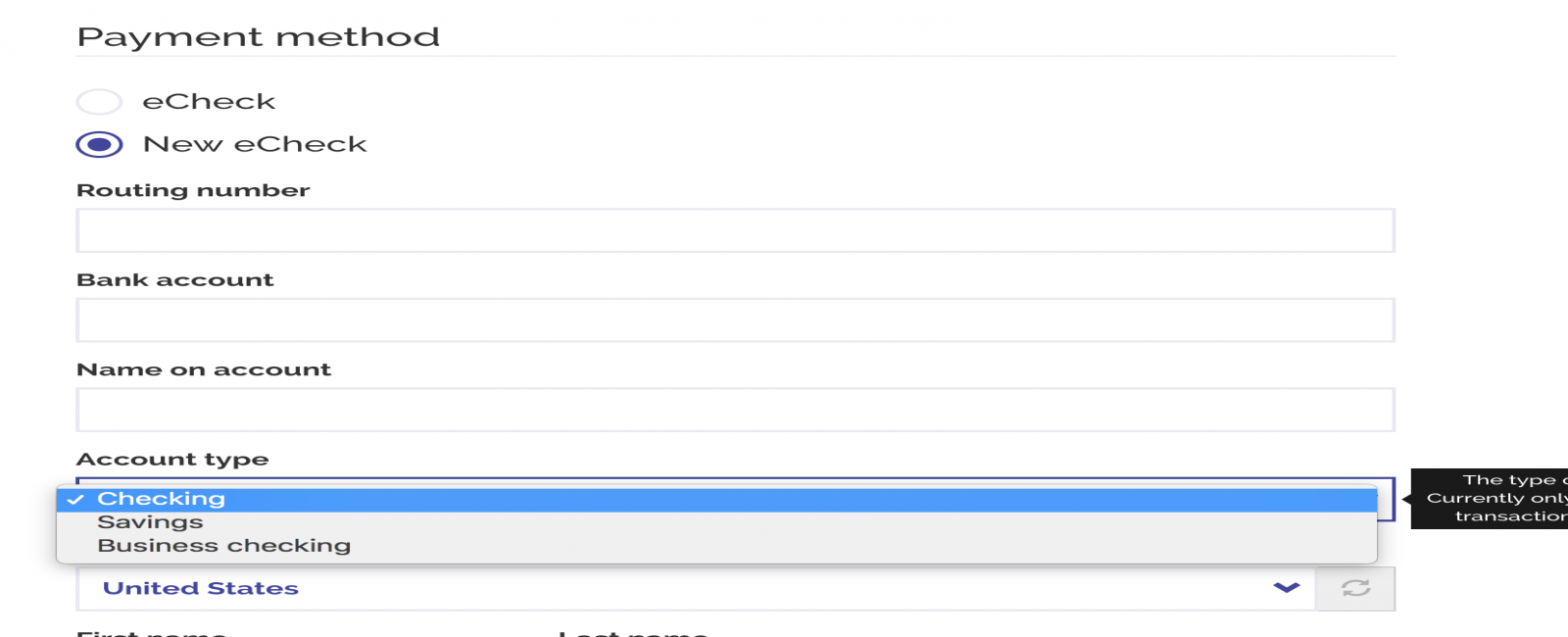

An e-check payment service provides a solution for online and traditional money transfers directly through the Virtual Terminal. The Echeck payments can be accepted online, by phone, fax or mail.

Being a merchant, you should be well versed with all kinds of payment options including credit cards and e-checks. Offering multiple payment options will extend the services and products within the reach of millions of consumers. This is an easier way to increase their sales. Any mode that the customer chooses to pay should be welcomed by the merchant to be successful.

E-checks are web or telephone initiated electronic transfers. The payment is authorized from a consumer's checking or savings account. The money is transferred into the account of a biller and this service has the opportunity of accessing it 24 hours a day, 7 days per week.

According to the statistics, 75% of all non-cash payments are paid by either paper checks or e-checks. This reflects the massive use of e-checks for paying for purchases. E-checks Payments are a good alternative payment option for those who do not possess credit cards. Just having a savings bank account will be your key to start using this service.

Advantages of using e-checks:

- The sales channel is expanded with the acceptance of e-checks.

- Even the money is saved as there is less transaction fee on the processing of E-checks. The credit card payment processing fee is slightly more.

- The customers who do not prefer to use the credit card as the mode of payment due to some security issues may go for e-checks as they are safe, secure, accurate and on time payment option.

- E-checks protect recurring billing income. The merchants have an easy to stabilize recurring billing cash flows due to this interface.

- It decreases the time taken by paper checks to reach the respective seller.

There are many companies that facilitate the payments through electronic check format. To cater to such services, they need to build a good reputation with years of solid experience. These companies which are called an e-check payment processing company charge a very nominal fee for each processed check. Electronically it is fast and convenient, but financial transactions sent through the Internet carry great risk of being intercepted or hacked. Therefore the e-check payment processing company is supposed to implement the strongest encryption protocol to protect sensitive customer information. Ensure that your service provider sticks to 128-bit, SSL, secure encryption technology. Also, it is imperative that the e-check processing company maintains a 24/7 helpdesk, called technical support, to give necessary assistance that’s needed at the time of any fraud.

In this digital world, the means are enormous and the time is shrinking. The bill-paying process should also match this fast pace of the digital world. So, eChecksdeposit.com is a low-cost payment solution for the online payment system. This mode is faster and takes just a few clicks time. It is a tool for retailers, billers and non-profit organizations to improve cash flow. Consumer loyalty is built with time. E-checks simplify bill paying by reducing the paperwork involved in financial management.